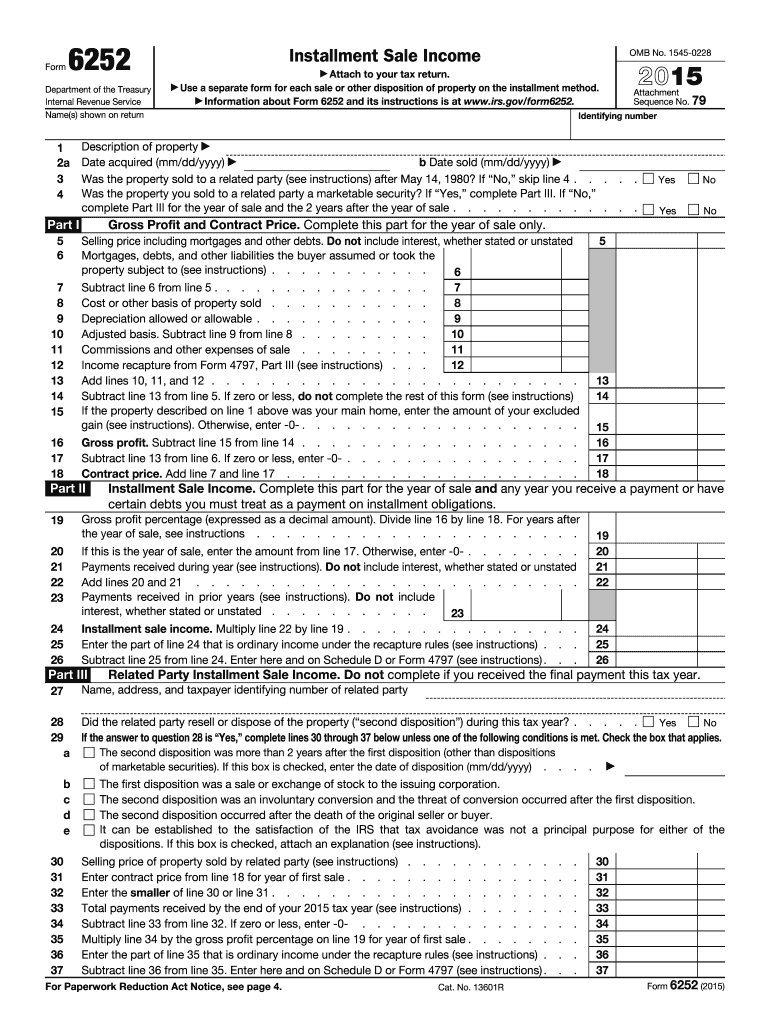

Definition and Meaning of the 2 Form

Form 6252 is a tax document utilized to report income from installment sales of property when at least one payment is received after the tax year of the sale. An installment sale occurs when a seller allows the buyer to make payments over time rather than requiring full payment upfront. The sales can involve various types of properties, including real estate, vehicles, and personal property.

This form is critical for taxpayers who engage in installment sales, as it determines how income is reported for tax purposes over the duration of the installment period. The seller must outline the gross profit from the sale, the contract price, and the income received, while ensuring compliance with IRS guidelines. Understanding the intricacies of this form is essential for anyone participating in installment sales to avoid tax reporting errors.

Key Components of Form 6252

- Gross Profit Calculation: This section explains how to calculate the profit made from the sale.

- Contract Price: A detailed description of what constitutes the total contract price in an installment arrangement.

- Installment Sale Income: How to report the income received from payments made in the current tax year.

- Related Party Transactions: Special rules that apply when the buyer and seller are related parties.

How to Use the 2 Form

Using the 2 form involves several structured steps to ensure accurate reporting of installment sale income. The quickest way to access the form is through the IRS website, where it can be downloaded and printed.

Steps to Utilize the Form:

- Download the Form: Obtain the 2 form from the IRS website or trusted tax preparation software.

