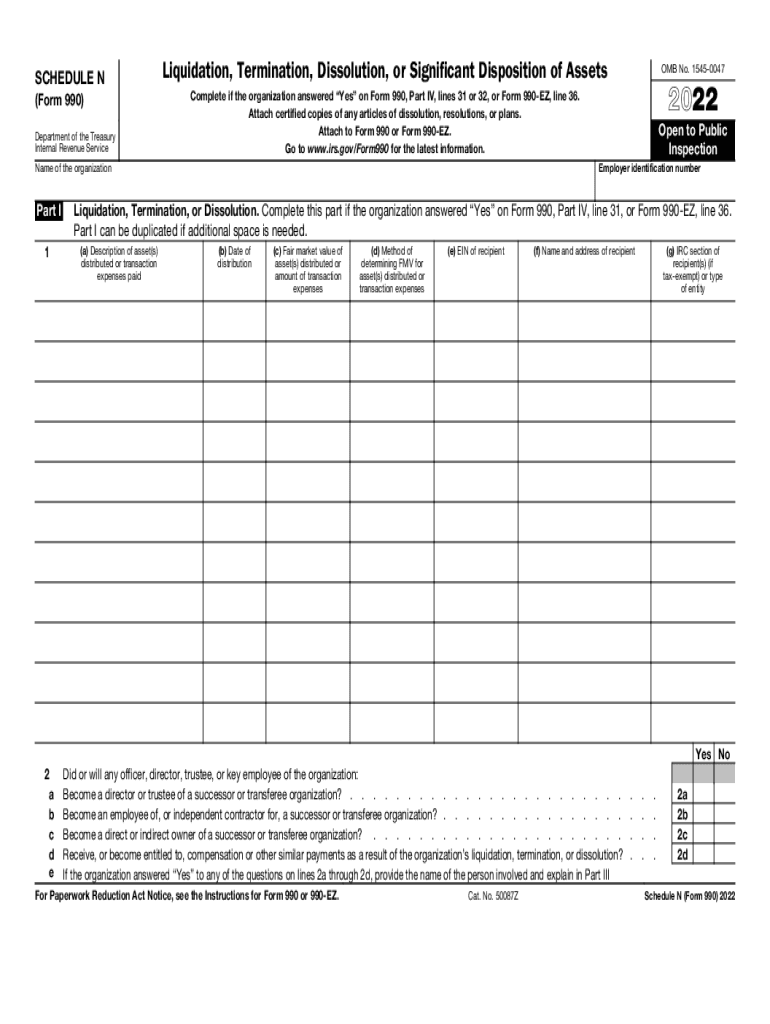

Definition & Purpose of 2022 Schedule N (Form 990)

Schedule N (Form 990) is a specialized document required by the Internal Revenue Service (IRS) for filing by certain organizations that undergo liquidation, termination, dissolution, or a significant disposition of assets. This form is specifically designed to capture detailed information regarding these substantial changes in an organization’s structure or asset handling. It is part of the broader Form 990, an annual reporting return that federally tax-exempt organizations must file, providing the IRS with a comprehensive picture of their financial status and activities.

-

Liquidation and Termination: This part involves winding down the affairs of the organization, settling debts, and distributing any remaining assets. Organizations must report specific details of these processes in Schedule N.

-

Significant Disposition of Assets: When an organization disposes of a significant portion of its assets, whether through sale, transfer, or donation, detailed reporting on Schedule N is necessary. This ensures transparency and compliance with regulatory requirements concerning asset handling.

Examples of Scenarios

-

A non-profit organization deciding to cease operations and distribute its remaining funds and physical assets to other charitable organizations would use Schedule N to detail these transactions.

-

An educational charity donating a large number of books to multiple schools must report the disposal specifics on Schedule N, including the fair market value and receipt details.

How to Obtain 2022 Schedule N (Form 990)

Obtaining the 2022 Schedule N is straightforward and can be completed through various methods, offering flexibility to fit different organizational needs.

-

Online Download: The IRS website provides a downloadable PDF version of the form, accessible directly for those handling their filings digitally.

-

Tax Preparation Software: Platforms like TurboTax and QuickBooks often integrate Schedule N into their suite of tax forms, assisting users in ensuring compliance and correct filing.

