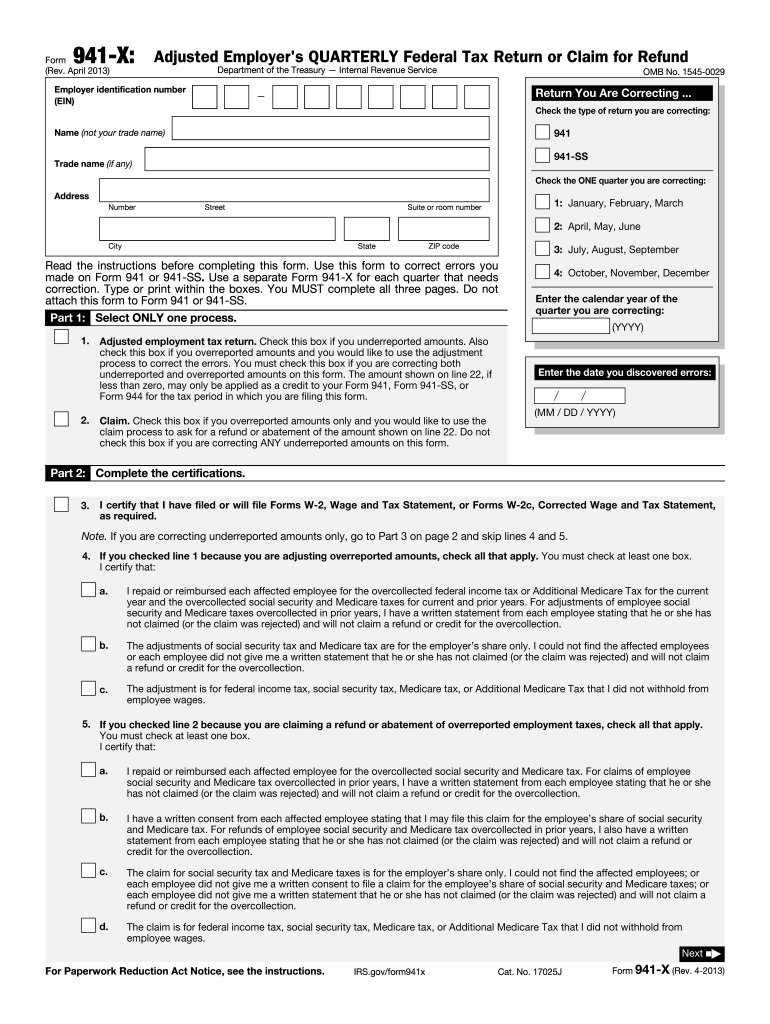

Definition and Purpose of Form 941-X

Form 941-X, also known as the Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund, is an official IRS document used by employers to correct errors previously reported on Form 941 or 941-SS. This form is essential for making adjustments to previously filed information such as wages, tips, and taxes withheld from employees' paychecks. Employers can use Form 941-X to amend underreported or overreported employment taxes for specific quarters or years. Accurately completing this form ensures compliance with federal requirements and helps maintain accurate records with the IRS.

Examples of When Form 941-X is Needed

- Underreported Wages: If an employer discovers that wages were underreported on the original Form 941, they need to file Form 941-X to correct this oversight.

- Overreported FICA Taxes: In cases where FICA taxes were overpaid, the employer can use Form 941-X to adjust and claim a refund for the overpayment.

- Incorrect Tax Classification: If an error in employee classification leads to incorrect tax reporting, this form allows employers to rectify these inaccuracies.

How to Obtain Form 941-X

Employers can easily access Form 941-X through multiple channels, ensuring convenience and accessibility:

- IRS Website: The form is available for download in a fillable PDF format directly from IRS.gov. This method is ideal for those who prefer to complete and submit the document electronically.

- Mail Requests: Employers can request a physical copy of Form 941-X by contacting the IRS directly, though this process may take longer compared to digital avenues.

- Professional Tax Software: Many tax preparation software platforms such as TurboTax or QuickBooks offer Form 941-X as part of their suite of services, simplifying the process of amending returns for users who rely on these programs.

Key Features of Obtaining Form 941-X

- Instant Access via IRS.gov: Look up and print from authoritative sources anytime.

- Availability in Tax Software: Seamless integration with software can reduce errors and enhance efficiency.

