Definition & Meaning

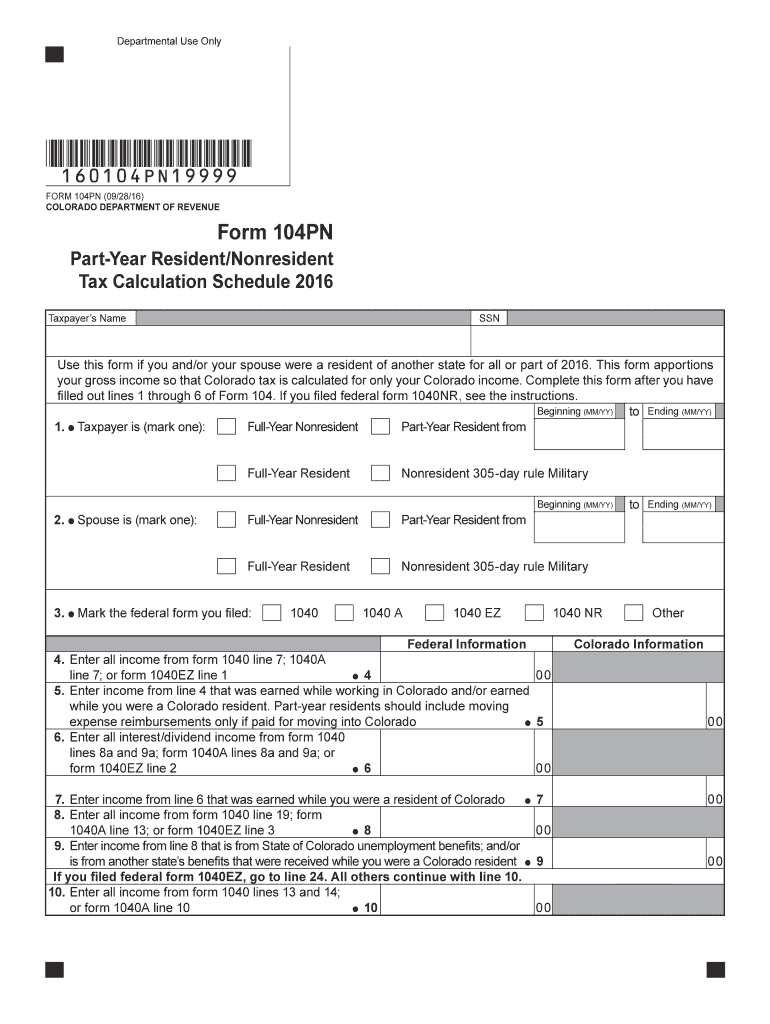

Form 104PN for the year 2016 is a tax schedule specifically designed for part-year residents and nonresidents of Colorado. This form aids taxpayers who lived both in Colorado and another state within the same tax year, ensuring they accurately report their income to determine their Colorado tax liability based solely on their earnings in Colorado. This separation ensures that out-of-state income is not unfairly taxed by Colorado.

How to Use the Form 104PN 2016

To effectively use Form 104PN 2016, individuals should begin by gathering all required financial documentation that illustrates income both earned within and outside of Colorado during that year. The form provides sections to detail various income categories, allowing taxpayers to apportion their earnings accurately. They will need to complete each section meticulously, aligning their income with the corresponding descriptions provided in the form to avoid errors.

Steps to Complete the Form 104PN 2016

-

Gather Documentation: Collect documents like W-2s, 1099s, and other records of earnings to identify all income sources.

-

Identify Residency Status: Determine the periods and the exact number of days spent inside and outside Colorado.

-

Calculate Income: Use the relevant sections of the form to separate Colorado-earned income from other state earnings. Each income type must be reported separately.

-

Make Adjustments: Apply necessary adjustments to account for deductions and credits applicable only to income earned in Colorado.

-

Complete the Form: Follow instructions for each section to enter the necessary details accurately.

-

Review and Submit: Double-check all entries for completeness and correctness before submission.

Who Typically Uses the Form 104PN 2016

Form 104PN 2016 is predominantly used by individuals who were part-year residents in Colorado or who were nonresidents with income sourced from Colorado. This can include those who moved into or out of the state during the tax year or individuals who have multiple homes and earn income from various locations.

Important Terms Related to the Form 104PN 2016

- Part-Year Resident: A person who lived in Colorado for only part of the year.

- Nonresident: An individual who resides in another state but earns income in Colorado.

- Apportionment: The process of dividing income between different states based on where it was earned.

- Colorado-Sourced Income: Any income derived from work or services performed in Colorado or from property located in Colorado.

Key Elements of the Form 104PN 2016

- Income Types: The form includes fields for various income types such as wages, dividends, capital gains, etc.

- Apportionment Calculation: Specific lines are designated for calculating the percentage of income apportioned to Colorado.

- Adjustments and Credits: Sections dedicated to adjustments for specific deductions and credits relevant to Colorado taxpayers.

Filing Deadlines / Important Dates

Taxpayers using Form 104PN 2016 must align with the standard filing deadline for Colorado state taxes, typically April 15th, unless a specific extension has been granted. Filing after this date can result in penalties and interest on any owed tax.

Penalties for Non-Compliance

Failure to accurately complete or submit Form 104PN 2016 by the deadline can lead to several penalties, including interest on unpaid tax amounts, late filing fees, and other potential legal implications. It's essential to ensure compliance with all reporting requirements to avoid these consequences.

Digital vs. Paper Version

Individuals have the option to complete Form 104PN 2016 digitally or on paper. The digital version offers convenience and may integrate with tax software, streamlining the process. However, some may prefer a paper submission for a manual check of calculations and data entry. Both methods require careful review to ensure all information is complete and accurate before filing.