Definition & Meaning

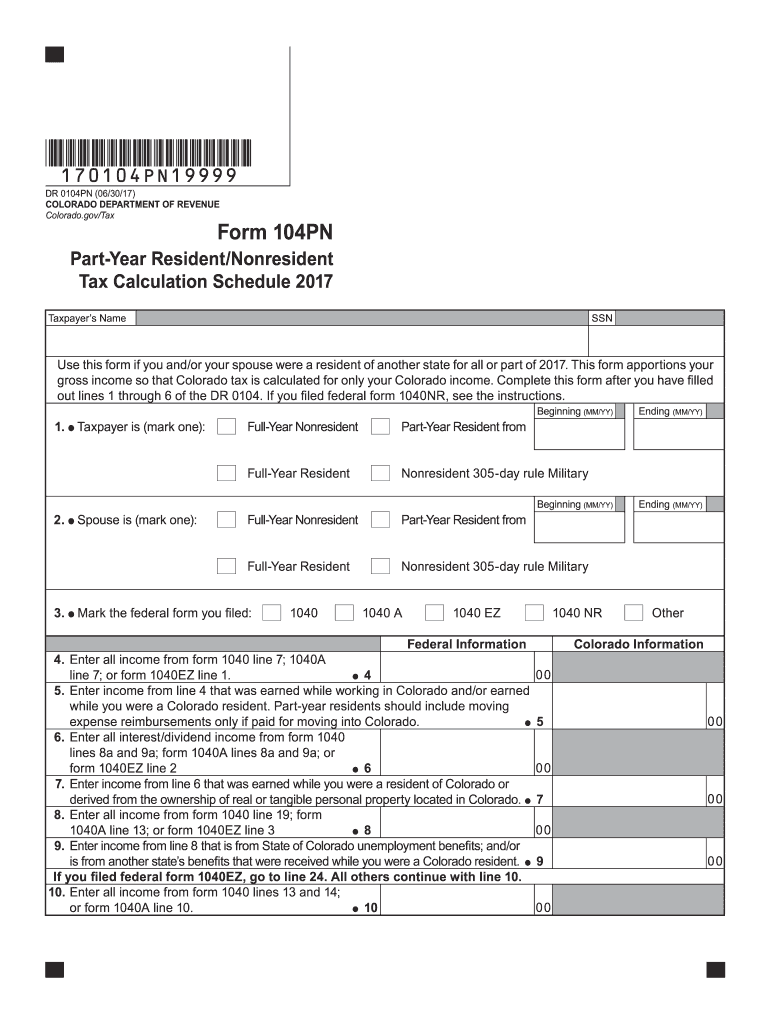

The 2014 Colorado Form 104PN is a tax form designed for part-year residents and nonresidents who earned income in Colorado during the year 2014. This form is essential for calculating the state income tax based specifically on earnings that occurred within Colorado. It facilitates the correct apportionment of income and mitigates any potential tax liability discrepancies by detailing various types of income and required adjustments.

Key Elements of the Form

- Part-Year Residents: Taxpayers who moved to or from Colorado during the tax year must include income earned while residing within the state.

- Nonresidents: Those who did not reside in Colorado but earned income in the state are also required to report.

- Separation of Income Types: Sections dedicated to earned income, investment returns, and other revenue streams.

Steps to Complete the 2014 Colorado Form 104PN

Completing the 2014 Colorado Form 104PN involves several specific steps. Each step is critical for ensuring accurate tax calculations:

- Gather Income Documentation: Collect all relevant W-2s, 1099s, and other documents that reflect income earned in Colorado.

- Determine Residency Status: Identify whether you are a part-year resident or nonresident to accurately separate income as required.

- Calculate Apportioned Income: Use the form's guidance to apportion gross income, taking into account only income earned in Colorado.

- Complete Adjustments: Include any necessary deductions or credits applicable to the specific circumstances outlined in the form.

- Review and Submit: Ensure all calculations are accurate, and submit the form by the specified deadline. Double-check for completeness to avoid penalties.

Why Use the 2014 Colorado Form 104PN

Utilizing this form is essential for fair and accurate tax reporting for those with income sourced from Colorado but who do not reside in the state all year:

- Legal Compliance: Ensures adherence to Colorado state tax laws, avoiding potential legal complications.

- Accurate Tax Payment: Prevents the overpayment or underpayment of state taxes by clearly delineating between in-state and out-of-state income.

- Peace of Mind: By rigorously following procedures, taxpayers can confidently meet state regulations and tailor tax reporting to their unique residency situation.

Who Typically Uses the 2014 Colorado Form 104PN

Several types of taxpayers utilize the 2014 Colorado Form 104PN based on their residency and income details:

- Individuals Moving to or from Colorado: Those who have changed their residence during the tax year and have earned income in Colorado need this form.

- Out-of-State Workers: Professionals or contractors working in Colorado part-time or periodically.

- Students and Retirees: Those who lived or studied in Colorado temporarily may need the form if they had Colorado-generated income.

Important Terms Related to 2014 Colorado Form 104PN

To effectively navigate the 2014 Colorado Form 104PN, taxpayers should familiarise themselves with key terms:

- Apportionment: The process of dividing income based on where it was earned, essential for determining state tax obligations.

- Adjusted Gross Income (AGI): A taxpayer’s total income minus specific deductions, forming the baseline for state tax calculations.

- Taxable Year: Refers to the calendar year 2014, specifying when the income was earned and tax obligations incurred within the state.

State-Specific Rules for the 2014 Colorado Form 104PN

Colorado has unique rules regarding the filing and completion of the 104PN form:

- Resident Criteria: Defines who qualifies as a part-year resident for state tax purposes.

- Nonresident Income Tax Rate: Differentiates from full-resident rates and requires apportionment, detailed within the form.

- Deadline Compliance: Aligns with state tax deadlines, independent of federal due dates.

Filing Deadlines / Important Dates

Compliance with critical deadlines for the 2014 Colorado Form 104PN is essential:

- Standard Due Date: Typically falls on April 15 of the following year.

- Extensions: Available upon request, providing additional time to file without penalty.

- Late Filing Penalties: Impose fees unless valid extensions are granted prior to the deadline.

Examples of Using the 2014 Colorado Form 104PN

Real-world examples clarify the application of the 2014 Colorado Form 104PN:

- Scenario 1: A taxpayer moves from California to Colorado mid-year, requiring the apportionment of salary received from both states.

- Scenario 2: A nonresident consultant with projects in Colorado needs to report income earned from these contracts solely within state lines.

- Scenario 3: A Colorado resident retires in the middle of the year, necessitating the calculation of pensions and dividends as per the state's tax regulations.

By following structured steps outlined in the 2014 Colorado Form 104PN, taxpayers can ensure that their state tax responsibilities are thoroughly and correctly calculated, reflecting their unique residency and income scenarios.