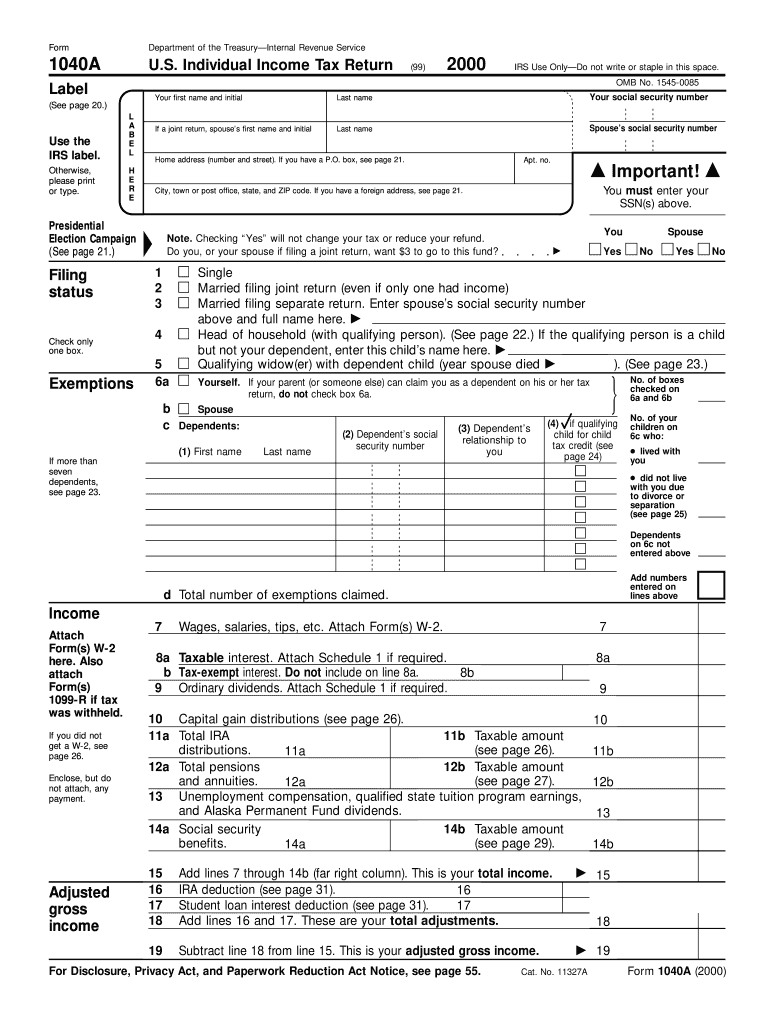

Definition and Purpose of the 2000 IRS Form

The 2000 IRS Form, specifically Form 1040A, is essential for U.S. taxpayers to report their income, exemptions, and tax liabilities for the year 2000. This form serves as a simplified version of the standard Form 1040, intended for taxpayers with straightforward tax situations. It allows individuals to detail their income sources, claim various exemptions, and determine any tax refunds or dues with clarity and precision. As a streamlined form, it excludes items like self-employment income and largely limits deductions and credits to common individual choices, making it accessible for the average taxpayer.

Obtaining the 2000 IRS Form

To obtain the 2000 IRS Form, taxpayers have multiple avenues. Typically, these forms could be accessed directly from the IRS website in downloadable PDF format or requested via mail by contacting the IRS directly. Some local libraries and post offices also historically distributed tax forms during the tax season. In addition, taxpayers could utilize tax preparation software or visit professional tax preparers who generally have access to archived IRS forms, including those from specific years such as 2000.

Key Elements of the 2000 IRS Form

The 2000 IRS Form is structured to include several key elements essential for calculating tax obligations:

- Personal Information: Name, Social Security number, and filing status.

- Income Details: Wages, dividends, and any other income, excluding complex sources like sole proprietorship earnings.

- Adjustments to Income: IRA contributions, student loan interest deductions, and educator expenses.

- Tax Computation: Calculation based on provided taxable income.

- Credits and Refunds: Eligibility for child tax credits, education credits, and refund computations.

Each section guides the user to present complete and accurate data to ensure proper filing and compliance with tax regulations.

Steps to Complete the 2000 IRS Form

Accurate completion of the 2000 IRS Form involves a multi-step process:

- Collect Necessary Documents: Gather W-2 forms, investment income statements, and any relevant deduction documentation.

- Enter Personal Information: Fill in name, address, and Social Security number at the top of the form.

- Report Income: List income according to the provided categories on the form to calculate the total income.

- Claim Deductions: Utilize allowable deductions to reduce taxable income.

- Apply Tax Credits and Compute Due Tax: Enter eligible credits and calculate the total tax due using the applicable tax table.

- Sign and Date: Authenticate the form with a signature before submission.

Accuracy is crucial at each step to prevent delays or discrepancies in tax filing.

Taxpayer Scenarios for the 2000 IRS Form

Different taxpayer scenarios influence the utilization of the 2000 IRS Form. Common scenarios include:

- Single Filers: Individuals with a single source of income seeking a simplified filing process.

- Married Couples: Those filing jointly without complex tax situations or high itemized deductions.

- Dependents or Guardians: Parents claiming dependents may find this form suitable when coupled with appropriate child tax credits.

These varied use-cases exhibit the form’s flexibility and appropriateness for typical, uncomplicated tax obligations.

IRS Guidelines for the 2000 IRS Form

The IRS provides specific guidelines detailing which individuals should use the 2000 IRS Form. These guidelines typically emphasize:

- Simplified income requirements, excluding self-employment or substantial capital gains.

- Compatible deductions such as educator expenses or IRA contributions.

- Credit applications limited to common credits like education or child tax credits.

Following these guidelines ensures taxpayers use the correct form tailored to their tax situation and legal requirements.

Form Submission Methods: Paper vs. Digital Versions

Taxpayers in 2000 had options to submit their forms through traditional paper mail or, increasingly, digital submissions as e-filing gained popularity.

- Paper Submission: Fill out by hand or typewriter, ensuring clarity and postal submit by the IRS deadline.

- E-filing: Use authorized tax software or services to file digitally, often resulting in expedited processing and reduced error rates.

Choosing a submission format greatly depended on personal preference and access to technology, with e-filing offering a more modern, streamlined approach.

Penalties for Non-Compliance with the 2000 IRS Form

Failing to comply with filing requirements, such as inaccurate reporting or late submissions, may result in penalties. The IRS typically imposes fines for:

- Late Filing: Penalties for missing the stated deadlines, usually motioned monthly until resolved.

- Underpayment or Misreporting: Fines for incorrect reporting or payments, emphasizing the importance of accuracy.

- Negligence: Additional liabilities for negligence or serious errors in submitted data.

Awareness of these potential penalties underscores the necessity of precision and timeliness in tax submission to avoid unnecessary financial burdens.