Definition & Meaning

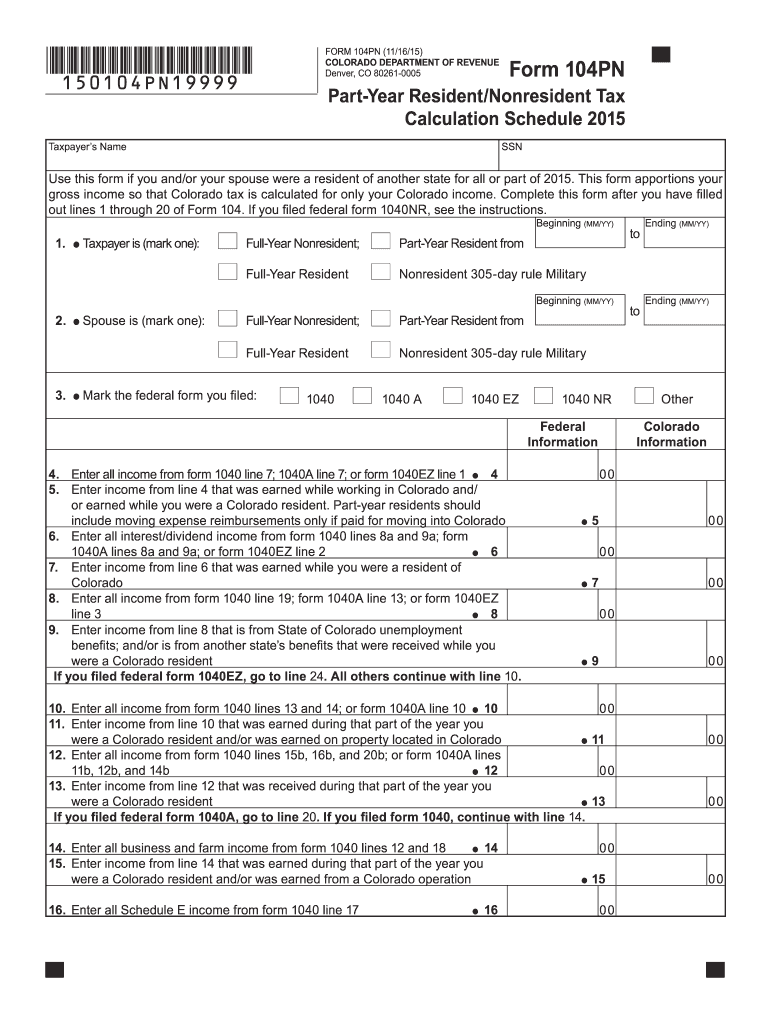

Form 104PN is designed specifically for part-year and nonresidents who have income sourced from Colorado. It is used to apportion gross income effectively to determine the Colorado tax liability, detailing only the income earned within the state. It acts as a supplemental document to Form 104, providing a clear picture of a taxpayer's obligations with respect to Colorado's tax regulations for the year 2015. This form also helps in ensuring accurate reporting of residency status and related income adjustments, facilitating compliance with state tax laws.

How to Use the 2015 Form 104PN

To use the 2015 Form 104PN effectively, begin by gathering your primary tax form, Form 104, where your total income and deductions are listed. Proceed to apportion your income on Form 104PN, clearly differentiating between income earned inside Colorado and elsewhere. The form requires you to detail your residency status, differentiate between sources of income, and carefully allocate adjustments corresponding to your time in Colorado. This ensures precise reflection of your taxable income within the state, aligning with Colorado’s taxation requirements.

Steps to Complete the 2015 Form 104PN

-

Gather Necessary Documentation: Before filling out the form, collect all pertinent documentation, including income statements, tax returns from other states, and any relevant schedules.

-

Provide Personal Information: Fill in your personal details, including name, Social Security Number, and filing status, consistent with your Form 104.

-

Residency Details: Specify your residency details, such as the duration of your stay in Colorado and other states, and validate your nonresident or part-year resident status.

-

Income Allocation: Calculate and allocate your Colorado-sourced income separately from your out-of-state earnings. This often involves detailing wages, business income, and other income streams.

-

Adjustments and Deductions: Reflect any adjustments or deductions applicable to Colorado income specifically, ensuring accurate apportionment.

-

Review and Submission: Double-check the form for completeness and accuracy, then attach it to Form 104. Submit both forms according to Colorado's filing procedures.

Who Typically Uses the 2015 Form 104PN

The 2015 Form 104PN is typically used by taxpayers who have lived both inside and outside Colorado within the tax year, such as:

-

Individuals with Interstate Employment: Those who moved to or from Colorado during the year for work purposes and have income in both Colorado and another state.

-

Seasonal Workers: People who earn income from seasonal employment or projects specifically in Colorado while residing elsewhere for part of the year.

-

Retirees: Individuals who retire during the year and change their primary residence, impacting where their income is sourced.

-

Students: College students who might earn income through internship or part-time jobs in Colorado but maintain a permanent residence in another state.

Key Elements of the 2015 Form 104PN

-

Residency Status: A section detailing the taxpayer's residency status and duration within Colorado, critical for accurately apportioning tax liability.

-

Income Apportionment: Instructions and fields for separating income earned in Colorado from that earned outside the state.

-

Adjustments Section: Specified areas for adjustments that align with Colorado taxation rules, ensuring compliant reporting.

-

Tax Calculation: The form includes calculations to determine the proportionate amount of tax owed to Colorado, given partial residency or nonresidency.

Filing Deadlines / Important Dates

Filing deadlines for submitting the 2015 Form 104PN align with Colorado's state tax deadlines, generally following the federal income tax deadline of April 15th. However, taxpayers who may require an extension must ensure they file the appropriate requests and submit estimated tax payments by this date, if necessary, to avoid penalties. Deadlines for specific extensions and estimated payments should be verified closely with Colorado's Department of Revenue guidelines.

State-Specific Rules for the 2015 Form 104PN

Colorado imposes rules that specifically affect how nonresident and part-year resident income is reported:

-

Allocation Method: Income must be strictly allocated based on where it was earned during the taxpayer's presence in Colorado.

-

Exemptions and Deductions: Only apply deductions to income directly tied to Colorado activities. Non-Colorado income deductions are not entertained in the apportionment.

-

Documentation Requirements: Detailed records must support claims regarding residency duration and income allocation, especially for audit protection.

Examples of Using the 2015 Form 104PN

Consider an individual who begins a new job in Colorado in May and relocates, but maintains property in another state. They must file Form 104PN, reporting income earned from the job initiated in Colorado separately from other state's income. Similarly, a Colorado resident who leaves the state in September to work elsewhere needs to report income earned only within the state on the form for the portion of the year spent as a resident.

IRS Guidelines

While the IRS does not govern this state-specific form, the process of filing Form 104PN adheres to broader federal guidelines regarding state-to-state income apportionment. Taxpayers are encouraged to reconcile their state filings with federal ones to ensure all income allocations align with overall earned income and relevant deductions.

This comprehensive analysis of the 2015 Form 104PN delivers detailed insights, aiding taxpayers in navigating Colorado's specific tax filing requirements with precision.