Definition and Purpose of IRS Form 2848

IRS Form 2848, known as the Power of Attorney and Declaration of Representative, allows taxpayers to authorize individuals to represent them in tax matters before the Internal Revenue Service (IRS). This form grants the representative authority to receive and inspect confidential tax information, sign forms, and make decisions related to the taxpayer's tax obligations. The legal framework for the use of this form is established under U.S. tax laws, which recognize the necessity of allowing taxpayers to appoint trusted advisors or professionals to navigate complex tax matters on their behalf.

Key Uses of IRS Form 2848

- Tax Representation: Taxpayers can designate a representative, such as an attorney, certified public accountant, or enrolled agent, to manage their dealings with the IRS.

- Information Authorization: The authorized representative can access sensitive tax information needed for accurate representation.

- Decision-Making Authority: Representatives can make decisions regarding tax strategies, payments, and tax return filings.

How to Obtain IRS Form 2848

Taxpayers can access IRS Form 2848 through various methods, ensuring ease of availability for those needing to appoint a representative. The form can be obtained in several ways:

- IRS Website: The most straightforward method is to download the form directly from the IRS website in PDF format. It is important to ensure that you are using the latest version available to avoid any compliance issues.

- Tax Software: Some tax preparation software offers a fillable version of the form which can streamline the process of completing the necessary information.

- Tax Professional: Many tax professionals provide this form to their clients as needed, ensuring that all information is filled out correctly during the appointment process.

Steps to Complete IRS Form 2848

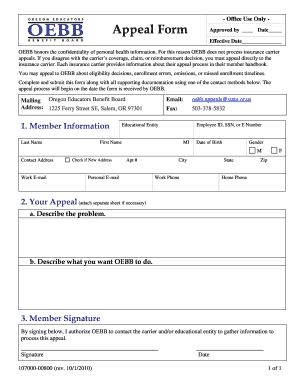

Completing IRS Form 2848 involves several key steps, ensuring that all required information is accurately presented.

- Provide Taxpayer Information:

- Enter the taxpayer’s name, address, and Social Security number (or Employer Identification Number if applicable).

- Designate the Representative:

- Fill in the representative’s details, including name, address, and the designated representative's IRS designation (like attorney or CPA).

- Specify Power of Attorney:

- Indicate the specific tax matters and years/periods the form covers to clearly define the scope of representation.

- Signature and Date:

- The taxpayer must sign and date the form, verifying that they authorize the appointed representative to act on their behalf.

- Submission:

- Determine if the form will be submitted online, via mail, or through in-person delivery, depending on the required IRS procedures.

Additional Tips

- Ensure all names and identification numbers are accurate to avoid processing delays.

- Review the instructions associated with the form for additional guidance.

Common Scenarios for Using IRS Form 2848

IRS Form 2848 serves a variety of taxpayers in different circumstances:

- Self-Employed Individuals: Freelancers or business owners may require assistance with tax planning or audits, making it essential for them to appoint a representative who can handle communications with the IRS.

- Taxpayers Under Audit: Individuals facing an IRS audit may wish to authorize a representative to manage correspondence and defend their tax positions.

- Tax Preparation: Many taxpayers choose to have a tax professional file their returns and handle related issues, utilizing the form to ensure representation is legally recognized.

Important Terms Related to IRS Form 2848

Understanding key terminology associated with IRS Form 2848 can enhance the effectiveness of using the form:

- Power of Attorney (POA): A legal document that enables one person to act on another's behalf in legal or financial matters.

- Authorized Representative: An individual designated by the taxpayer to act in their interests regarding IRS tax matters.

- Tax Matters: The specific issues regarding taxes that the appointed representative will handle, such as audits, appeals, or compliance issues.

These definitions provide clarity to taxpayers about their rights and the implications of granting authority under this form.

Legal Considerations for IRS Form 2848

IRS Form 2848 is a legally binding document in the context of U.S. tax law. By signing this form:

- Grants Authority: The taxpayer officially grants the designated representative the power to act on their behalf concerning their tax obligations.

- Establishes Accountability: The representative must adhere to ethical and legal standards while acting for the taxpayer, as outlined by IRS guidelines.

- Potential Limitations: Taxpayers should understand that while representatives can assist with many aspects of tax matters, certain limitations may apply, particularly in cases of tax evasion or criminal investigation.

By utilizing IRS Form 2848 appropriately, taxpayers can effectively manage their tax representation, ensuring compliance and support in meeting their tax obligations.