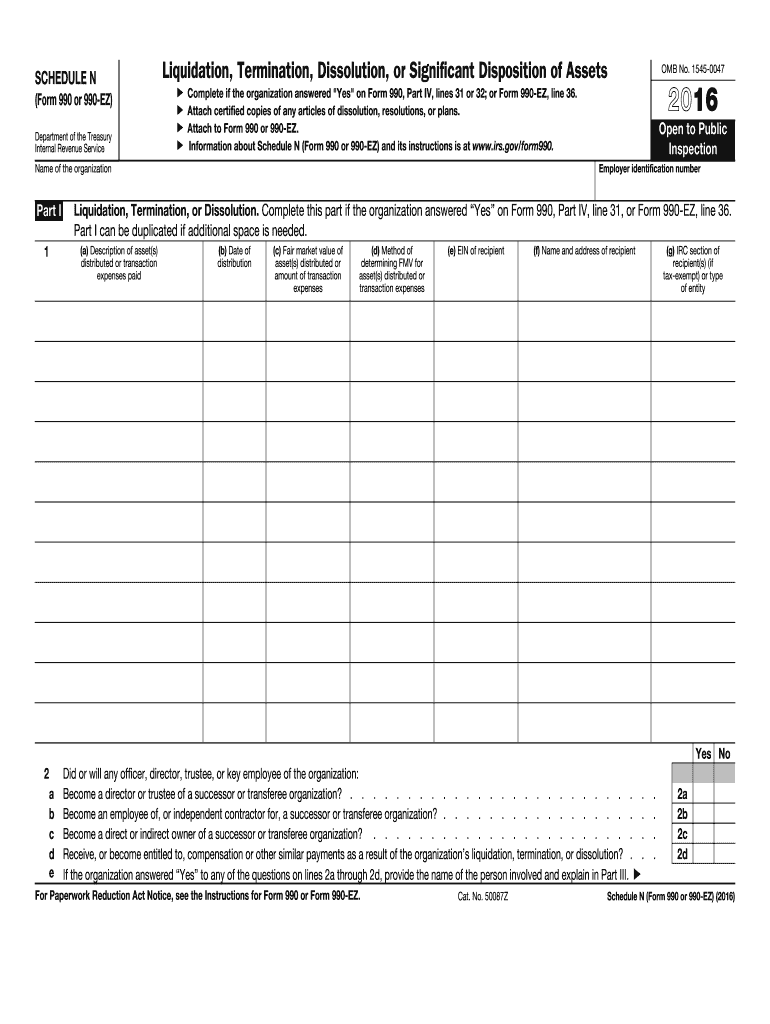

Definition and Purpose of 2016 Form 990 or 990-EZ (Schedule N)

The 2016 Form 990 or 990-EZ (Schedule N) is a crucial document filed with the IRS by certain tax-exempt organizations. This form is specifically used to report the liquidation, termination, dissolution, or significant disposition of assets by an organization. Schedule N helps the IRS and other regulatory bodies ensure proper compliance with the federal tax code as it relates to the distribution of an organization's assets upon its closure or reorganization.

Key Functions of Schedule N

- Asset Distribution Reporting: Organizations must detail the disposition of all assets, including the fair market value at the time of distribution.

- Compliance Verification: The form ensures adherence to governing documents and state laws regarding dissolution.

- Notification to Authorities: Reporting any notifications made to state officials about the organization’s closure.

How to Complete the 2016 Form 990 or 990-EZ (Schedule N)

When filling out Schedule N, organizations must ensure accuracy in every section to avoid penalties and additional scrutiny.

Instructions for Each Part

-

Part I: Liquidation, Termination, or Dissolution of the Organization

- List the steps taken to dissolve the organization.

- Specify the date of dissolution.

- Detail any assets transferred or distributed, including recipient information.

-

Part II: Significant Disposition of Net Assets

- Describe the nature of assets disposed of.

- Explain the rationale behind asset disposal.

- Record any liabilities associated with the disposed assets.

Necessary Supporting Documents

- Governing instrument or bylaws.

- Resolutions approving dissolution or asset disposition.

- Copies of notifications sent to state authorities.

Who Uses the 2016 Form 990 or 990-EZ (Schedule N)

Typically, tax-exempt organizations such as nonprofits, charitable organizations, and certain trusts use this form. Organizations undergoing structural changes, organizational dissolutions, or substantial asset sales must file Schedule N to document these events for the IRS.

Examples of Applicable Organizations

- Nonprofit foundations closing operations.

- Charitable trusts merging or transferring assets.

- Membership organizations reallocating funds.

IRS Guidelines and Compliance

The IRS provides specific guidelines on who should file Schedule N, including detailed instructions on completing the form and the consequences of non-compliance.

Important Compliance Aspects

- Timeliness: Ensure timely submission with the annual Form 990 or 990-EZ filing.

- Accuracy: Double-check all financial information and recipient details for accuracy.

- Recordkeeping: Maintain detailed records of all transactions listed in the form.

Penalties for Non-Compliance

Failing to file Schedule N accurately or punctually can lead to significant penalties. Understanding these consequences can motivate organizations to prioritize careful form completion.

Potential Consequences

- Monetary Fines: The IRS may impose fines for late or incomplete filings.

- Exemption Impact: Risk of losing tax-exempt status if compliance issues persist.

- Increased Scrutiny: Organizations may face audits or additional reviews.

Key Elements of 2016 Form 990 or 990-EZ (Schedule N)

Several elements are pivotal in Schedule N, focusing on accurately reporting asset-related events.

Components to Highlight

- Detailed Asset Reporting: Accurate valuation and documentation of asset transfers.

- Recipient Information: Comprehensive data about asset recipients to maintain transparency.

- Compliance with State Laws: Ensure that transactions align with applicable state dissolution laws.

Filing Deadlines and Important Dates

Adhering to important deadlines ensures compliance and avoids unnecessary penalties.

Timing and Submission

- Annual Deadline: Schedule N should be filed with the organization’s annual Form 990 or 990-EZ by the 15th day of the 5th month after the accounting period ends.

- Extensions: Organizations may file for an extension using Form 8868, but must provide a justifiable reason.

Software Compatibility and Filing Methods

With technological advancements, organizations can file Schedule N both digitally and by traditional paper methods.

Filing Options

- Digital Submission: Use platforms like TurboTax or QuickBooks for electronic filing, ensuring compatibility with IRS systems.

- Paper Filing: Submit a physical copy by mail, ensuring all documents are properly signed and dated.

Business Types and Scenarios for Schedule N

Understanding the types of entities and scenarios where Schedule N is applicable aids accurate compliance.

Beneficial Business Types

- Nonprofits Conducting Mergers or Reorganizations: Those that transfer or dispose of material assets.

- Trusts Ending Operations: Reporting asset liquidation for trusts concluding their activities.

Versions and Alternatives to 2016 Form 990 or 990-EZ (Schedule N)

Several variations and other forms can be relevant depending on the organization’s specific circumstances.

Alternatives

- Older Versions: Entities might need to file previous versions if reporting transactions from earlier fiscal years.

- Other Related Forms: Organizations should be aware of additional forms, like Schedule M for non-cash property contributions, that may need filing alongside Schedule N.