- Gather Financial Records: Compile all documents related to the sale, including the sales contract and payment records.

- Complete the Form: Fill in the required fields carefully. You will need to input details regarding the total selling price, the amount of any payments made, and other pertinent financial data.

- Calculate Income: Use the provided sections to calculate gross profit and installment sale income, paying close attention to which year you are reporting payments.

- Review: After filling out the form, double-check for accuracy and completeness before submission.

The importance of accurate completion cannot be overstated, as errors can lead to discrepancies that may trigger audits or penalties.

Steps to Complete the 2 Form

Completing the 2 form requires attention to detail and understanding of the specific sections involved. Each part of the form plays a critical role in accurately reporting the income generated from an installment sale.

Breakdown of Completion Steps:

-

Section I: Overview of the Transaction

- Indicate basic transaction details, including the type of property sold and the date of sale.

- Calculate the total selling price and the amount of any payments received in the current tax year.

-

Section II: Gross Profit Calculation

- Use the formula: Gross Profit = Selling Price - Adjusted Basis.

- This section should clearly disclose any expenses or adjustments related to the sale.

-

Section III: Installment Sale Income Identification

- Report the amount of income recognized for the current tax year based on payments received.

- Include calculations that arrive at the percentage of profit recognized.

-

Related Party Transaction Considerations

- If applicable, disclose information relating to transactions involving family members or close associates.

- Follow specific IRS instructions for these scenarios to maintain compliance.

-

Signature and Date: Ensure the form is signed and dated to verify its accuracy.

Completing each section with precise financial data is crucial to compliance and accurate taxation.

Important Terms Related to the 2 Form

Understanding the terminology associated with Form 6252 is essential for clarity in the reporting process. Several terms refer specifically to the methods and calculations necessary for accurately reporting installment sale income.

Key Terms Explained:

- Installment Sale: A sale where payments are made over time rather than in a lump sum at the time of sale.

- Gross Profit: The difference between the selling price of the property and the seller's adjusted basis in the property.

- Contract Price: The total amount the buyer agrees to pay, which may include interest and fees on the installment payments.

- Related Party Transactions: Transactions between parties who have a close relationship, requiring special consideration in the tax implications.

Familiarity with these terms will help taxpayers navigate the complexities of reporting installment sales.

Legal Use of the 2 Form

The legal framework surrounding the 2 form is established by tax regulations that govern how income from installment sales must be reported. It is crucial for taxpayer compliance and avoiding potential disputes with the IRS.

Key Legal Considerations:

- Compliance with IRS Guidelines: Adhering to the instructions provided for Form 6252 is vital for maintaining compliance with federal tax laws.

- Legal Binding of Installment Sales: Ensure that the contracts and agreements regarding installment sales are legally binding to facilitate reporting on Form 6252.

- Documentation Requirements: Maintain complete records of all transactions related to the sale, including any correspondence and payment schedules, to substantiate claims made on the form.

Understanding the legal implications of using this form ensures that taxpayers remain compliant with the law while accurately reporting installment sales.

Examples of Using the 2 Form

Real-world scenarios can provide context for how Form 6252 is utilized in different situations. These examples illustrate various types of property transactions and the associated reporting requirements.

Scenario Examples:

- Real Estate Transaction: John sells a rental property for $300,000 with a down payment of $60,000 and a repayment plan extending over five years. John will report the installment sale income on Form 6252 accordingly.

- Vehicle Sale: Sarah sells her car valued at $15,000 with an agreement for the buyer to make monthly payments. Sarah needs to report the income related to the payments received in the year after the sale, using Form 6252.

- Related Party Sale: Mark sells a business asset to his brother under an installment agreement. This transaction requires careful reporting on Form 6252 due to the familial relationship, which may invoke specific IRS scrutiny.

These examples showcase the importance of the 2 form in various installment sale scenarios, emphasizing the need for precision and compliance.