Definition & Meaning

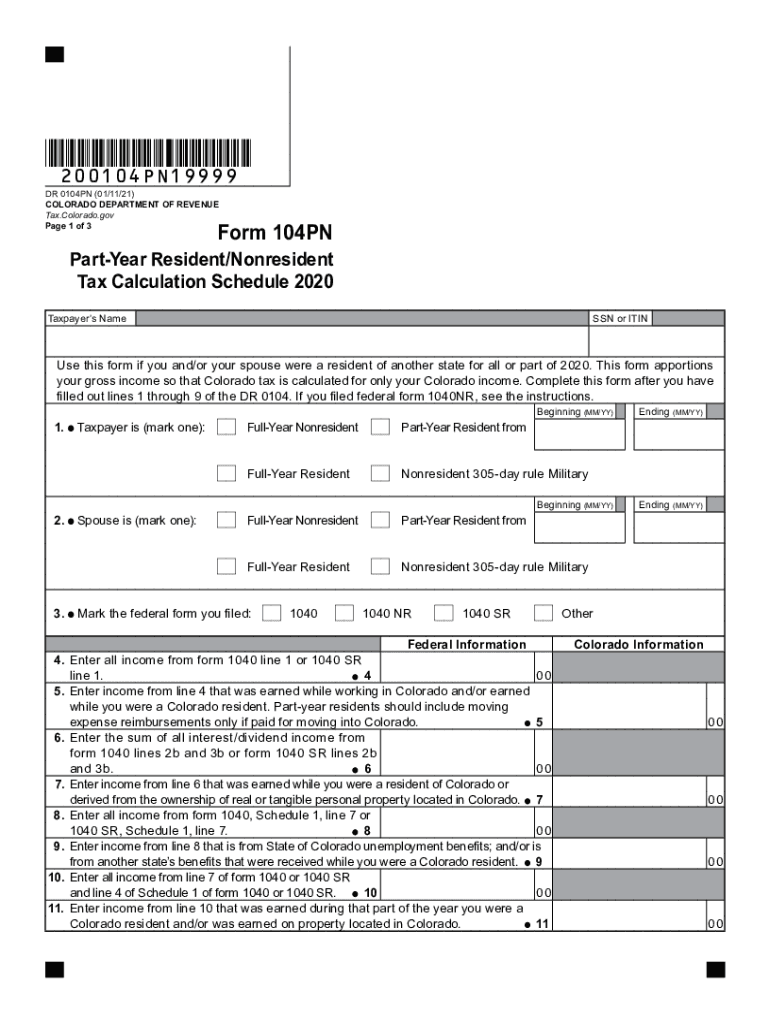

Form 104PN is a specialized tax form used by the Colorado Department of Revenue to determine the taxation of individuals who were not full-time residents of Colorado during the tax year. This form is essential for part-year residents and nonresidents as it helps apportion their gross income to calculate the taxable income attributable to Colorado.

Primary Use

The form serves as a tool to accurately report income earned while physically residing or working in Colorado. It is crucial for ensuring compliance with state tax obligations when an individual's residency status affects their income tax reporting.

How to Obtain the Colorado State Tax Form 104PN

Obtaining the Form 104PN is straightforward. It can be accessed:

- Online: Visit the Colorado Department of Revenue’s official website and download the form directly in PDF format.

- Mail: Request a physical copy to be mailed by contacting the Department of Revenue.

- Tax Software: Many tax software platforms, such as TurboTax and QuickBooks, include the form during the tax filing process.

Download Locations

- Ensure you access the latest version of the form to avoid discrepancies using obsolete versions. Check for updates annually.

Steps to Complete the Colorado State Tax Form 104PN

Completing Form 104PN involves several key steps:

- Personal Information: Enter your basic details, including name, social security number, and address.

- Residency Status: Specify your residency status and duration of residence in Colorado.

- Income Reporting: Record your total income as reported on the federal tax return. Then, allocate the portion of this income earned in Colorado.

- Adjustments and Deductions: Calculate allowable deductions connected to your Colorado income.

- Calculations for Tax Due: Complete the arithmetic as directed to determine any tax due based on the apportioned income.

Helpful Tips

- Use precise figures and double-check calculations for accuracy.

- Keeping thorough records can streamline filling out this form, especially the section concerning income allocation.

Key Elements of the Colorado State Tax Form 104PN

Several key sections of the form demand focused attention:

- Part-Year Residents: Specific calculation to differentiate between the periods inside and outside Colorado.

- Income Allocation: Accurate detailing of sources of income within and outside Colorado.

- Deductions Specific to Colorado: Optional adjustments specific to Colorado to determine taxable income.

Special Considerations

- Taxpayers should consider payroll stubs, W-2s, and 1099s to verify income sources.

- Consult Colorado’s specific deduction rules which might differ from federal guidelines.

Important Terms Related to the Colorado State Tax Form 104PN

Understanding the terminology used in Form 104PN is essential for accurate filing:

- Apportionment: Division of total income based on residency duration and income origin.

- Nonresident: A taxpayer who did not reside in Colorado at any point during the tax year.

- Part-Year Resident: A taxpayer who resided in Colorado for only part of the tax year.

Commonly Used Terms

- Gross Income: Total income before deductions specific to the tax year.

- Taxable Income: The portion of your income subject to state taxes after allowable deductions.

Who Typically Uses the Colorado State Tax Form 104PN

The form is primarily used by:

- Part-Year Residents: Individuals who lived in different states within a single tax year.

- Nonresidents: Those who earn income in Colorado but reside elsewhere full-time.

- Employees with Dual-State Income: Individuals who work in multiple states throughout the year.

Typical User Scenarios

- Seasonal workers who move for part of the year.

- Individuals who have accepted a job in Colorado but retained their legal residence in another state.

Filing Deadlines / Important Dates

Ensure compliance by adhering to strict state deadlines:

- General Deadline: Aligns with the federal tax deadline, typically April 15.

- Extensions: You can file for a state extension, usually valid until October 15. Ensure that your federal extension is filed to align both deadlines.

- Penalties for Late Filing: Financial penalties may apply for late submission, so timely filing is encouraged.

Important Considerations

- Check for any changes in deadline due to public holidays or special state directives.

- Monitor mail or email for reminders or notices from the Colorado Department of Revenue.

Legal Use of the Colorado State Tax Form 104PN

Filing Form 104PN correctly is legally required for taxpayers fitting the part-year or nonresident profile. Accurate and timely filing ensures compliance with Colorado state tax laws.

Legal Obligations

- Filing this form wrongfully or missing deadlines can result in audits or penalties.

- Ensure truthful reporting of income and deductions to avoid legal repercussions.

Examples of Using the Colorado State Tax Form 104PN

Practical scenarios can illuminate the use of Form 104PN:

- Example 1: John, who moved to Colorado in June for a new job, uses Form 104PN to report only the income earned after his relocation.

- Example 2: Sarah, living in Utah, works remotely for a company based in Colorado for a few months. She files Form 104PN to handle tax obligations for income earned during this period.

Real-Life Implications

- Accurate income allocation ensures adherence to tax responsibilities without overpayment or shortfall.

- Misreporting or omitting income could result in liabilities or state audits.