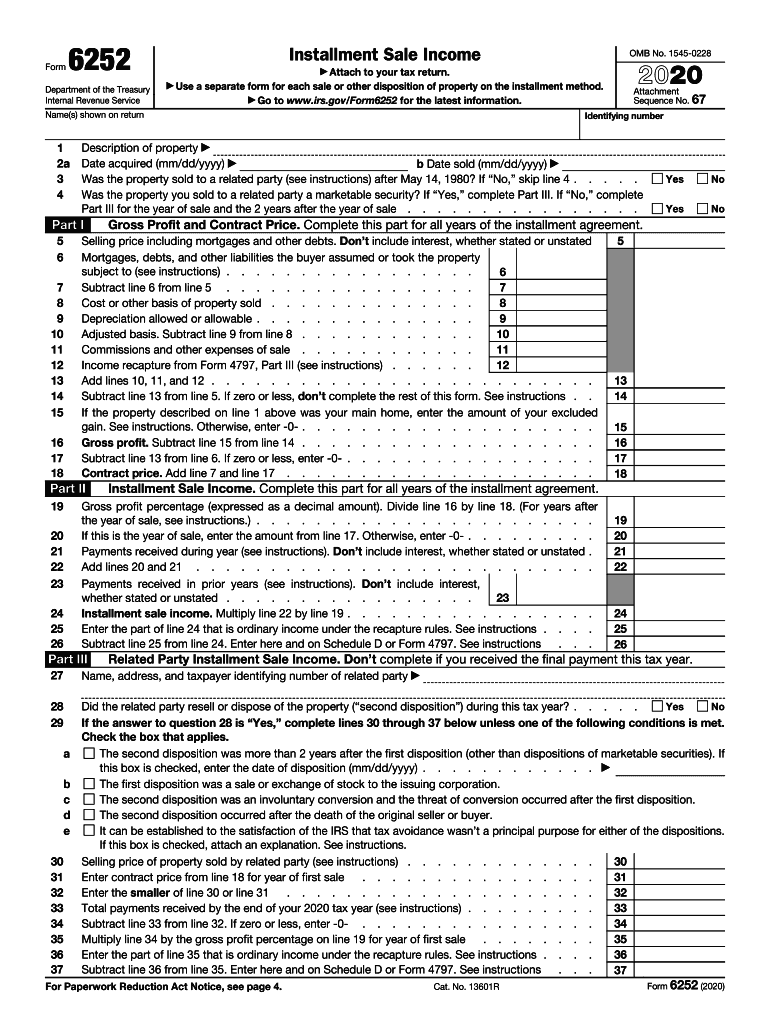

Definition and Purpose of Form 6252

Form 6252 is designated for reporting income generated from installment sales, where at least one payment is made in a tax year following the sale. This form plays a crucial role in determining tax liability associated with these transactions, allowing taxpayers to report the income they receive over multiple years instead of accounting for it all in one year. The core components of this form include information about gross profit from the sale, the contract price, and payments received throughout the installment agreement duration.

Key Concepts Related to Installment Sales

- Installment Sale: This refers to a transaction where a buyer makes multiple payments over time instead of a single lump-sum payment. This is common in real estate sales or large asset sales.

- Gross Profit: This is calculated by subtracting the basis (the seller's cost or investment in the property) from the selling price.

- Payment Allocation: The form requires taxpayers to distribute the total payment received during the tax year between principal and interest.

Step-by-Step Instructions for Completing Form 6252

Filling out Form 6252 accurately is essential for compliance and proper reporting. Below is a breakdown of how to complete the form, ensuring each section is correctly addressed.

-

Collect Necessary Information: Gather data regarding the sale, including dates, prices, and payment schedules. This information is critical for accurate reporting.

-

Report Sale Information:

- Enter the gross profit from the sale.

- Indicate the total contract price, which includes the total amount expected from the buyer.

-

Calculate Payment Received:

- Document any payments received during the year. Break these down into principal and interest components for clarity.

-

Calculate and Report Gross Profit Percentage:

- Use the formula: Gross Profit Percentage = (Gross Profit / Contract Price) x 100. This percentage informs subsequent tax reports.

-

Complete Additional Sections: Depending on specific transactions, the form may require further information regarding related parties or any capital gains associated with the sale.

-

Review and Submit: Before sending the form, verify all entries to ensure there are no errors that could lead to compliance issues.

Important Terms Related to Form 6252

Understanding terminology relevant to Form 6252 enhances comprehension and compliance. The following terms are integral to interpreting the form correctly:

- Installment Method: A tax reporting method allowing income from sales to be recognized as payments are received rather than when the sale occurs.

- Ordinary Income Recapture: Refers to the process where certain income, such as depreciation recapture, is subject to taxation as regular income rather than capital gains.

- Related Party Transactions: Sales involving parties that have a particular relationship, which may necessitate additional reporting requirements.

Filing Deadlines and Important Dates

Adhering to deadlines is critical in tax reporting. The key deadlines for submitting Form 6252 include:

- Tax Year Filing Deadline: Typically aligns with the individual's income tax return deadline. For most taxpayers, this is April 15 unless extended.

- Extended Deadlines: If claimed, extensions to file personal tax returns apply, generally pushing deadlines to October 15.

- Amendments: If mistakes are discovered after submission, taxpayers can file an amended return, which may also include corrections for Form 6252.

Examples of Using Form 6252 in Real Scenarios

Understanding the practical application of Form 6252 can clarifying its importance. Here are several scenarios illustrating its use:

-

Real Estate Sale: A homeowner sells their property for $300,000, receiving a $50,000 down payment and agreeing to receive the remaining balance in installments over five years. They will report their gross profit and utilize Form 6252 annually to declare the income as payments are received.

-

Business Sale: A small business owner sells their enterprise for $100,000 with a 10-year repayment plan. Each year, they report the payments received and any interest earned using Form 6252, ensuring they calculate taxes owed based on actual received income.

-

Related Party Sales: When a parent sells property to a child and structures the sale with installment payments, they must use Form 6252 to report the income while adhering to IRS guidelines to prevent non-compliance issues.

Legal Use of Form 6252 and Compliance

Using Form 6252 correctly is essential to remain compliant with IRS rules. This form adheres to the legal requirements set forth under the Internal Revenue Code regarding installment sales. Each taxpayer must ensure they:

- Accurately report all income: Misreporting can lead to audits or additional taxes owed.

- Maintain documentation: Keep thorough records of transactions and payment schedules to support claims made on Form 6252.

- Be aware of state laws: In some jurisdictions, different rules may affect how installment sales are treated for state tax obligations.

Understanding these facets aids taxpayers in executing their responsibilities correctly and avoiding penalties.