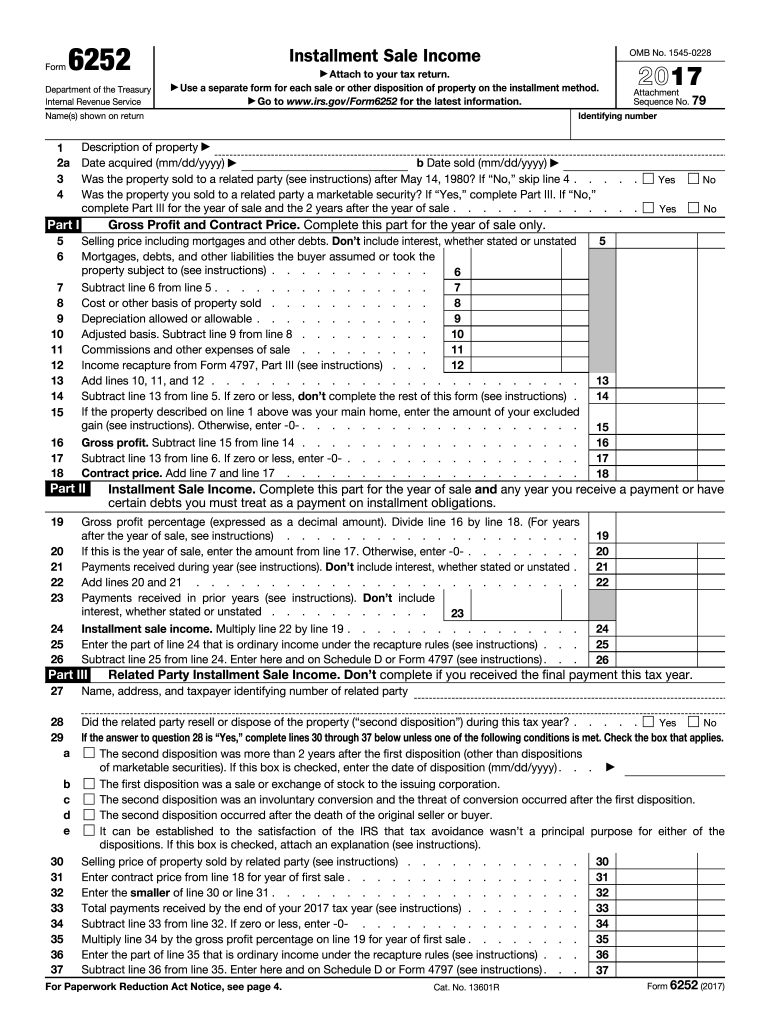

Understanding IRS Form 6252

IRS Form 6252 is specifically designed to report income from installment sales. It is essential when at least one payment is received after the tax year in which the sale occurred. This form plays a crucial role in helping taxpayers meet IRS requirements when reporting gains from property sold on an installment basis.

Key Elements of IRS Form 6252

The form includes several vital sections that taxpayers must complete to accurately report their gains:

- Gross Profit: This calculation reflects the profit made from the sale.

- Contract Price: It outlines the total price agreed upon for the sale of the property.

- Installment Sale Income: This section calculates the income attributed to each payment received.

Understanding these elements ensures that you correctly report taxable income, which can significantly impact your overall tax liability.

How to Complete IRS Form 6252

Completing IRS Form 6252 involves several critical steps:

- Gather Documentation: Collect information regarding the sale, including the purchase price and any related expenses.

- Fill Out Basic Information: Enter the taxpayer's name, address, and pertinent details about the property.

- Calculate Gross Profit: Deduct your basis in the property from the selling price to determine gross profit.

- Determine Installment Sale Income: Use the allocated gross profit percentage to calculate the income from each installment payment received.

Adhering to these steps will facilitate proper reporting and compliance with IRS regulations.

Examples of Using IRS Form 6252

Consider a scenario where a taxpayer sells a property for $300,000 with a basis of $200,000. The gross profit from this transaction would be $100,000. If they structure the sale as an installment sale, receiving payments over several years, IRS Form 6252 allows them to report these payments over time, ensuring tax liabilities are appropriately managed each tax year.

Another illustrative case may involve a seller who sells a piece of real estate to a relative through an installment plan. This situation may require careful consideration of related party transactions and adherence to specific IRS rules to avoid complications.

Important Terms Related to IRS Form 6252

Understanding terminology associated with IRS Form 6252 is crucial for accurate completion:

- Basis: Refers to the original value of the property, important for calculating gross profit.

- Installment Sale: A sale in which the buyer pays the seller in multiple payments over time.

- Related Party Transactions: Transactions involving family members or entities with significant control, which may have different reporting requirements.

Familiarity with these terms aids in navigating the complexities of the form and ensures compliance with established guidelines.

Legal Use of IRS Form 6252

IRS Form 6252 must be used according to specific legal guidelines set forth by the IRS. The form serves as a legal document that validates the reporting of installment sales for taxation purposes. Failure to correctly use this form can result in penalties or audit inquiries from the IRS.

Proper use includes ensuring that all pertinent information is accurately reported and that the form is submitted in accordance with IRS deadlines for tax filing.