Understanding Form 941-X: Definition and Purpose

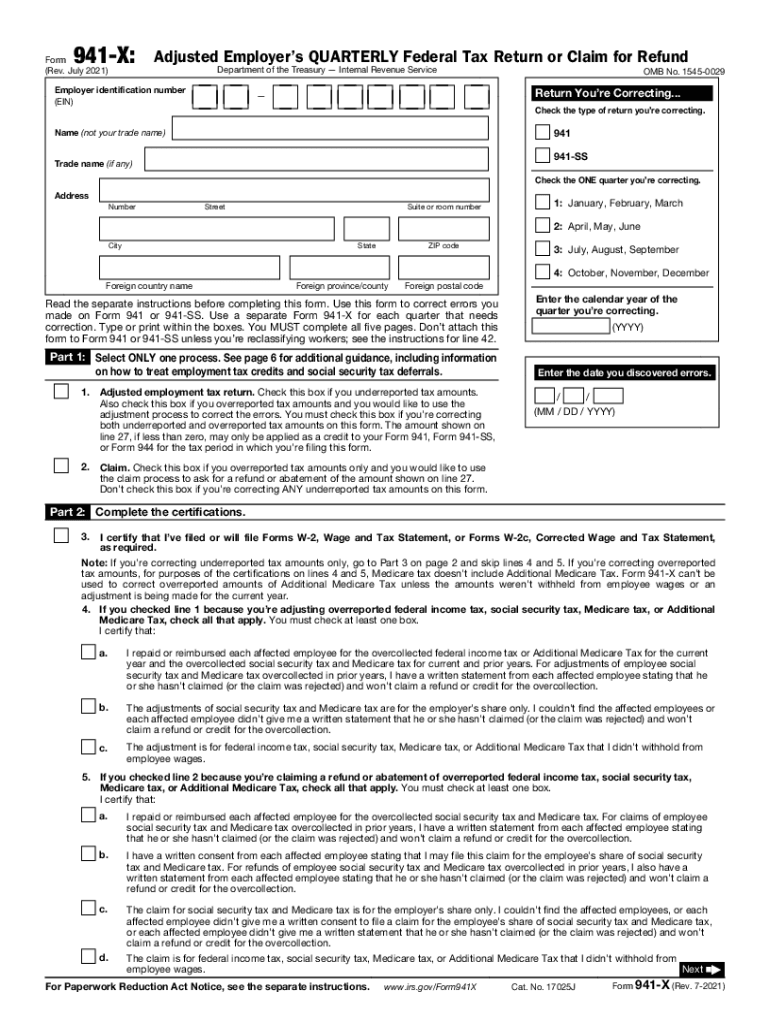

Form 941-X, officially known as the "Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund," allows employers in the United States to correct errors made on their previously filed Forms 941 or 941-SS. Employers use this form to adjust employment tax values, which may involve underreporting or overreporting taxes. By providing a mechanism to make these corrections, Form 941-X helps ensure that employers maintain accurate tax records and compliance with federal tax regulations.

How to Use Form 941-X

Employers need to understand when and how to file Form 941-X to rectify errors efficiently. The form can be submitted to:

- Adjust previous reports of wages and taxes withheld.

- Claim a refund or abatement of overreported taxes.

- Report amounts not previously included in Form 941 submissions.

Employers must explain the error, indicate the correction, and calculate the difference in tax liabilities. This ensures accurate adjustments and helps in preserving compliance with the IRS regulations.

Process to Obtain Form 941-X

Form 941-X can be accessed and downloaded directly from the IRS’s official website. The site provides the option to print the form for manual completion or fill it out digitally. Employers can also obtain physical copies by visiting IRS local offices or by requesting them via mail. Having easy and direct access to the form ensures that employers can address tax discrepancies promptly.

Detailed Steps to Complete Form 941-X

-

Part 1: Employer Identification Information

- Fill in the employer’s name, address, and EIN. Ensure these details match the prior submission to avoid processing delays.

-

Part 2: Explain the Error

- Provide a detailed explanation of the error made in the original filing. This involves specifying the type of error and the tax period affected.

-

Part 3: Correcting Wages and Taxes

- Compute the correct amounts for wages, credits, and taxes. Use worksheets provided by the IRS where necessary.

-

Part 4: Calculating Tax Adjustments

- Clearly calculate the corrected amounts and explain how these adjustments impact the overall tax liability or refund claim.

-

Part 5: Finalizing and Signing

- Sign the form—this can be done via traditional signature or through an authorized digital method if submitting online.

Importance of Using Form 941-X

Filing Form 941-X is crucial for maintaining accurate tax records. It protects employers from legal penalties by allowing them to correct mistakes proactively. Timely corrections can result in significant tax savings, and in scenarios where taxes were overpaid, it can lead to refunds that improve business cash flow.

Who Typically Utilizes Form 941-X

The form is primarily used by employers spanning various business entities, such as corporations, partnerships, and sole proprietorships in the U.S. Employers from diverse sectors, including industrial, educational, and non-profit organizations, may find themselves needing to file adjustments using Form 941-X. This form is particularly beneficial for businesses that frequently deal with complex payroll structures.

Legal Use and Compliance Related to Form 941-X

Employers must ensure that Form 941-X submissions are compliant with the IRS's legal requirements. Correct submissions contribute to accurate tax reporting and prevent potential legal issues. It's prudent for employers to stay updated on IRS guidelines and timelines for submitting corrections, as failing to do so may result in penalties or legal repercussions.

Key Elements of Form 941-X

- Accuracy: Precision in the details provided, reflecting accurate corrections.

- Documentation: Attachment of relevant documents and records supporting the claimed correction.

- Explanation: Clear, concise explanation of the discrepancies and its resolutions.

- Signatures: Authorized signature confirming the correctness of the adjustment for legal purposes.

IRS Guidelines and Deadlines

The IRS mandates that employers file Form 941-X according to specific guidelines and within set timeframes, typically within three years of the original filing date or two years from the date taxes were paid, whichever is later. Adhering to these deadlines ensures that corrections are accepted and processed effectively, safeguarding businesses from unnecessary interest or penalty charges.

By understanding and effectively utilizing Form 941-X, employers can manage their federal tax liabilities accurately and remain compliant with IRS regulations, ultimately supporting their financial health and organizational integrity.