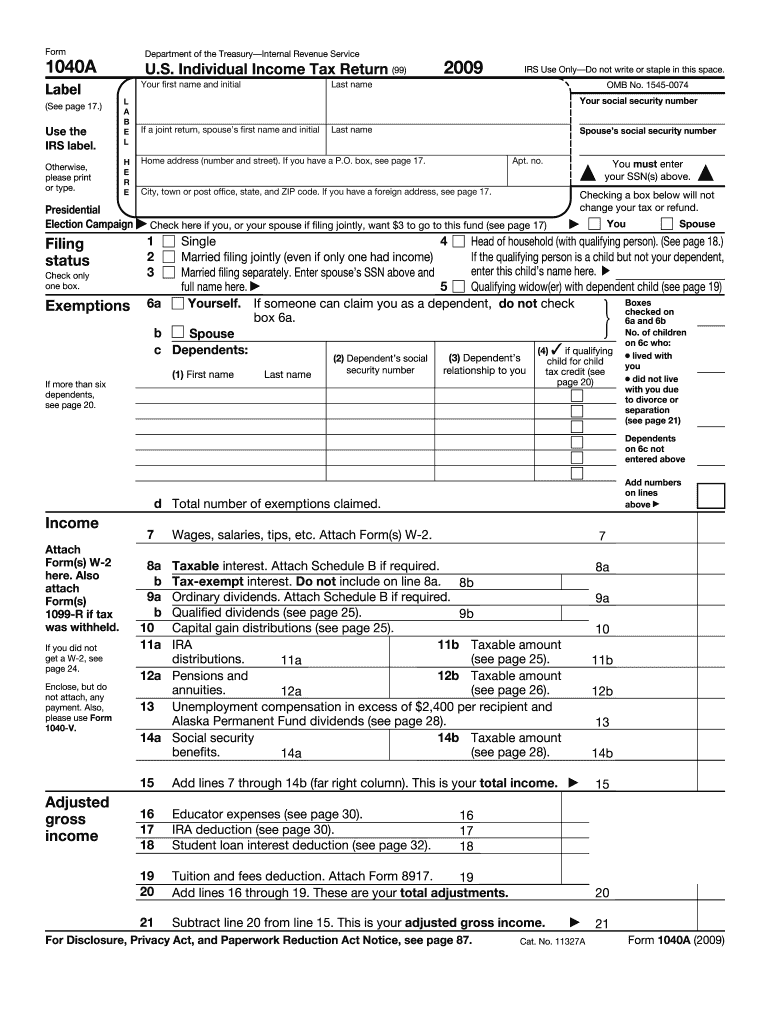

Definition and Meaning of the 1040A

The 1040A is a simplified version of the U.S. Individual Income Tax Return used to report income, claim deductions, and calculate tax liability. Introduced for taxpayers who meet certain requirements, it provides an easier alternative to the standard Form 1040, allowing individuals to file their tax returns with less complexity. The 1040A primarily serves those with straightforward financial situations, typically including wages, salaries, and certain pensions, enabling them to streamline their filing process. This form captures essential details such as personal information, income sources, and applicable credits and deductions.

How to Use the 1040A

To effectively use the 1040A, taxpayers need to follow a structured approach, ensuring every section is accurately filled out to avoid delays or complications.

- Gather Necessary Information: Start by collecting your income documents, such as W-2s, 1099 forms, and any documentation for deductions or credits you plan to claim.

- Identify Eligibility: Ensure that your income falls within the limits defined by the IRS for the tax year. For example, the 1040A can be used if your adjusted gross income does not exceed certain thresholds set each year.

- Fill Out the Form: Use clear and legible handwriting or electronic means if you're using a digital version. Follow the instructions carefully for each line item, ensuring you provide accurate figures.

- Review and Double-Check: Before submitting, review all entries for errors, ensuring that the math adds up and that all necessary schedules and forms are attached.

Steps to Complete the 1040A

Completing the 1040A involves several key steps, ensuring a thorough understanding of the information required.

-

Step One: Personal Information

Fill in your name, address, and Social Security number along with your filing status. Depending on your situation, you may select options like "Single" or "Married Filing Jointly." -

Step Two: Income Reporting

Accurately list all sources of income. Utilize your W-2 forms for wages, and include any taxable interest or dividends as required. -

Step Three: Deductions and Credits

Identify deductible amounts, such as contributions to retirement accounts or qualifying education expenses. Input these figures where indicated to calculate your overall tax liability correctly. -

Step Four: Calculate Tax and Payments

Compute your total tax using the tax tables provided with the 1040A instructions, considering any withholding amounts from pay stubs. -

Step Five: Signature and Submission

Ensure all fields are filled, sign the form, and indicate the date before mailing it to the IRS or electronically filing through approved software.

Important Terms Related to the 1040A

Understanding key terminology associated with the 1040A is essential for accurate filing:

-

Adjusted Gross Income (AGI): This is your total gross income minus specific deductions, crucial for determining your taxable income.

-

Taxable Income: The amount of income that is subject to taxation after deductions and exemptions have been applied.

-

Withholding: An amount taken out of your paycheck for taxes, which can be credited against your total tax liability.

-

Tax Credits: These directly reduce the amount of tax owed, unlike deductions which reduce the taxable income.

-

Filing Status: Determines the tax rates and brackets applicable to your income level; includes categories like Single, Married Filing Jointly, and Head of Household.

Who Typically Uses the 1040A?

The 1040A is designed for a specific group of taxpayers. Typically, its users include:

- Individuals with straightforward income sources, such as W-2 employees.

- Taxpayers who do not itemize deductions and can take the standard deduction instead.

- Individuals whose total income falls below the threshold where itemizing deductions becomes beneficial.

- Those eligible for certain tax credits, such as the Earned Income Credit, that do not require itemization.

This form appeals to a considerable portion of the population due to its simplicity and ease of understanding, making tax filing less daunting.

Filing Deadlines / Important Dates

Timely filing of the 1040A is critical to avoid potential penalties and interest. Key deadlines include:

-

April 15 (or the next business day): The standard deadline for filing the 1040A for the previous tax year. If extra time is required, taxpayers can request an extension using Form 4868.

-

Payment Deadline: Tax payments are also due on April 15. Failure to pay may lead to additional penalties.

-

States with Different Requirements: Some states may impose different deadlines for state tax forms, necessitating additional attention to local regulations.

Understanding these dates ensures taxpayers are adequately prepared for the tax season without last-minute obstacles.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the 1040A, allowing for flexibility based on personal preferences:

-

Online Filing: Using IRS-approved software or tax preparation services provides a fast and efficient method. E-filing typically results in quicker processing and refunds.

-

Mail Submission: For those opting for paper filing, the completed form should be mailed to the designated IRS address depending on the taxpayer’s state of residence. It's recommended to use certified mail to ensure proof of submission.

-

In-Person Filing: Certain local tax offices or IRS branches may accept in-person submissions, although this option may be limited and requires checking beforehand.

Each method has its advantages, and taxpayers should choose one that aligns with their comfort level and urgency concerning refunds.