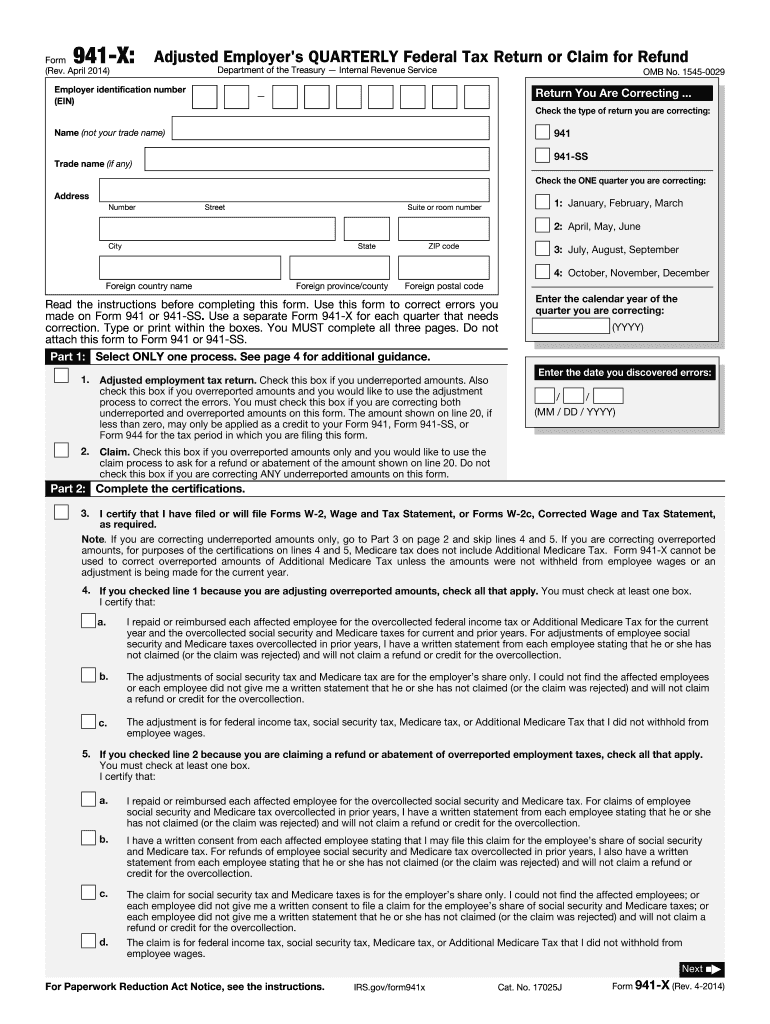

Definition and Purpose of the 2014 Form 941-X

The 2014 Form 941-X is used by employers in the United States to correct errors previously reported on Form 941 or Form 941-SS, which are the Employer’s Quarterly Federal Tax Returns. This form serves to rectify inaccuracies related to employment taxes, such as Social Security, Medicare, and income tax withholding. It helps businesses ensure compliance by providing a mechanism to adjust both underreported and overreported amounts, maintaining accurate financial records and tax obligations.

- Underreported Amounts: When an employer identifies underpayment of taxes in a prior quarter, the 941-X form provides sections to report these additional liabilities.

- Overreported Amounts: Similarly, overpayments can also be addressed, with options to correct the record and potentially secure a refund or credit.

- Certification Requirements: Employers must provide certification regarding reimbursements to employees, confirming the accuracy of corrections made.

Steps to Complete the 2014 Form 941-X

Filing the 2014 Form 941-X requires attention to detail and adherence to specific steps to ensure all corrections are accurately reported. Here's a step-by-step approach:

- Identify the Error: Begin by identifying the specific discrepancies that occurred on the original Form 941.

- Obtain the Correct Form: Ensure you have the correct 2014 version of the 941-X form.

- Fill in Employer Information: Enter information such as the employer's name, address, and Employer Identification Number (EIN).

- Complete Adjustments Sections: Include details of the corrections, utilizing the appropriate lines for underreported or overreported amounts.

