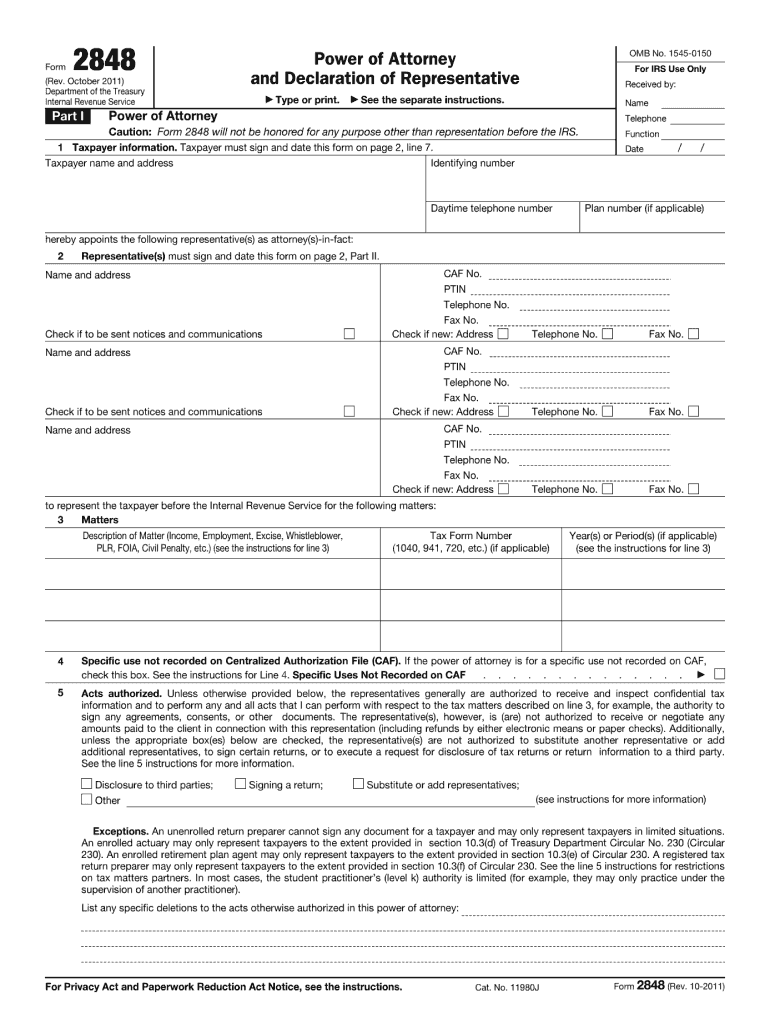

Definition & Purpose of IRS 2011 Form

The IRS 2011 Form serves a specific function in the tax reporting process for the United States. Generally, such forms vary year to year to accommodate changes in tax laws, inflation adjustments, and policy updates. Understanding the role of any IRS form starts with recognizing what it is designed to achieve. It could relate to tax filings, reporting income or deductions, or declaring financial transactions that require regulatory oversight. Each form typically aligns with annual amendments to tax codes, demanding the most recent version be utilized, ensuring compliance with current tax legislation.

How to Obtain the IRS 2011 Form

Securing the IRS 2011 Form involves several straightforward methods. Taxpayers can visit the official IRS website, where PDF versions of most forms are available for download. Alternatively, physical copies can be requested by mail through the IRS's order forms service. Taxpayers also have the option to collect forms from local IRS offices. Utilizing online tax preparation software or services often includes direct access to applicable forms, ensuring they are completed digitally before submission, reducing errors associated with manual entry.

Steps to Complete the IRS 2011 Form

Completing an IRS 2011 Form requires careful attention to detail:

-

Gather Required Information: Before starting, collect all necessary documents, such as W-2s or 1099s, which provide essential income data.

-

Verify Personal Details: Ensure that your name, Social Security number, and address are correctly filled out to avoid processing delays.

-

Input Income Data Accurately: Enter all sources of income precisely as reported on your income statements. This step may involve converting figures into specified sections of the form to reflect total yearly earnings accurately.

-

Claim Deductions and Credits: Use available worksheets or instructions to claim eligible deductions and tax credits, ensuring any required documentation is attached or retained for records.

-

Double-Check for Errors: Review each section for mistakes or omissions before submission. This reduces the potential for processing errors or amended filings.

-

Finalize and Submit: Follow the instructions for filing, whether electronically or through mail, and retain copies of your return and supporting documents.

Important Terms Related to IRS 2011 Form

Understanding terminology related to the IRS 2011 Form clarifies its completion and purpose:

- Adjusted Gross Income (AGI): Total income after specific adjustments are made; it forms the basis for calculating taxable income.

- Exemptions: Deductions available for taxpayers and dependents, reducing taxable income.

- Tax Credits: Direct reductions from total tax due, which differ from deductions as they apply after tax calculations are made.

Terms may vary based on the specific form being considered, but understanding these foundational concepts ensures accurate form completion and tax accountability.

Key Elements of the IRS 2011 Form

-

Identification Information: Section for entering taxpayer's personal information to match IRS records.

-

Income Section: Dedicated lines for reporting different types of income, such as wages, interest, dividends, and bonuses.

-

Deductions: Sections allowing taxpayers to report itemized deductions or claim a standard deduction, influencing the taxable income total.

-

Tax Computation: Part of the form that calculates the final tax liability or refund by applying current tax rates to taxable income after credits.

Penalties for Non-Compliance

Failure to accurately complete and submit an IRS 2011 Form can lead to penalties:

- Late Filing: Fines and interest accruing on unpaid taxes when a return is not filed by the deadline.

- Underpayment: Charges for failing to report total income or applicable tax amounts, sometimes leading to additional scrutiny.

Awareness of deadlines and compliance regulations minimizes such risks, ensuring timely and accurate tax management.

Form Submission Methods

IRS forms provide multiple submission options:

-

Electronic Filing: Offering speed and accuracy, electronic submissions are processed quicker and generally recommended.

-

Mail: Paper submissions remain an option for those without access to digital tools, though they involve longer processing times.

-

In-Person: Direct submission at IRS offices, applicable for taxpayers needing assistance in understanding or completing their forms correctly.

Each method caters to a range of preferences, allowing compliance through preferred or necessary channels.

IRS Guidelines and Legal Use

IRS guidelines accompanying the 2011 Form provide clear instructions on lawful use. These include eligibility criteria, such as income thresholds or specific scenarios, which necessitate the filing of particular forms. Guidelines help ensure forms are utilized correctly and aid in navigating the tax code's complexities. Proper adherence to these instructions supports accurate documentation and reporting, reducing legal risks associated with improper tax filing, which can include audits or penalties. Understanding and following these directives allows taxpayers to fulfill their obligations confidently and thoroughly.