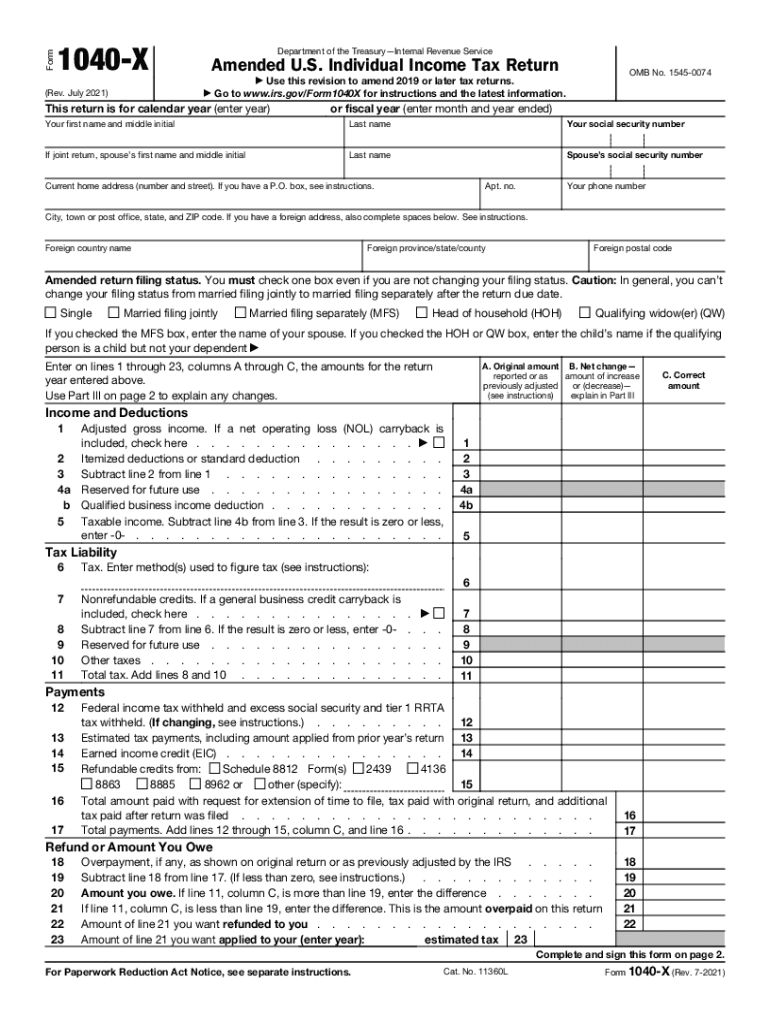

Definition and Purpose of the 1040-X Form

Form 1040-X, the Amended U.S. Individual Income Tax Return, is utilized by taxpayers in the United States to amend a tax return that has already been filed for years 2019 and later. When errors or omissions are discovered in the original filing, this form allows taxpayers to correct their filing status, income, deductions, or credits. It provides an opportunity to adjust previously submitted information to ensure accuracy and compliance with IRS regulations.

Key Elements of the 1040-X Form

- Personal Information: Includes taxpayer's name, Social Security Number, and address.

- Filing Status: Any changes in marital status or dependents that affect the filing status.

- Income and Deductions: Sections for correcting previously reported income and deductions.

- Tax Liability and Payments: Details adjustments to calculated taxes and credits.

- Explanation of Changes: A narrative section requiring a detailed explanation for each change made.

How to Obtain the 1040-X Form

Taxpayers can obtain Form 1040-X through several methods. The IRS website offers a downloadable PDF version that can be printed for physical filing. Alternatively, electronic versions can be accessed through tax software providers, allowing for digital submission. Local IRS offices might also provide paper copies.

Access Points for the Form

- IRS Website: Ensure downloading the most current version.

- Tax Software: Platforms like TurboTax and QuickBooks support electronic filing.

- Local IRS Offices: Provide physical copies for non-digital use.

Steps to Complete the 1040-X Form

When completing Form 1040-X, taxpayers should follow a structured process to ensure accuracy and compliance.

- Confirm the Original Return: Review the original tax return to identify discrepancies.

- Gather Necessary Documentation: Collect documents that support changes, such as W-2 forms, 1099 forms, and receipts.

- Complete Each Relevant Section: Update personal information, adjust income, deductions, and explain changes thoroughly.

- Review and Double-Check Entries: Confirm all calculations and details are correct to prevent further amendments.

- Submit the Form: Choose whether to submit electronically via tax software or mail a paper form to the IRS.

Important Considerations

- Reconciliation with original entries is important to avoid contradictions.

- Attach all supporting documentation for each change.

- Use precise figures — avoid rounding unless specified by IRS guidelines.

Why You Might Need to Use the 1040-X Form

There are several reasons a taxpayer might need to amend their original tax return using the 1040-X form. Common instances include discovering unreported income, forgotten deductions, or incorrect filing status. Additionally, legislative changes or IRS notices might necessitate alterations after the initial filing.

Scenarios Prompting an Amendment

- Unreported Income: Discovering additional income sources or tax forms received after filing.

- Missed Deductions/Credits: Identifying deductions or credits eligible for claims.

- Filing Status Errors: Incorrectly selecting single, married, or head of household.

Who Typically Uses the 1040-X Form

Generally, individual taxpayers who have already filed their returns for the tax year utilize Form 1040-X. It is particularly common among those with complex deductions or who receive income from multiple sources.

Common Users

- Self-Employed Individuals: Often need to report adjusted income or expenses.

- Retirees: May overlook pension contributions or medical expense deductions.

- Students: Variable tuition and fees can impact credits and deductions.

Important Terms Related to the 1040-X Form

Understanding specific terminology is crucial when dealing with Form 1040-X. Familiarity with these terms can aid in accurate completion of the form.

- Adjusted Gross Income (AGI): Total gross income minus specific deductions.

- Tax Liability: The total amount of tax that must be paid.

- Credits: Amounts that directly reduce tax liability.

- Filing Status: Classification used to determine tax rates and eligibility for certain deductions and credits.

Detailed Definitions

- AGI Adjustments: Changes affecting gross income calculations.

- Tax Credits vs. Deductions: Credits reduce taxes owed, while deductions decrease taxable income.

IRS Guidelines for the 1040-X Form

The IRS provides specific instructions and guidelines for completing Form 1040-X, which must be adhered to in order to avoid penalties or rejection of the amendment.

Key IRS Rules

- Amend returns within three years from the original filing date.

- Ensure all amended returns are signed and dated.

- Corrections related to personal details, income sources, or credits must be substantiated with appropriate documentation.

Filing Deadlines and Important Dates

Timeliness is essential when amending tax returns. Understanding the critical deadlines ensures compliance and avoids late fees or penalties.

Key Dates to Remember

- Three-Year Rule: Submitting the amendment within three years of the original filing date or within two years from the date taxes were paid, whichever is later.

- IRS Processing Time: Typically, eight to twelve weeks are required for the IRS to process amended returns.

Practical Considerations

- Keep track of submission and acknowledgment from the IRS.

- Consider potential state requirements for amendments, as they might differ in deadlines and procedures.