Steps to Complete Form 941-X

Completing Form 941-X involves several detailed steps to ensure accuracy and compliance:

- Identify the Errors: Review previous Form 941 submissions to identify specific errors in reported information.

- Select the Correct Tax Year and Quarter: Clearly indicate the period for which the amendment applies at the top of the form.

- Correct Reporting Details: Enter the corrected figures in the appropriate fields, ensuring accuracy in calculations for wages, taxes, and other related entries.

- Justify Adjustments: Provide detailed explanations in the designated area on the form, including the nature of the error and steps taken to correct it.

- Calculate Totals: After entering adjustments, ensure new totals are consistent with updated information.

- Certification: The form must be signed and dated by an authorized signatory who certifies the accuracy of the amendments.

Important Considerations

- Required Attachments: Include any supporting documents or schedules that substantiate the claims made in Form 941-X.

- Confirmation of Employee Reimbursements: If applicable, make sure employee reimbursements have been processed before filing.

IRS Guidelines for Form 941-X

The IRS provides specific guidelines to ensure Form 941-X is used correctly. These guidelines touch on various aspects of filing, including circumstances under which filing is necessary and the eligibility criteria for making corrections. Employers are required to follow these guidelines to avoid non-compliance penalties and ensure their records are accurate and up-to-date.

Key Aspects of IRS Guidelines

- Timing of Corrections: The IRS typically allows corrections to be made for up to three years after the original filing date.

- Certification of Accuracy: The responsible party must attest to the truthfulness of the corrections made.

Filing Deadlines and Important Dates

The filing deadlines for Form 941-X are crucial for maintaining compliance. Employers have a finite period after noticing an error to file this form:

- Filing Periods: Generally, corrections must be filed within three years from the date on which the original 941 was filed or two years from the date the tax was paid, whichever is later.

- Quarterly Deadlines: Employers need to keep track of quarterly filing dates to align corrections with the appropriate periods.

Timing for Optimal Compliance

- Early Corrections: Address inaccuracies as soon after discovery as possible to mitigate potential penalties.

- Monitor Compliance Dates: Maintain a reliable calendar system to manage deadlines effectively.

Required Documents for Form 941-X

When filing Form 941-X, specific documents are necessary to substantiate the corrections being made:

- Original Form 941 Copies: Copies of the originally submitted 941 forms for reference and validation.

- Supporting Documentation: Any records or receipts that provide evidence of withheld taxes, paid wages, or other employment tax-related items that require adjustments.

- Employee Statements: If applicable, include statements showing any reimbursements to employees for overpaid taxes.

Examples of Supporting Documentation

- Payroll Records: Ensure detailed records are available to support changes in reported wages.

- Tax Payment Receipts: Document any payments to or from the IRS relevant to the adjustments being made.

Penalties for Non-Compliance with Form 941-X Requirements

Failing to comply with the regulations surrounding Form 941-X can lead to several consequences for employers, including potential fines and interest charges:

- Failure to Correct Misstatements: Not filing corrections in a timely manner may result in penalties proportional to the discrepancies found.

- Misrepresentation Penalties: Intentionally submitting false information can trigger severe financial and legal repercussions.

- Notification Delays: Failing to correctly notify employees affected by the changes may lead to additional scrutiny and penalties.

Avoiding Compliance Issues

- Regular Audits: Conduct regular payroll audits to preemptively spot and correct discrepancies.

- Automated Solutions: Utilize software that flags potential errors before they necessitate amendments.

Form Submission Methods for Form 941-X

Employers should be aware of the different submission methods for Form 941-X to find the most suitable option depending on their circumstances:

- Electronic Filing: Submit forms directly through the IRS's online system, a method favored for its speed and efficiency.

- Mail Submissions: Paper submissions via mail are still accepted, albeit with a longer processing time.

- In-Person Delivery: In some cases, forms might be submitted in person at IRS centers, though this is less common.

Choosing Submission Method

- Speed and Confirmation: E-filing offers faster processing and instant submission confirmation.

- Complex Cases: Mail submissions may be preferable when additional documentation is substantial and best presented in a physical format.

Employers should ensure Form 941-X is completed accurately and submitted using the most appropriate method to maintain optimal compliance and efficiency.