Definition and Meaning of "Asset(s) Distributed or"

The term "asset(s) distributed or" primarily applies within financial and legal contexts, referring to the allocation of resources or properties by an organization or individual. This involves transferring ownership or control of assets to another party, which could be an individual, a group, or another entity. Such distributions are commonly associated with business liquidations, trust dispersals, and estate management. In nonprofits, it often involves a schedule like Schedule N (Form 990 or 990-EZ), which tracks the distribution of assets during organizational restructuring or collapse.

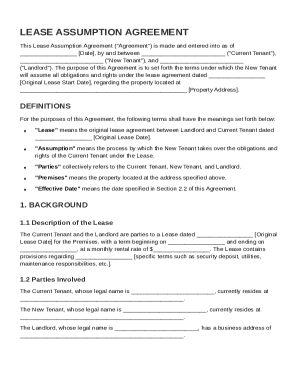

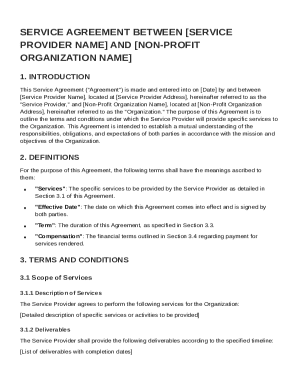

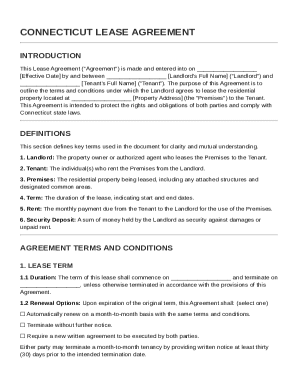

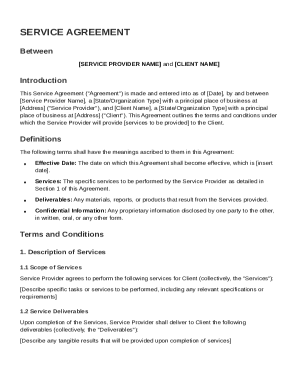

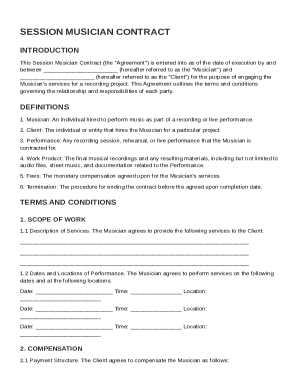

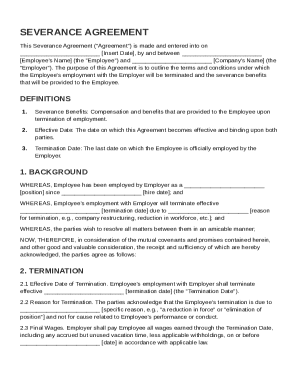

How to Use "Asset(s) Distributed or" in Documentation

When documenting distribution processes, clarity and precision are essential. Properly detailing the types and values of assets, as well as the recipient information, is crucial. This ensures transparency and compliance with legal obligations. Using DocHub, these details can be captured accurately via fillable forms or by annotating documents. By utilizing secure document editing and sharing features, organizations can manage distribution records efficiently.

Steps to Complete the "Asset(s) Distributed or" Form

- Determine Eligibility: Assess whether your organization needs to file, often driven by specific activities like liquidation.

- Gather Required Information: Compile comprehensive data on distributions, including asset valuations and recipient details.

- Access the Relevant Form: Obtain Schedule N (Form 990 or 990-EZ) from the IRS website or applicable source.

- Fill the Form: Use platforms like DocHub to enter data accurately, taking advantage of interactive fields and digital signature functionalities.

- Review and Finalize: Double-check for accuracy and completeness before finalizing.

- Submit: Follow IRS guidelines for submission, either online or via mail, ensuring proper filing within deadlines.

Key Elements of "Asset(s) Distributed or"

- Asset Valuation: Determine the fair market value of the assets being distributed.

- Compliance: Ensure all distributions comply with organizational and legal frameworks.

- Recipient Information: Capture detailed information about the individual or entity receiving the assets.

- Transaction Documentation: Maintain comprehensive records throughout the distribution process.

Legal Use of "Asset(s) Distributed or"

Distributing assets must align with legal standards and regulations. This includes observing federal and state laws, ensuring proper documentation, and fulfilling disclosure requirements. Nonprofits, for instance, have specific guidelines under IRS scrutiny, such as adhering to the ESIGN Act for electronic transactions. Legal compliance also involves ensuring that all parties involved in the transaction acknowledge and agree to the distribution terms.

IRS Guidelines for "Asset(s) Distributed or"

The IRS requires organizations to file specific forms when distributions occur, particularly if the distributions involve substantial assets. Such guidelines ensure transparency and accountability. For nonprofits using Form 990 or 990-EZ, Schedule N specifically addresses questions around the dissolution, liquidation, or significant disposals of assets, requiring detailed reports on involved parties and transaction nature.

Required Documents for "Asset(s) Distributed or"

To properly document and report asset distributions, organizations need:

- Inventory of Assets: Detailed listings of all assets being distributed.

- Distribution Agreements: Contracts outlining the terms of the distribution.

- Recipient Acknowledgements: Signed confirmations from recipients.

- Supporting Financial Records: Evidence of asset valuations and transaction flow.

Penalties for Non-Compliance

Failure to comply with reporting requirements can result in significant penalties. These could include fines, sanctions against the organization, or revocation of tax-exempt status for nonprofits. Legal consequences vary depending on the jurisdiction and the nature of the non-compliance but generally emphasize the importance of accurate and timely reporting of distributions.

By understanding these facets of "asset(s) distributed or," organizations can navigate their legal and financial responsibilities effectively, using tools like DocHub to streamline documentation and compliance.