Definition & Meaning

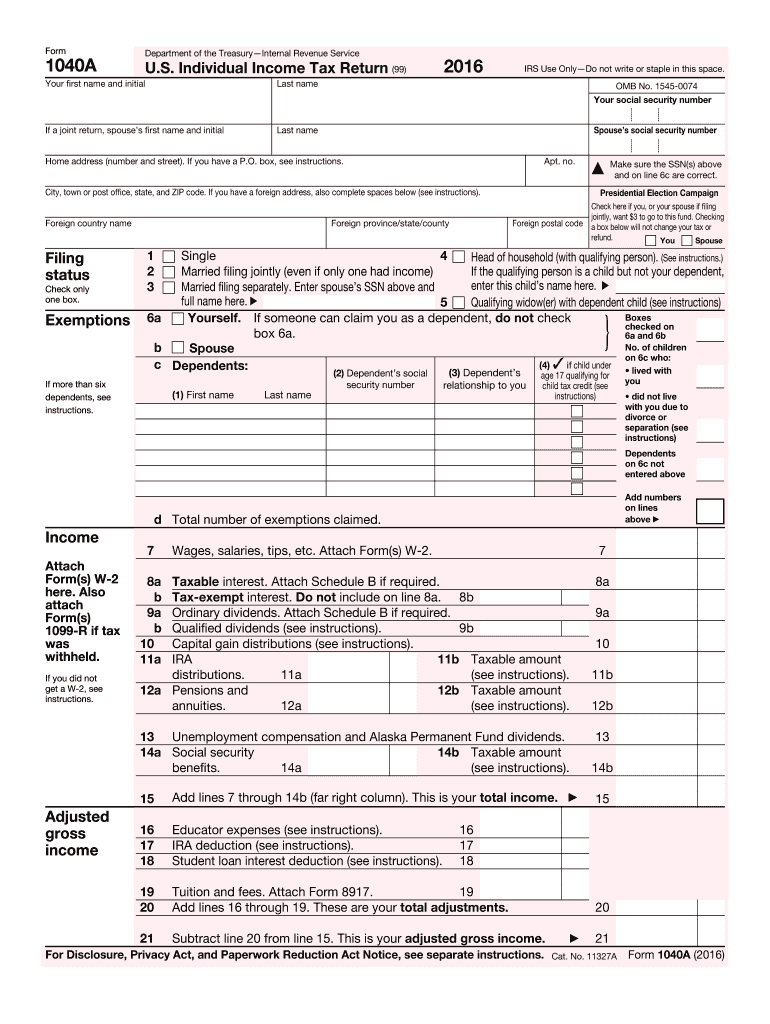

The 2016 Form 1040A is a simplified version of the U.S. Individual Income Tax Return, allowing taxpayers to report income, claim deductions and credits, and calculate tax liabilities or refunds. This form is intended for individuals with straightforward tax situations, providing a more concise alternative to the more detailed Form 1040.

Features of Form 1040A

- Designed for individuals with income from wages, salaries, tips, interest, and dividends.

- Suitable for those claiming specific tax credits, such as the Earned Income Tax Credit and Child Tax Credit.

- Employs a simplified layout that covers key sections like exemptions and adjustments to income.

How to Use the 1040A 2016 Form

Using the 2016 Form 1040A requires careful attention to each section to ensure accurate filing. Here's how to approach it:

Step-by-Step Guide

- Gather Required Documents: Collect W-2s, 1099s, and any records of other income, deductions, and credits.

- Personal Information: Enter your name, address, and Social Security number. This forms the foundation for your tax identity.

- Filing Status: Choose your filing status—Single, Head of Household, or Married Filing Jointly.

- Income Reporting: Input all sources of income on the form, including wages, interest, and dividends.

- Adjustments and Credits: Apply any applicable deductions and credits to lower your taxable income.

- Tax Calculation: Follow the form's detailed instructions to calculate your total tax or refund.

Practical Example

A single taxpayer earning $50,000 with no dependents would report wages, apply the standard deduction, and include eligible credits to calculate the tax.

How to Obtain the 1040A 2016 Form

The form can be accessed through various channels:

Methods to Acquire the Form

- Online: Download the form from the IRS website. This is the most common and accessible method.

- IRS Office: Visit a local IRS office to obtain a physical copy of the form.

- Mail: Request a mailed copy by calling the IRS Forms and Publications line.

Steps to Complete the 1040A 2016 Form

Completing the form involves several critical steps:

- Read Instructions Thoroughly: Familiarize yourself with all provided instructions for each section of the form.

- Verify Tax Information: Double-check all filled information against original documents to ensure accuracy.

- Calculate Taxes and Refunds: Use the worksheet provided within the form to ensure correctness in tax calculations.

- Attach Relevant Schedules: If claiming specific deductions, attach corresponding schedules or forms like Schedule B for interest and dividends.

- Review and Submit: Verify all entries and signatures before submitting the form to the IRS.

Key Elements of the 1040A 2016 Form

Understanding the critical components of the form is essential for correct filing:

Core Sections

- Personal Information: Identifies the taxpayer and their status.

- Income: Details various income streams subject to tax.

- Deductions: Outlines deductions that can decrease taxable income.

- Credits: Includes applicable credits that lessen tax liability.

- Refund/Payment Info: Summarizes the final tax refund or amount due.

Importance of Each Section

Each segment plays a pivotal role in determining your tax status and obligations. Accurately completing each part ensures compliance with tax laws and optimizes potential refunds.

Filing Deadlines / Important Dates

Adherence to specific timelines is vital to avoid penalties:

Significant Dates

- Tax Filing Deadline: April 15, unless extended.

- Extension Requests: April 15 is also the deadline for requesting a filing extension via Form 4868.

IRS Guidelines

Filing with Form 1040A requires compliance with IRS guidelines:

Compliance Tips

- Record Keeping: Maintain documents for the tax year, as they may be necessary if audited.

- Accuracy: Use precise figures and re-check calculations.

- Eligibility: Confirm if your financial situation fits the form's simplified scope before filing.

Required Documents

Certain documents are essential to support your tax return:

Document Checklist

- Income Statements: W-2, 1099 forms for all income.

- Deduction Records: Receipts, invoices, and records of qualifying expenses.

- Credit Documentation: Proof of eligibility for claimed credits such as child care or education expenses.

Importance of Supporting Documents

These documents substantiate your financial declarations, ensuring your tax return is both accurate and verifiable. Keeping detailed records aids in a stress-free audit process if the need arises.