Definition & Meaning

The dissolution of assets and Form 990 instructions pertain to the process required by the IRS for organizations that are liquidating, terminating, or significantly restructuring. Specifically, Form 990 is a critical document that nonprofit organizations must file annually to maintain their tax-exempt status. When an organization undergoes dissolution, it must follow specific guidelines to account for its assets and ensure proper legal and financial closure. This involves the liquidation or transfer of assets, compliance with the IRS, and adherence to state-specific dissolution requirements.

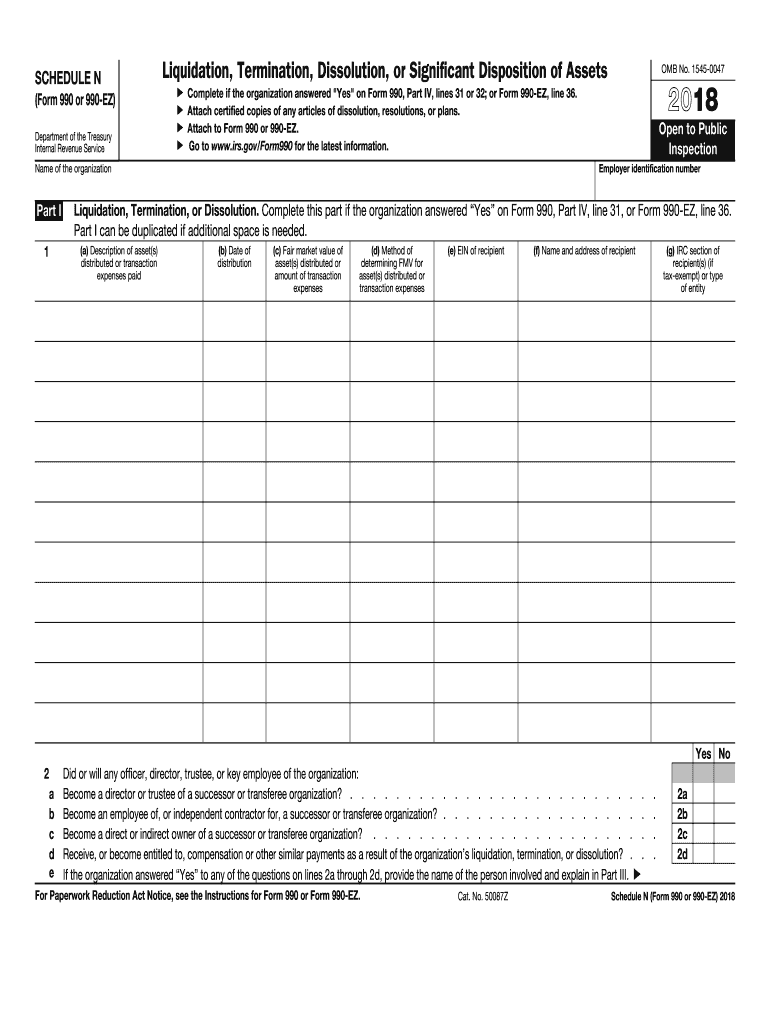

- Form 990: This form includes various schedules based on the organization's activities, including Schedule N, which is relevant for dissolved entities.

- Assets: Include financial investments, physical property, and other resources the organization holds.

- Dissolution: Involves formally closing an organization, through asset distribution and legal settlements, ensuring no obligations remain.

Steps to Complete the Dissolution of Assets and Form 990 Instructions

- Prepare Required Documents: Gather financial statements, asset inventories, and any previous tax filings.

- Complete Form 990: Ensure all sections are accurately filled, especially those concerning asset distribution.

- Attach Schedule N: If the dissolution affects significant asset holdings, include Schedule N to provide detailed information on asset disposition.

- Submit to the IRS: File the forms by the due date to avoid penalties, ensuring compliance with all federal requirements.

Important Considerations

- Correct Information: Double-check all entries for accuracy to avoid rejections or delays.

- Consultation: Seek advice from financial experts familiar with nonprofit tax laws if necessary.

Important Terms Related to Dissolution of Assets and Form 990 Instructions

Understanding the terminology can greatly assist in the accurate completion of Form 990 and in the dissolution process:

- Liquidation: The process of converting assets into cash or settling debts.

- Tax-exempt status: A designation that allows organizations to operate free from federal income tax.

- Schedule N: A section of Form 990 that details dispositions of assets upon liquidation or restructuring.

Examples of Common Terms Used in Form 990:

- Nonprofit: Organizations that operate without profits as their primary objective, often for charitable purposes.

- Filing Thresholds: The criteria that determine whether an organization must file Form 990 or simplified versions such as 990-EZ or 990-N.

State-Specific Rules for the Dissolution of Assets and Form 990 Instructions

State laws can vary greatly in terms of how dissolution must be handled:

- State Approval: Some states require pre-approval before assets can be transferred during dissolution.

- Final Filings: States may require final annual reports or communication with the state attorney general.

Examples of State-Specific Requirements

- California: Mandates notification to the Attorney General before dissolving.

- New York: Requires a plan of dissolution filed with the New York State Department of Finance.

IRS Guidelines

The IRS provides specific guidance for completing Form 990 related to dissolution:

- Accuracy of Information: Emphasizes precise and complete data entries.

- Supporting Documentation: Advises on documenting all asset valuations and transactions for audit purposes.

Key Points

- E-file Options: The IRS encourages electronic filing for faster processing.

- Professional Assistance: Engaging with a qualified tax professional can prevent common errors.

Penalties for Non-Compliance

Failure to properly complete and file Form 990 during the dissolution process can lead to significant penalties:

- Monetary Fines: Can range from daily penalties for late filings to lump sums for gross inaccuracies.

- Loss of Tax-exempt Status: Persistent non-compliance can result in revocation.

Prevention Strategies

- Timely Submission: Ensure all deadlines are met to avoid penalties.

- Regular Audit: Conduct internal reviews before submission to catch potential issues.

Examples of Using the Dissolution of Assets and Form 990 Instructions

- Case Study 1: A nonprofit dissolving after a merger must accurately list all asset transfers and liabilities to ensure legal compliance and maintain public trust.

- Case Study 2: An NGO facing closure due to funding loss must document all asset distributions on Schedule N for IRS submission.

Learnings:

- Documentation is Key: Accurate tracking of asset liquidation is crucial.

- Compliance: Following IRS and state guidelines ensures a smooth dissolution.

Filing Deadlines / Important Dates

Adhering to deadlines is crucial in the dissolution process to avoid penalties:

- Annual Due Date: Form 990 is typically due by the 15th day of the 5th month after the fiscal year ends.

- Extension Possibility: Organizations can request a six-month extension by filing IRS Form 8868.

Impact of Missing Deadlines

- Penalties: Fines accumulate, increasing the longer the delay.

- Operational Roadblocks: Delays in asset transfer and legal closure without completed filing.