Definition and Meaning of the PR 2013 Form

The PR 2013 Form, specifically known as Form 1040-PR, is a tax declaration form utilized by self-employed individuals in Puerto Rico. This form facilitates the reporting of income, deductions, and credits, with particular emphasis on those claiming the Additional Child Tax Credit. Understanding its purpose and components is essential for accurately fulfilling tax obligations in compliance with U.S. tax laws.

Key Components of the PR 2013 Form

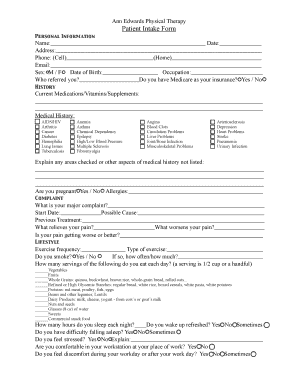

- Personal Information: The form requires the taxpayer’s name, address, and social security number (SSN) to establish identity and ensure accurate reporting.

- Income Reporting: Self-employed individuals must report their business income, which can include revenue from services rendered or goods sold.

- Deductions and Credits: Various credits, especially those related to children, can be claimed, which reduces the overall tax liability.

- Calculations for Taxes Owed or Refunded: The form includes calculations to determine the amount of taxes owed or potentially refunded based on the declared income and eligible deductions.

Importance of the PR 2013 Form

Filing the PR 2013 Form is crucial for compliance with tax regulations. Failure to accurately report income can lead to penalties or audits. This form also allows individuals to claim legitimate tax credits, potentially resulting in significant tax savings.

Steps to Complete the PR 2013 Form

Completing the PR 2013 Form requires several steps that ensure all necessary information is accurately reported.

-

Gather Required Documents: Collect all relevant financial documents, including income statements, business records, and documentation for any child tax credits.

-

Fill Out Personal Information: Input your name, address, and SSN at the top section of the form.

-

Report Income: Document your total self-employment income accurately, ensuring all sources of income are included.

-

List Deductions: Identify and include all eligible deductions under the appropriate sections. This may involve detailing expenses related to business operations.

-

Calculate Taxes Owed or Refunded: Follow the instructions on the form to complete the tax calculation section. Review and double-check for accuracy.

-

Sign and Date the Form: Ensure to sign the form before submission, as an unsigned form may be considered invalid.

How to Obtain the PR 2013 Form

Obtaining the PR 2013 Form is straightforward.

- IRS Website: The form can be downloaded directly from the IRS website.

- Tax Preparation Software: Many software options, including TurboTax and H&R Block, include the form as part of their offerings, enabling easy filling and e-filing.

- Local Tax Offices: Physical copies may also be available at local IRS offices or tax preparation service locations within Puerto Rico.

Filing Deadlines / Important Dates for the PR 2013 Form

Being aware of important filing deadlines is crucial for avoiding penalties.

- Filing Deadline: Typically, the PR 2013 Form must be filed by April 15, aligning with federal tax deadlines. However, taxpayers should check for specific variations or extensions applicable to Puerto Rico.

- Extensions: Taxpayers may file for an extension allowing additional time for submission, which usually extends the deadline by six months.

Legal Use of the PR 2013 Form

Understanding the legal implications of the PR 2013 Form is essential for compliance.

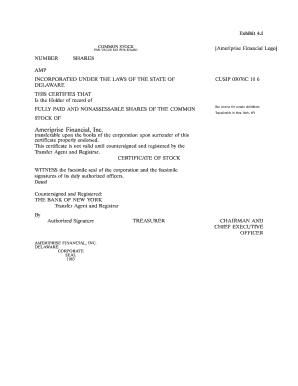

- Adherence to the ESIGN Act: Signatures on this form, especially if submitted electronically, are legally binding.

- Required for Self-Employed Individuals: Only self-employed individuals are eligible to use the PR 2013 Form, ensuring that income and deductions meet specific legal criteria for U.S. tax law.

This comprehensive understanding of the PR 2013 Form highlights its significance for self-employed individuals in Puerto Rico and provides them with essential knowledge to navigate their tax obligations effectively.