- Certify Corrections: Sign and certify the form, ensuring all reimbursement declarations are accurate.

- Submit the Form: Decide on submission method (mail or online), ensuring it aligns with IRS requirements.

Special Considerations

- Multiple Corrections: If corrections span multiple quarters, separate forms must be filled out for each quarter.

- Explanation of Corrections: Clearly detail the corrections in the designated area to provide context and avoid processing delays.

Why You Should Use the 2014 Form 941-X

Correcting filed tax returns is crucial for maintaining compliance with IRS regulations. Here are key reasons to use the 2014 Form 941-X:

- Avoid Penalties: Correcting errors promptly can help avoid fines imposed for inaccurate tax filings.

- Financial Accuracy: Ensures that financial records reflect true liabilities, which is essential for audits and financial assessments.

- Reimbursements and Credits: Offers the potential to claim refunds or credits for overpaid taxes, aiding in financial recovery.

Real-World Scenario

Consider a small business that inadvertently overstated its tax liabilities due to miscalculations. Using Form 941-X, they can correct these errors and potentially recover overpaid amounts, improving their cash flow.

Key Elements of the 2014 Form 941-X

Understanding the components of the 2014 Form 941-X is pivotal for accurate completion:

- Employer Information: Basic identification details of the business.

- Adjustments Sections: Areas to detail underreported and overreported tax amounts.

- Certification: The employer's attestation of accuracy and employee reimbursements.

- Explanation of Changes: Space provided to narrate the corrections made and the reasoning behind them.

Detailed Breakdown

- Part 1: Correcting Employment Tax Liability

- Part 2: Certifications and Signatures

- Part 3: Detailed Explanation of Errors

Legal Use and Compliance

Form 941-X is governed by regulations that mandate its usage for all corrections to previously filed Form 941 or 941-SS tax returns. It is essential for employers to utilize this form strictly for its intended purpose to remain compliant with federal tax laws.

- Compliance with ESIGN Act: Legal electronic signatures are permissible, ensuring authenticity.

- Record Retention: Employers should maintain copies of filed forms and related documents as part of their compliance records.

IRS Guidelines for the 2014 Form 941-X

The IRS provides specific guidelines for completing and submitting the 941-X form:

- Timeliness: Corrections must generally be filed within three years of the original Form 941 due date or two years from the date tax was paid, whichever is later.

- Documentation: Employers should substantiate the corrections with documentation to support claims of overpayment or underpayment.

Submission Guidelines

- Paper Submission: Mail to the IRS service center assigned to your geographical location.

- Electronic Filing: Utilize authorized electronic filing platforms supporting Form 941-X.

Filing Deadlines and Important Dates

Adhering to deadlines is critical for the effective processing of corrections:

- Timely Corrections: Guidelines mandate that corrections should be filed as soon as errors are identified to minimize potential penalties.

- Statute of Limitations: Keep track of filing limits to ensure eligibility for making amendments.

Deadlines Overview

- Quarterly Considerations: Corrections are quarter-specific and adhere to the original filing timelines.

Form Submission Methods

Employers can choose different submission methods for the 2014 Form 941-X:

- Mail: Traditional paper forms can be sent directly to the IRS.

- Online Submission: Electronic filing options are available via the IRS's electronic systems.

Advantages of Online Submission

- Faster Processing: Online submissions often result in quicker response times from the IRS.

- Trackable: Electronic submission allows for tracking the status of the filing.

Practical Case Studies and Examples

To enhance understanding, consider these examples:

- Scenario 1: A company discovers an inadvertent omission of paid wages. Utilizing Form 941-X, they adjust the reported amount, ensuring the accurate calculation of liabilities.

- Scenario 2: An organization identifies an overpayment due to a software error. By filing the form, they secure a credit on future tax liabilities.

Edge Cases

- Self-Employed Individuals: Typically, self-employed individuals are not subject to employment taxes reported on Form 941; however, misclassifications should be corrected with the appropriate form.

By addressing these aspects thoroughly, employers can assure compliance with tax regulations, maintain accurate financial records, and mitigate potential financial repercussions associated with filing errors on Form 941.