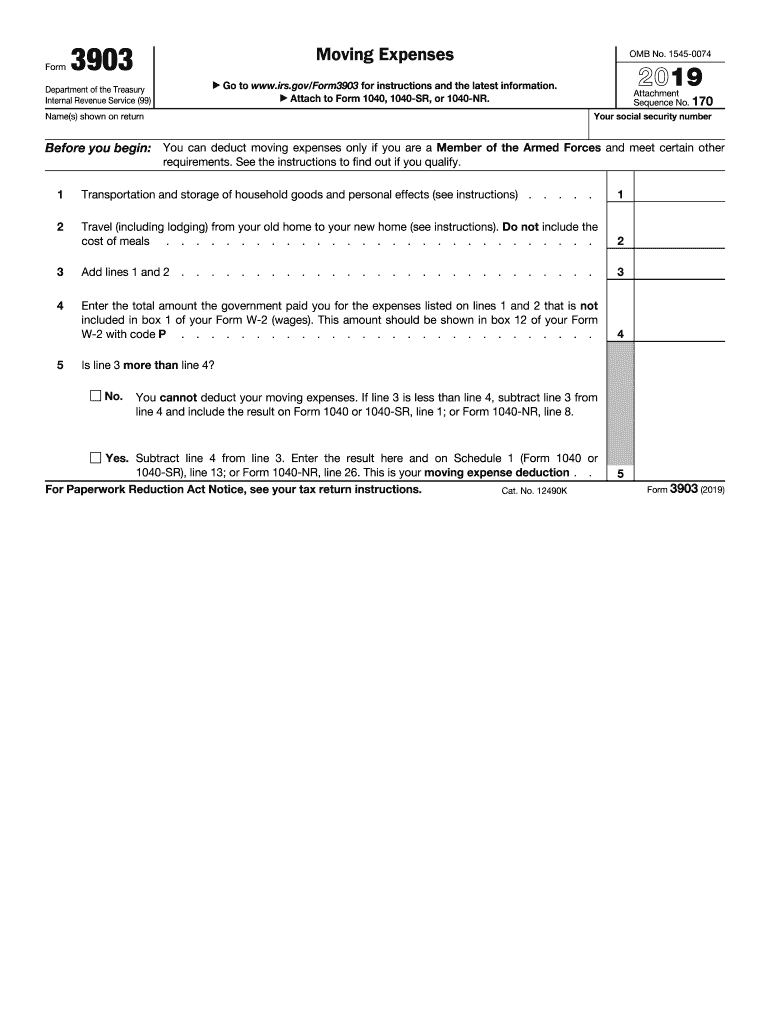

Definition and Purpose of Form 3903

Form 3903, "Moving Expenses," is an IRS document utilized by Members of the Armed Forces to report and deduct moving expenses on their federal tax returns. This form primarily accommodates those who have moved due to a military order and need to claim deductions for related expenses. It categorizes deductible expenses, such as the costs associated with transporting household goods and travel to the new residence. This ensures military personnel can financially manage relocations necessitated by service requirements.

How to Use Form 3903

To effectively use Form 3903, eligible taxpayers should first determine if their expenses qualify under IRS guidelines. Start by gathering all receipts and records of moving-related expenses. The form requires you to input details such as the dates and nature of the move, costs for travel, and expenses incurred for transporting household items. Ensure accurate entries in each relevant section to facilitate the proper calculation of your total allowable deduction.

Procedural Steps

- Enter personal information, such as name and Social Security number.

- Record costs related to the moving of goods.

- List travel expenses, including lodging but excluding meals.

- Calculate the total deductible amount.

- Transfer the calculated deduction to your primary tax form.

Steps to Complete Form 3903

Completing Form 3903 involves a structured approach:

- Compile Documentation: Gather all necessary financial documents and receipts related to the move.

- Enter Moving Expenses: Begin with the costs associated with moving household goods and personal effects.

- Detail Travel Expenses: Document costs linked to travel to the new location. Note that meals are not deductible.

- Review and Calculate: Ensure all entries are accurate before proceeding to perform the final calculations for the moving expense deduction.

- Check Eligibility: Confirm that the move was prompted by a military order and meets IRS criteria.

IRS Guidelines for Using Form 3903

The IRS provides specific guidelines to ensure accurate reporting on Form 3903. Military members can deduct reasonable expenses incurred when moving due to a change of station. Review IRS Publication 521, which details deductible expenses and helps determine eligibility. Important reminders include verifying that your expenses align with IRS specified criteria and ensuring that you retain documentation as proof of costs claimed.

Key Elements of Form 3903

Several key components of Form 3903 require careful attention:

- Transporting Goods: Costs associated with relocating household items to the new home.

- Travel Costs: Expenses related to the journey to the new home, excluding meals.

- Deductions: Proper calculation and deductions based on accurately filled form details.

Detailed Breakdown

- Direct Travel: Log the costs of transporting yourself and your family.

- Goods Transport: Record expenses for shipping belongings, including moving containers or rental trucks.

Eligibility Criteria for Form 3903

Eligibility for using Form 3903 is primarily reserved for Armed Forces members experiencing a move due to a military order. Consider the following criteria:

- Military Orders: The move must be a result of official military orders.

- Distance Test: Ensure the new location is at least 50 miles farther from the old home than the old workplace was.

- Service Members: Exclusively available to active-duty service members.

Required Documents for Filing

Ensuring that you have all necessary documentation can simplify the filing process:

- Order Copies: Include copies of military orders outlining relocation instructions.

- Expense Receipts: Gather all receipts related to moving and travel expenses.

- Travel Logs: Maintain a detailed log of miles traveled and related costs.

Filing Deadlines and Important Dates

The deadline for filing Form 3903 aligns with the federal income tax filing deadline, typically April 15. If the deadline falls on a weekend or holiday, the deadline may be extended. Keeping track of any extensions granted by the IRS due to special circumstances such as natural disasters is also advisable.

Examples of Using Form 3903

To illustrate the practical use of Form 3903, consider a common scenario where a service member is transferred from Camp Pendleton in California to Fort Bragg in North Carolina. The individual incurs expenses for moving household goods and vehicles while traveling. By accurately documenting and claiming these expenses on Form 3903, the service member can effectively reduce their taxable income, offering significant financial relief.

Case Study

- Transport of Belongings: Expense for shipping a car separately which qualifies for deduction.

- Cross-Country Move: Document lodging expenses across several states while moving from California to North Carolina.

These outlined blocks ensure comprehensive coverage of Form 3903, offering practical explanations and procedures critical for eligible tax filers.