-

IRS Offices: Physical copies of the form can be obtained by visiting IRS offices or through USPS mail, which some organizations may prefer for traditional record-keeping.

Important Considerations

- Ensure that the version is current by verifying the tax year on the form, as regulations and form fields can change yearly.

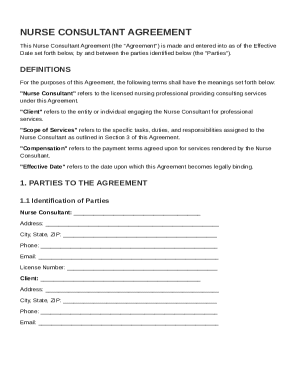

Steps to Complete the 2022 Schedule N (Form 990)

Completing the 2022 Schedule N requires meticulous attention to detail. The form is segmented into parts focusing on different aspects of liquidation and asset disposition.

-

Gather Necessary Documents: Collect all relevant financial records, including balance sheets, transaction records of asset sales or transfers, and any legal documents related to the dissolution process.

-

Fill in Basic Identification Information: Input the organization’s name, identification number, and tax year.

-

Detail the Liquidation or Asset Disposition: Disclose information on the process, the fair market value of disposed assets, and the parties involved in these transactions.

-

Submit to the IRS: Forms can be mailed to the IRS address specified for your state or filed electronically through approved e-filing systems for convenience and speed.

Common Errors to Avoid

- Incomplete recipient details or values for disposed assets.

- Failure to attach supplementary schedules or explanations for transactions that require clarification.

Who Typically Uses the 2022 Schedule N (Form 990)

Schedule N is primarily used by tax-exempt organizations such as non-profits, charities, and certain public benefit corporations.

-

Non-Profit Organizations: Upon deciding to dissolve due to insolvency or strategic shift, they must report this activity using Schedule N to ensure transparency with donors and regulatory bodies.

-

Charities: When reallocating significant portions of their endowment or operational assets to better serve their mission or as part of strategic organizational changes.

Key Elements of the 2022 Schedule N (Form 990)

Understanding the key elements of Schedule N ensures comprehensive and compliant submissions. Each part of the form addresses specific aspects of dissolution or asset disposition.

-

Part I – Liquidation and Termination: Reports on the cessation of operations and includes details such as the identity of assets and liabilities, the means of asset distribution, and compliance with winding-up procedures.

-

Part II – Significant Disposition: Requires information on the nature of the disposed assets, their market valuation, and recipient organization details.

Real-World Application

- Consider a charity collaborating with another organization to distribute programs previously managed internally. Schedule N facilitates capturing the financial implications of such strategic collaborations comprehensively.

IRS Guidelines for 2022 Schedule N (Form 990)

The IRS provides detailed instructions for completing Schedule N, emphasizing accuracy and thorough documentation.

-

Documentation Requirements: Organizations should attach explanations for complex transactions, especially where valuation methodologies or recipient identities need clarification.

-

Compliance and Collection: The IRS expects organizations to maintain supporting records for all entries on Schedule N for potential audits or inquiries.

Filing Deadlines and Important Dates

Meeting filing deadlines is crucial to avoid penalties and maintain good standing with regulatory bodies.

-

Standard Due Date: Historically, the filing deadline for Form 990, including Schedule N, aligns with the 15th day of the fifth month after the end of the organization's fiscal year. For example, organizations operating on a calendar year would be required to file by May 15.

-

Extensions: Organizations can request an automatic extension, typically up to six months, providing additional time to ensure accurate and complete filings.

Example of Deadline Management

- A non-profit with a fiscal year ending on December 31st would file its Form 990, including Schedule N, by May 15 of the following year but could extend this deadline to November with a timely filed extension request.

Penalties for Non-Compliance

Not adhering to IRS filing requirements can result in significant penalties and adverse impacts on an organization's tax-exempt status.

-

Financial Penalties: These can range from daily fines for late submission to more stringent actions for non-filing or gross inaccuracies on the form.

-

Impact on Exempt Status: Repeated failures to comply with filing requirements can lead to revocation of tax-exempt status, which is vital for the financial health and operational viability of non-profits and similar organizations.

Avoiding Compliance Issues

- Regular audits and thorough checks by internal or external finance teams can preempt compliance issues, ensuring that organizations consistently meet IRS expectations regarding accuracy and filing timeliness.