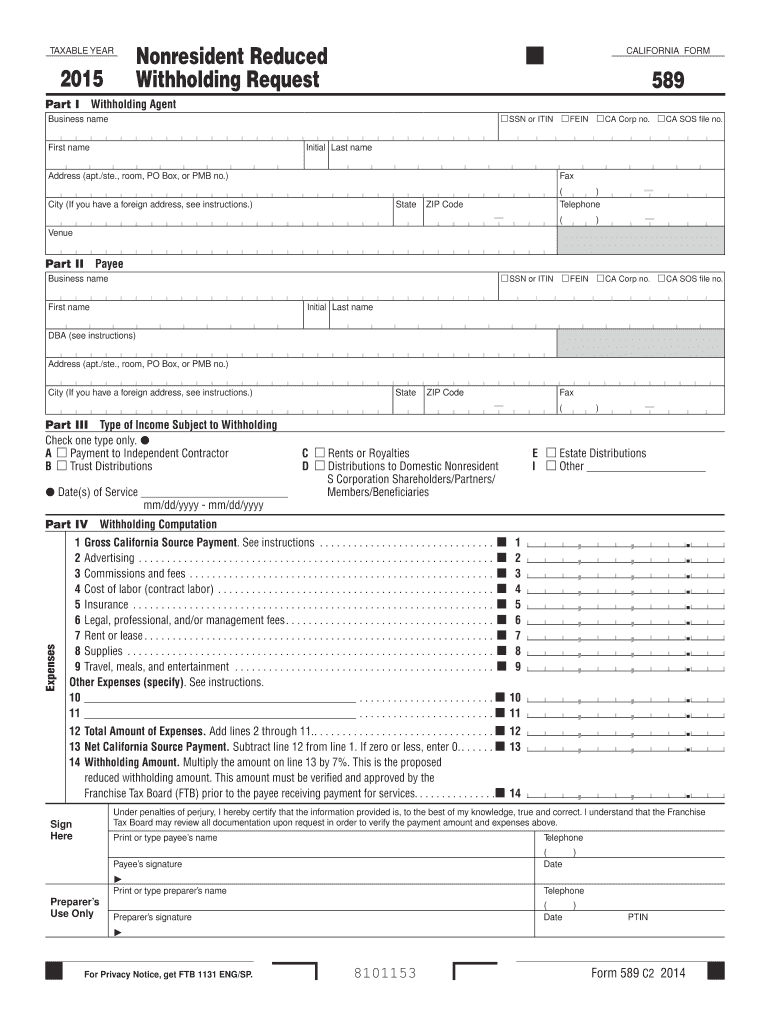

Definition and Meaning of 2015 Withholding Form

The 2015 form withholding generally refers to tax forms used for withholding purposes during the 2015 tax year. This might include forms like the W-4, which allows employees to specify the amount of federal income tax to withhold from their wages. The form is crucial for ensuring accurate tax payment levels throughout the year and avoiding large balances owed or refunds due when tax returns are filed.

How to Use the 2015 Withholding Form

Employees typically complete the 2015 withholding form when starting a new job or when their financial situation changes, such as marital status or additional income sources. By providing accurate information on the form, employees help employers determine the correct amount of tax to withhold from their paycheck. Accurate withholding can help prevent underpayment or overpayment of taxes throughout the year.

How to Obtain the 2015 Withholding Form

The form was available on the IRS website, local IRS offices, or through employers who distributed it during onboarding or when employees requested changes to their withholding status. It's important to use the version corresponding to the tax year, as forms can change annually to accommodate tax law adjustments.

Steps to Complete the 2015 Withholding Form

- Gather Personal Information: Start by entering your name, address, and Social Security number. It's vital to ensure all details are accurate to avoid processing delays.

- Report Marital Status: Check the box that applies to your marital status; this affects the amount your employer withholds.

- Claim Allowances: Use the provided worksheet to determine the number of allowances to claim, accounting for dependents, additional income, and other factors.

- Additional Withholding: If needed, specify any extra amount to withhold aside from the calculated amount based on allowances, helping in situations where more tax needs to be withheld.

- Sign and Date the Form: Ensuring the form is properly signed and dated is essential before submission to your employer.

IRS Guidelines for the 2015 Withholding Form

The IRS provided comprehensive instructions to accompany the 2015 form, outlining how to calculate withholding allowances accurately. Taxpayers were advised to review changes in personal situations or tax law that might impact their withholding needs. This proactive approach helps avoid either substantial tax liabilities or large refunds, promoting a more balanced, predictable tax outcome.

Filing Deadlines and Important Dates

Although there was no specific submission deadline for the withholding form, employees are encouraged to submit the form to their employer as soon as changes occur. This prompt submission ensures that appropriate adjustments to tax withholding are made timely, preventing discrepancies in tax responsibility at year-end.

Penalties for Non-Compliance

Failing to submit an updated withholding form when applicable could lead to insufficient tax withholding, resulting in underpayment penalties when taxes are filed. Alternatively, excessive withholding means less take-home pay during the year, even though a larger refund may be received. Timely updates help manage obligations responsibly.

Important Terms Related to the 2015 Withholding Form

- Allowances: Personal exemptions that reduce the amount of tax to be withheld.

- Withholding Certificate: Another term often used to describe the form employees complete to indicate withholding preferences.

- Tax Liability: The total amount of tax owed to the IRS, which withholding helps manage over time.

Who Typically Uses the 2015 Withholding Form

Employees across a wide range of sectors utilize the withholding form whenever they are newly employed or when life circumstances alter their financial situation. This diversity includes full-time workers, part-time roles, and individuals with multiple jobs needing to adjust their withholding to avoid paying penalties at tax time.

Key Elements of the 2015 Withholding Form

Key components of the form include personal identification details, marital status, the number of withholding allowances claimed, any additional withholding amounts desired, and signature verification. These elements combine to influence the overall tax withholding strategy, aiming to align closely with individual tax responsibilities.