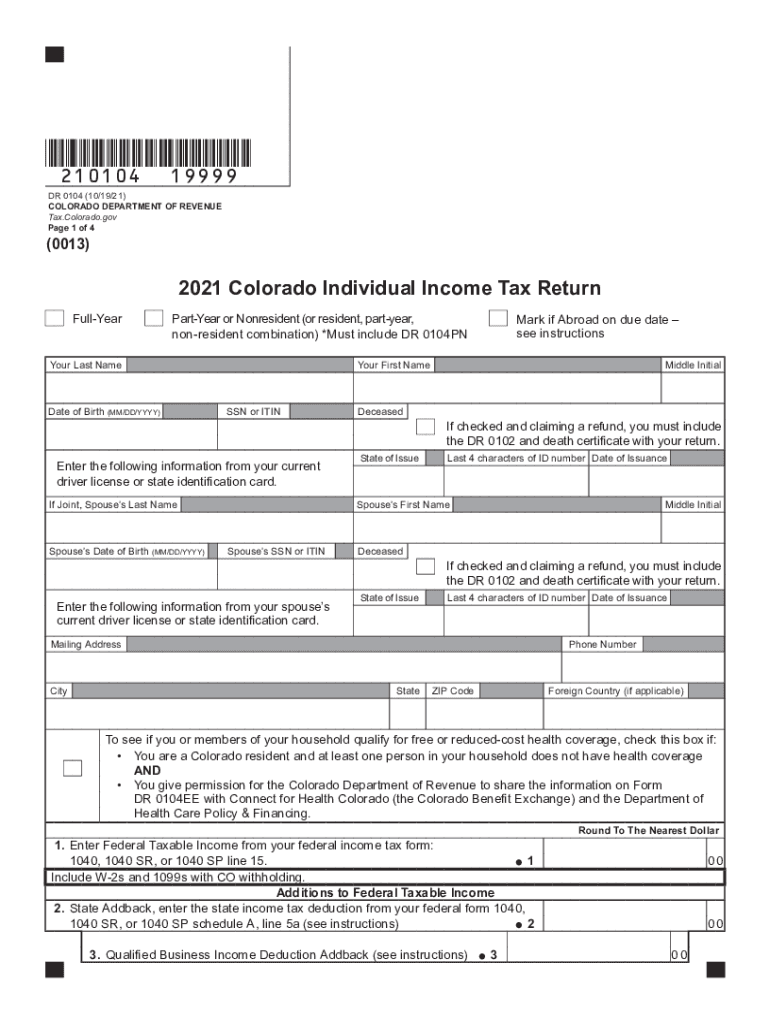

Definition & Meaning of Form CO 104

The CO 104, officially known as the Colorado Individual Income Tax Return form, is a crucial document used by residents of Colorado for filing state income taxes. It is applicable for full-year, part-year, and nonresident filers alike. The CO 104 requires taxpayers to report their income, calculate their state tax obligations, and determine eligibility for various tax credits and deductions. Its structure includes sections dedicated to personal information, income reporting, tax calculations, and refund requests. Understanding the purpose and requirements of this form is essential for compliant and accurate tax filing.

Importance of the CO 104 in Tax Filing

Filing the CO 104 correctly ensures adherence to state tax laws, minimizes the risk of penalties, and aids in accurate calculation of potential refunds or taxes owed. Given its role in the broader tax ecosystem, taxpayers must be cautious in completing the form to reflect their financial situations accurately. This document becomes central when compiling financial information for both state and federal evaluations.

Steps to Complete the CO 104

Completing the CO 104 involves several methodical steps to ensure accurate filing. Taxpayers should first gather all necessary financial documents, including W-2 forms, 1099 statements, and records of any deductions or credits applicable to them.

