Definition and Meaning of Form 2848

Form 2848, also known as the Power of Attorney and Declaration of Representative, is a crucial document used by taxpayers to authorize individuals to represent them before the Internal Revenue Service (IRS). This form allows the designated representatives, such as attorneys, accountants, or enrolled agents, to act on behalf of taxpayers in tax matters. Typically, it encompasses various responsibilities, including accessing tax information, representing the taxpayer during audits, and handling appeals on their behalf.

Key Components of Form 2848

- Taxpayer Information: This section requires the taxpayer's name, address, and taxpayer identification number (TIN), which is essential for the IRS to identify the individual.

- Representative Details: Information about the appointed representatives must be provided, including their names, addresses, and identification numbers. This ensures that the IRS knows who is authorized to act on behalf of the taxpayer.

- Acts Authorized: Taxpayers can specify the range of acts their representatives are allowed to perform, providing clarity and limiting authority where necessary.

Understanding the definition of Form 2848 is vital, as it lays the foundation for knowing its purpose and the importance it holds in taxpayer representation.

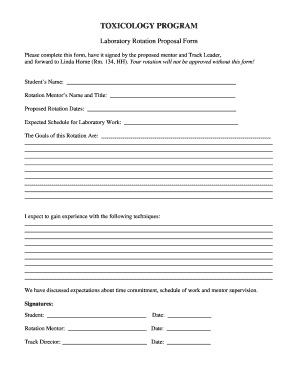

Steps to Complete Form 2848

Filling out Form 2848 involves careful attention to detail and accurate information. Follow these structured steps to ensure successful completion of the form.

- Download the Form: Access the IRS website or use a platform like DocHub to locate Form 2848. Download the form in a fillable format for ease of use.

- Complete Taxpayer Information: Fill in your name, address, and TIN in the top section. Ensure your information matches IRS records.

- Input Representative Information: Add the names and contact details of the individuals you are authorizing. You can designate multiple representatives if needed.

- Specify Authorized Acts: Clearly list the actions your representative can take on your behalf. Consider potential scenarios they may face, such as audits or payment negotiations.

- Sign and Date the Form: Both the taxpayer and each representative must sign and date the form. Ensure signatures are provided in the appropriate sections.

- Submit the Form: After signing, submit Form 2848 to the IRS either electronically or via traditional mail.

By following these steps, you can ensure that the completion of Form 2848 is accurate, compliant, and comprehensive.

How to Obtain Form 2848

Acquiring Form 2848 is straightforward with several options available to ensure you can quickly access the necessary documentation for authorization.

- IRS Website: The IRS provides free access to Form 2848 on their official website. You can easily download a fillable version.

- DocHub: Using platforms like DocHub allows you to import the form, fill it out electronically, and manage it alongside your other documents. The platform offers tools for easy editing, saving, and sharing.

- Local IRS Office: For those preferring physical copies, visiting a local IRS office will enable you to request Form 2848 in person.

Each of these options facilitates effective access to Form 2848, catering to various preferences for obtaining tax documentation.

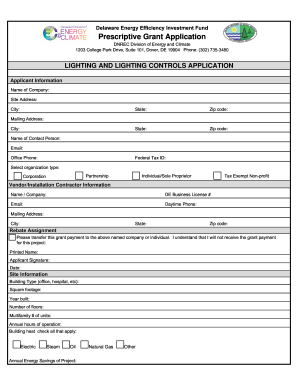

Who Typically Uses Form 2848

Form 2848 serves a diverse range of users who seek representation in tax-related matters. Understanding the typical users helps identify who may benefit from filling out this form.

- Individual Taxpayers: Many individuals use Form 2848 to authorize their accountants or tax professionals to handle their IRS affairs during tax preparation or audits.

- Business Owners: Sole proprietors and large business owners often designate representatives for assistance in tax compliance, dispute resolution, and more.

- Estates and Trusts: Executors of estates or trustees may utilize Form 2848 to empower professionals to manage tax obligations effectively on behalf of the estate or trust.

- Nonprofit Organizations: Nonprofits may designate representatives to handle filings and communications with the IRS regarding their tax-exempt status.

Understanding these various groups emphasizes the importance of Form 2848 in facilitating appropriate power of attorney for tax representation.

Important Terms Related to Form 2848

Familiarity with key terms associated with Form 2848 is essential for effective navigation of the document and its associated processes.

- Power of Attorney (POA): A legal document granting authority to act on another individual's behalf, which is a central aspect of Form 2848.

- Authorized Representative: The individual designated by the taxpayer to represent them in tax matters before the IRS.

- Taxpayer Identification Number (TIN): A unique identifying number required by the IRS for processing taxpayer information; this may include Social Security Numbers (SSNs) or Employer Identification Numbers (EINs).

- Acts Authorized: Specific actions that the appointed representative can perform on behalf of the taxpayer as indicated on Form 2848.

Understanding these terms helps demystify the workings of Form 2848 and reinforces its importance in tax representation and communication with the IRS.