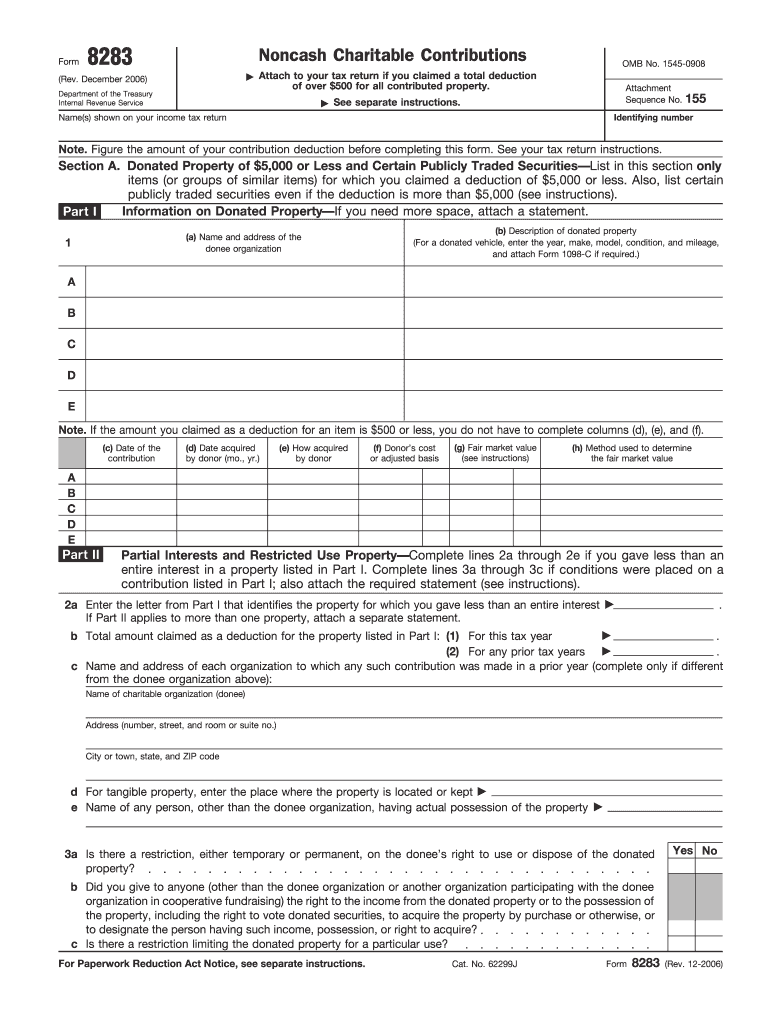

Definition and Purpose of Form 8283 (Rev. 2006)

Form 8283, known officially as "Noncash Charitable Contributions," is used by taxpayers in the United States to report information about noncash charitable contributions when they exceed $500. This form is particularly crucial for individuals or organizations looking to claim deductions for their charitable donations of property. It is divided into sections that document details of donated property valued at $5,000 or less and more than $5,000, ensuring compliance with IRS tax deduction criteria. Adequate documentation includes information about the donor, the donee organization, property description, fair market value, and any usage restrictions.

How to Use Form 8283 (Rev. 2006)

Filling out the 8283 form requires attention to detail:

-

Complete Section A: Enter details for donations over $500 but not exceeding $5,000. This includes the description of the items, the value, and information about the receiving organization.

-

Fill Section B: For donations exceeding $5,000, you'll need detailed appraisals, typically by a qualified professional.

-

Obtain Signatures: Both the donor and possibly an appraiser must sign declarations affirming the fair market value of the property donated.

- Example: A taxpayer donates art valued at $7,000; they must provide an appraisal alongside complete information in the appropriate sections.

How to Obtain Form 8283 (Rev. 2006)

Form 8283 can be accessed via the IRS website, downloaded as a PDF, or acquired from tax preparation software like TurboTax or QuickBooks. Here’s how to download it:

- Visit IRS.gov: Navigate to Forms & Publications.

- Search for 8283: Use the search bar to find and download the current version.

- Download and Print: You can then fill it out electronically or print it for a handwritten completion.

Steps to Complete Form 8283 (Rev. 2006)

Follow these steps:

- Identify Donations: List all properties donated, ensuring you separate items valued at $5,000 or less from those over $5,000.

- Calculate Fair Market Value: Use a reputable appraiser if necessary.

- Document Donor and Donee Information: Include your details and those of the charity.

- Gain Required Signatures: All parties must sign, including a responsible official from the charity and possibly an appraiser for larger donations.

- Retain Copies: Keep a copy for your records and submit one with your tax return.

- Nuances: Donations of cars, planes, or boats have additional stipulations and may require Form 1098-C.

Importance and Benefits of Using Form 8283

Form 8283 is pivotal for maximizing tax deductions related to noncash charitable contributions. Proper filing:

- Ensures compliance with IRS regulations.

- Maximizes potential deductions by providing documented evidence of donations.

- Protects against audits by showing due diligence and transparency in claims.

Key IRS Guidelines for Form 8283 (Rev. 2006)

- Documentation: Keep all receipts, letters, and acknowledgments from charities.

- Appraisals: Essential for items over $5,000 in value.

- Submission: Attach complete Form 8283 to your federal tax return.

Penalties for Non-Compliance

Non-compliance with IRS rules can lead to disallowed deductions, fines, and potential audits. Examples of non-compliance include:

- Failing to provide necessary appraisals for high-value items.

- Incorrect fair market value reporting.

- Lack of proper signatures.

Methods for Submitting Form 8283 (Rev. 2006)

Form 8283 can be submitted either electronically with your e-filed tax return or mailed alongside a paper tax return. Electronic submission is often advisable due to speed and efficiency. Here’s how:

- Electronic Filing: Use approved tax software.

- Mailing: Attach to the paper return and send to the IRS as instructed in the tax return filing instructions.

Eligibility Criteria for Using Form 8283

Eligibility for filing includes any U.S. taxpayer who has donated noncash property over $500 within a tax year. Essential criteria encompass:

- Donations must be made to qualified charitable organizations.

- Proper and timely filing ensures eligibility.

- Detailed documentation must accompany claims to support the deduction amounts reported.

Provide detailed explanations for clarity and comply with IRS standards to optimize charitable contribution deductions.