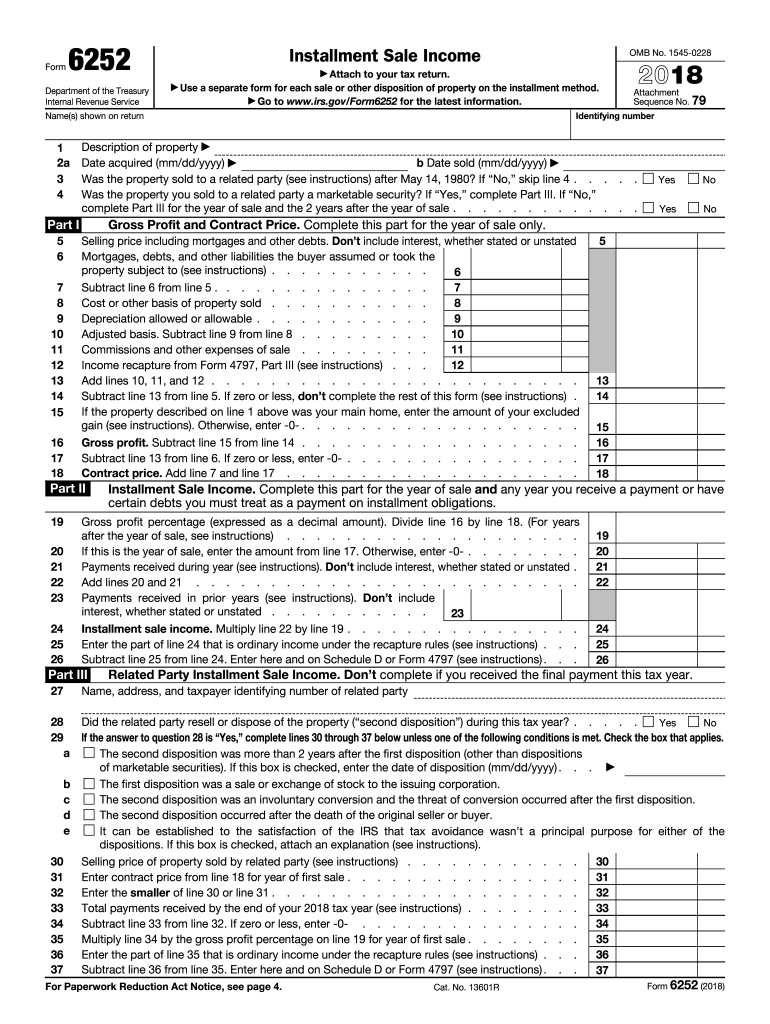

Definition and Purpose of IRS Form 6252

IRS Form 6252 serves to document income from installment sales, which occur when sellers receive at least one payment after the year in which the sale was executed. This form is vital for taxpayers who finance the sale of property and allows for the reporting of income from such arrangements. By utilizing this form, taxpayers can spread the reporting of the income over the period they receive payments, thus potentially lowering their tax burden during a specific tax year.

The form contains sections for various calculations essential for the taxpayer, including:

- Gross profit from the sale

- Contract price

- Actual income recognized from installment payments

Additionally, Form 6252 addresses special rules applicable to sales involving related parties, capital gains, and recapture penalties, thus ensuring that taxpayers comply with IRS guidelines while reporting consistent income streams.

How to Properly Use IRS Form 6252

To utilize IRS Form 6252 effectively, taxpayers must first ensure they meet the criteria for installment sales.

Basic Steps:

- Determine Sale Type: Verify if the sale qualifies as an installment sale under IRS definitions.

- Gather Required Information: Collect data regarding the sales price, the basis of the property sold, and any relevant transaction fees or costs.

- Complete the Form: Fill out each section carefully to ensure accurate reporting. Each line requires specific data related to the sale.

Important Notes:

- Only include properties sold on installment if at least one payment is received post-tax year.

- Use this form to report income from sales of property, other than stocks or bonds, if the payments extend beyond one tax year.

Steps to Complete IRS Form 6252

Completing IRS Form 6252 requires attention to detail and understanding of applicable tax laws.

Step-by-Step Completion Process:

-

Part I - Gross Profit Percentage:

- Calculate your gross profit by subtracting the total basis for the property sold from the total sales price. Divide this amount by the total sales price to find the percentage.

-

Part II - Installment Sale Income:

- For each payment made during the tax year, multiply the payment amount by the gross profit percentage derived in Part I to determine income recognized.

-

Part III - Reporting Related Party Transactions:

- If applicable, disclose any specifics if the sale involves family members or related entities, as special rules may apply.

-

Record Keeping:

- Retain copies of all documentation regarding the sale, including the original installment sale contract, as proof of income reported.

Important Terms Related to IRS Form 6252

Understanding key terminology is essential when dealing with IRS Form 6252, particularly for accurate tax reporting.

Common Terms Include:

- Installment Sale: A sale of property where payments are made over time after the initial sale.

- Gross Profit: The difference between the selling price and the basis (cost) of the property sold.

- Contract Price: The total amount received from the sale, which may include cash and any debt assumed by the buyer.

- Recapture: The process of reporting previously deducted depreciation as income when the asset is sold for a profit.

Familiarity with these terms helps in accurately filling out the form and meeting compliance requirements.

Filing Deadlines for IRS Form 6252

The filing deadlines for IRS Form 6252 align with the overall income tax filing deadlines in the United States.

Key Dates:

- Standard Tax Filing Deadline: Typically, forms are due on April fifteenth of the following tax year, unless a weekend or holiday extends the date.

- Extended Filing: If an extension is filed for your tax return, Form 6252 must be submitted by the extended deadline.

Considerations:

- Failure to file by the deadline can result in penalties, emphasizing the importance of verifying the completion of this form well in advance of the due date.

Examples of Using IRS Form 6252

Practical examples enhance understanding of IRS Form 6252's application in real-world scenarios.

Scenario Examples:

-

Example One: A homeowner sells their property on installment, receiving monthly payments over five years. Each year, they report the portion of income using Form 6252, applying the gross profit percentage to determine taxable income.

-

Example Two: A business sells equipment on an installment basis to another company. The reporting of income follows the same guidelines as real estate, requiring careful tracking of payments to ensure correct income reporting each tax year.

These examples underline the significance of Form 6252 in diverse financial situations, ensuring compliance and accurate tax reporting.