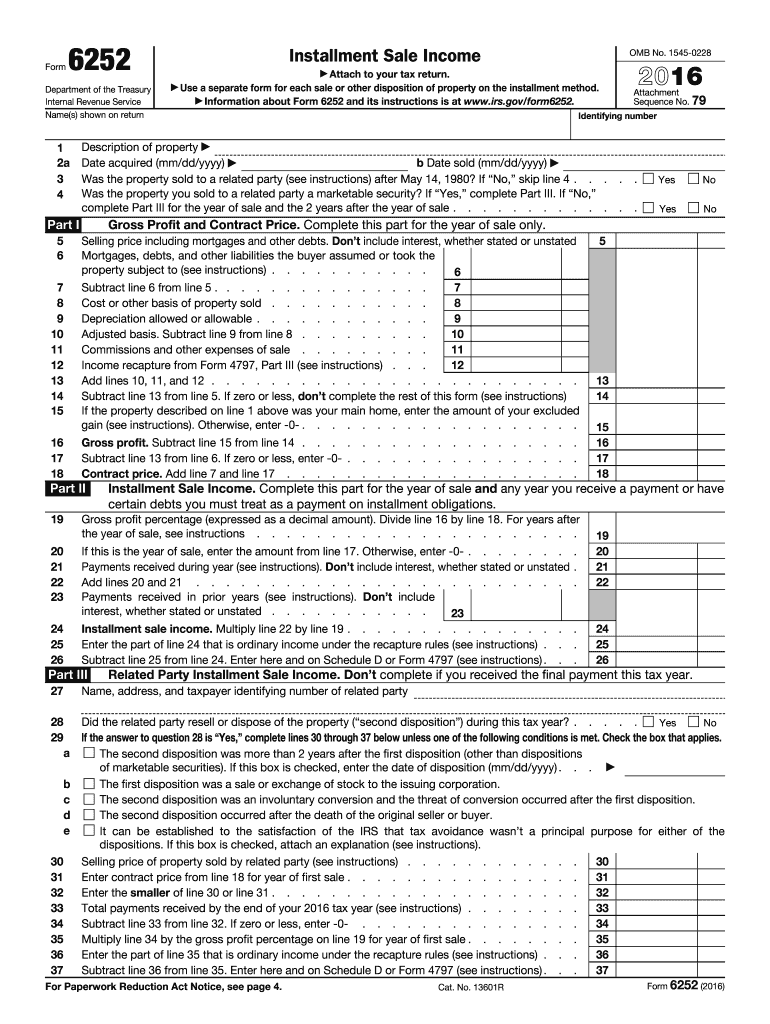

Definition & Purpose of the 2016 IRS Form 6252

Form 6252, officially known as the "Installment Sale Income," is used by taxpayers to report income from installment sales. Installment sales occur when at least one payment is received after the tax year of the sale. This form allows sellers to report gains and losses from property sales under the installment method, which can lead to tax benefits by spreading income over several tax years.

Key elements of Form 6252 include:

- Reporting gross profit from the sale.

- Determining the contract price.

- Calculating the installment sale income for current and future years.

- Addressing related party transactions with specific reporting requirements.

- Establishing rules related to interest and depreciation, which can affect taxable income.

Understanding how to effectively use Form 6252 is crucial for individuals who conduct sales on an installment basis, as it provides a framework for accurately assessing tax liabilities.

How to Complete the 2016 IRS Form 6252

Filling out Form 6252 involves several critical steps. Taxpayers must gather information about the sale transaction and identify the necessary financial details to accurately report income.

-

Gross Profit Calculation:

- The first step requires calculating the gross profit from the sale, which involves determining the selling price and subtracting the adjusted basis of the property sold.

-

Contract Price:

- It is essential to identify the total contract price, which includes cash payments plus the fair market value of any property received.

-

Installment Sale Income:

- Taxpayers must calculate the installment sale income for the current year by applying the gross profit percentage to the payment received during the year.

Fields within the form where these calculations take place include:

- Part I: Gross profit calculation.

- Part II: Reporting installment sale income.

- Additional spaces to detail any payments made in prior years or expected future payments.

Ensuring accuracy in these calculations helps avoid any complications with the IRS.

Essential Terms Related to the 2016 IRS Form 6252

Familiarity with specific terminology related to Form 6252 is important for proper completion and understanding. Some key terms include:

- Installment Sale: A sale of property where at least one payment is deferred to a future date.

- Gross Profit: The difference between the selling price of the property and its adjusted basis.

- Contract Price: The total amount agreed upon in the sales contract, including non-cash payments.

- Installment Sale Income: The amount of income recognized in a given year from installment sales based on received payments.

Understanding these terms aids in grasping how income from sales must be reported and helps tax filers manage their financial records appropriately.

Filing Deadlines for the 2016 IRS Form 6252

Compliance with deadline requirements is critical for all taxpayers. Form 6252 must be filed as part of the income tax return (Form 1040) for the tax year in which the sale occurred. Here are key points regarding filing deadlines:

- Standard Filing Deadline: Typically, tax returns are due on April 15 of the following year, unless it falls on a holiday or weekend, in which case it may be extended to the next business day.

- Extensions: If additional time is required, taxpayers can file for an extension, usually granting an additional six months to file the return, but any tax owed must still be paid by the original deadline to avoid penalties.

Being mindful of these deadlines facilitates compliance with IRS regulations and avoids late filing fees.

Who Uses the 2016 IRS Form 6252?

Varied individuals and business entities may find Form 6252 applicable, particularly those engaged in sales involving long-term property transactions. The following groups typically use Form 6252:

- Real Estate Sellers: Individuals selling property on an installment basis to buyers can benefit from spreading taxable gains over years.

- Business Owners: Owners of businesses that have sold assets or inventory under installment agreements also rely on this form.

- Tax Professionals: Accountants and tax advisors prepare and file Form 6252 on behalf of clients to ensure compliance with IRS reporting requirements.

Understanding who typically uses the form can help identify the various scenarios in which it may be relevant, thus aiding preparation and filing processes.

Important Guidelines from the IRS regarding Form 6252

The IRS provides specific guidelines related to the use and completion of Form 6252. Adhering to these instructions is necessary to ensure that tax obligations are met correctly:

- Installment Sales Rules: Sellers must report income as payments are received, which may differ from the traditional method of reporting all income at the time of the sale.

- Related Party Transactions: Special rules apply when the buyer or seller is a related party. Additional scrutiny may be necessary to comply with IRS regulations.

- Special Considerations: Certain forms of property or transactions may not qualify for installment reporting, including sales that are financed through loans or third-party financing.

Taxpayers must review these guidelines to ascertain that their transactions qualify for installment sale treatment, ensuring compliance and accuracy in reporting.

Examples of Using the 2016 IRS Form 6252

Understanding practical scenarios can clarify how Form 6252 is utilized in real-life situations. Here are two common examples:

-

Real Estate Transaction: A homeowner sells an investment property for $300,000, with $100,000 down and a promise of $200,000 payable over five years. They report the $100,000 received immediately and then calculate the income from annual payments based on the gross profit percentage for the remaining balance.

-

Business Equipment Sale: A small business sells machinery for $50,000, collecting $20,000 upfront and the remaining $30,000 in installments over the next two years. The owner must complete Form 6252 to report the portion of the gain attributable to payments each year.

These examples highlight the various applications of Form 6252 across different types of transactions, reinforcing the importance of accurate reporting for tax compliance.