-

Gather Required Documents

Collect all income statements, proof of residency, and other documentation pertinent to state taxes to facilitate a smooth filing process. -

Fill Out Personal Information

Enter personal details accurately, including your name, address, Social Security number, and residency status. Misentries can lead to processing delays. -

Report Income Sources

Complete the sections that require detailed reporting of all income sources, including wages, business income, and investment earnings. Utilize your W-2 and 1099 forms for precise figures. -

Calculate Tax Obligations

Follow the form's instructions to compute your total taxable income and state tax liability. Utilize the tax tables or calculators provided by the Colorado Department of Revenue to find the appropriate amounts. -

Claim Deductions and Credits

Identify any available tax deductions or credits, such as those for property taxes or educational expenses. This will impact your final tax due or refund amount. -

Final Review and Submit

Thoroughly review the completed form for accuracy. Ensure all fields are filled and cross-verify your calculations. Submit the form as per the guidelines provided.

Completing each step with diligence aids in avoiding errors that could lead to audits or fines.

How to Obtain the CO 104

Taxpayers can acquire the CO 104 through various methods, ensuring easy access for all Colorado residents. Here are the primary ways to obtain the form:

-

Online Download

The most convenient method is to download the CO 104 directly from the Colorado Department of Revenue's official website. This option allows for immediate access to the latest version of the form in PDF format. -

Request by Mail

Taxpayers can also request a hard copy of the CO 104 by contacting the Colorado Department of Revenue. Providing your mailing address will ensure you receive the form at home. -

In-Person Visits

Local tax offices and libraries in Colorado often carry printed copies of the CO 104. Visiting these locations provides an opportunity to ask questions about completing the form.

Accessing the CO 104 through one of these methods ensures that you are using the correct version, which is critical for timely and accurate filing.

Key Elements of the CO 104

Understanding the essential components of the CO 104 is fundamental for effective tax preparation. Here are the primary elements included in the form:

-

Personal Information Section

Contains fields for the taxpayer's name, address, and identification numbers required for processing. -

Income Reporting Section

This area encompasses multiple lines to report salary, self-employment income, dividends, and various other income sources. -

Deductions and Credits

Spaces designated for state-specific deductions, tax credits, and other relevant adjustments. -

Tax Calculation Area

Here, taxpayers will perform calculations based on their reported income and applicable tax rates. This section is critical to determine total tax due. -

Signature and Date

Taxpayers must review their completed forms and sign them to confirm the accuracy of the information provided.

Each of these components plays a vital role in establishing your tax obligations and ensuring compliance with Colorado tax laws.

Filing Deadlines and Important Dates for CO 104

Being aware of filing deadlines is crucial to avoid penalties and interests on late submissions. Key dates include:

-

Annual Filing Deadline

For most individuals, the standard deadline for submitting the CO 104 aligns with federal tax deadlines, typically April 15. -

Extended Filing Options

Taxpayers may apply for an extension to file their return. However, any taxes owed must still be paid by the original deadline to avoid penalties. -

Payment Dates

Any tax payments due alongside your CO 104 must also be aligned with the annual filing deadline. Late payments can incur additional fees.

Staying informed of these dates helps ensure timely and accurate reporting, reducing stress during the tax season.

Legal Use of the CO 104

The CO 104 serves as a legally binding document within the framework of Colorado tax law. Compliance with its filing rules is essential for avoiding tax fraud allegations or penalties. Here are critical aspects of its legal implications:

-

Legitimacy of Signatures

Signatures on the CO 104 confirm that the taxpayer is responsible for the assertions made regarding their income and deductions. This form of declaration binds the individual legally. -

Penalties for Misrepresentation

Incorrect information or intentional fraud can lead to severe penalties, including fines, interest charges, or legal action from the state. -

Right to Appeal

Taxpayers have the right to appeal decisions made about their taxes if they believe a mistake has occurred. The information on the form can significantly impact these proceedings.

Understanding the legal implications of the CO 104 ensures that taxpayers approach the form with the seriousness it demands, fostering responsible tax behavior.