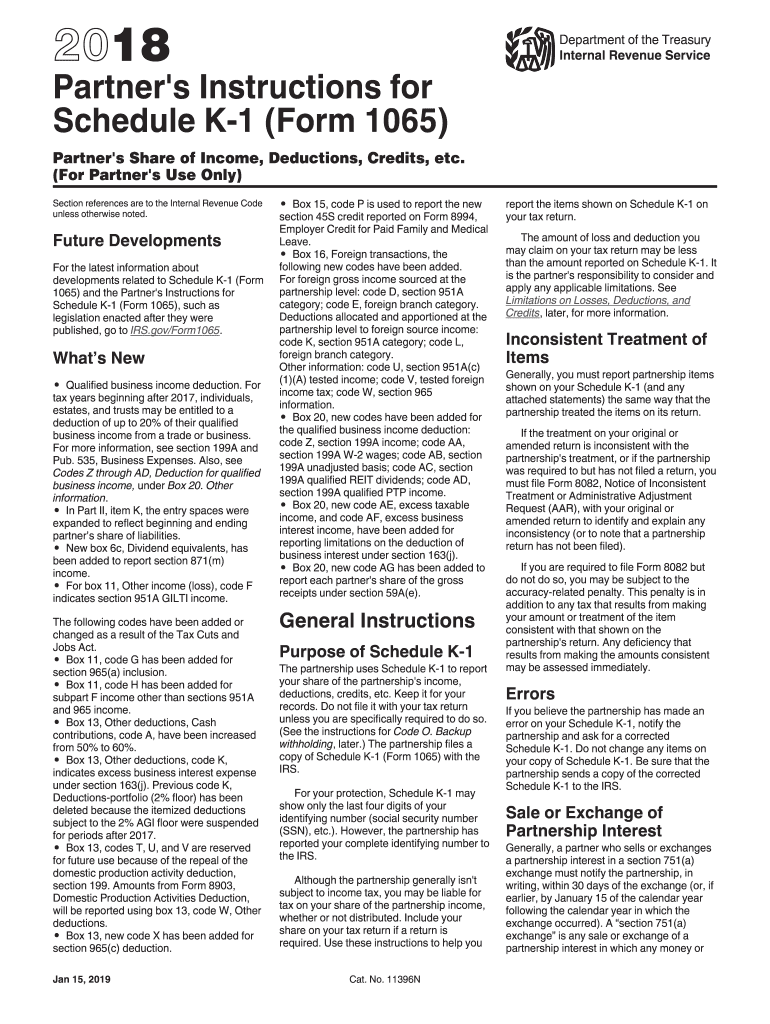

Definition and Meaning of the 2S Schedule K-1

The 2S Schedule K-1 is a tax document used to report income, deductions, credits, and other tax-related items for shareholders of S corporations. It serves as a crucial link between the corporation and its shareholders, facilitating the accurate reporting of the shareholders' share of the corporation's income on their personal tax returns. Each shareholder receives their individual K-1, providing detailed information needed to complete their personal income tax filings.

This form is necessary for S corporations, which are appointed by the IRS to allow income to pass through directly to shareholders without facing federal corporate income tax liability. The 1120S Schedule K-1 ensures that the company's income, losses, and deductions are distributed proportionately to each shareholder according to their ownership stake. The information must align with the S corporation’s tax filings to ensure compliance and avoid discrepancies during audits.

Key elements included on the 2S Schedule K-1 are:

- Shareholder's details.

- Shareholder percentage of ownership.

- Net income (loss) of the S corporation.

- Deductions and credits associated with the shareholder's share.

Steps to Complete the 2S Schedule K-1

Completing the 2S Schedule K-1 requires systematic attention to detail. Follow these steps for correct completion:

-

Gather Necessary Information: Collect all relevant financial records of the S corporation, including income statements, balance sheets, and prior year tax returns. Confirm shareholder specifics, such as name, address, and Social Security number or taxpayer identification number.

-

Header Information: Fill out the corporate information, including the S corporation's name, address, and Employer Identification Number (EIN). Ensure accuracy to prevent delays during filing.

-

Shareholder Details: Input the individual shareholder’s information, including their details and percentage of ownership. This will determine the distributive share of income reported.

-

Income and Deductions: Accurately report each shareholder’s share of earnings, losses, credits, and any distributions. Use the income items from the S corporation's tax return, typically Form 1120S, as reference points.

-

Final Review: Verify all entries for compliance with IRS guidelines, ensuring figures match with other filings. It is advisable to have a tax professional review the K-1 for accuracy before distribution to shareholders.

-

Distribute to Shareholders: Once completed, provide each shareholder with their copy. They will use this information when filing their personal tax returns.

-

File with IRS: While individual K-1 forms are sent to shareholders, the S corporation must submit a copy of the Schedule K-1 with its Form 1120S.

Key Elements of the 2S Schedule K-1

Understanding the key elements of the 2S Schedule K-1 is essential for both the issuing corporation and its shareholders:

-

Identification Information: Contains the S corporation's name, address, and employer identification number, which should match the IRS records.

-

Shareholder Information: Lists the name, address, and Social Security number or taxpayer identification number of the shareholder. This information is crucial for proper identification during tax filing.

-

Shareholder Ownership Percentage: Indicates the percentage of the corporation owned by the shareholder, which determines their share of income, deductions, and credits.

-

Income Items: Details various income types, including ordinary business income, rental income, and dividend income that the shareholder must report on their personal tax return.

-

Deductions and Credits: Specifies the different deductions and tax credits allocated to the shareholder based on their share of ownership, such as charitable contributions and investment interest.

Each of these elements plays a critical role in ensuring accurate tax reporting for both the S corporation and its shareholders.

IRS Guidelines for the 2S Schedule K-1

Adhering to IRS guidelines is vital when preparing the 2S Schedule K-1. The requirements include:

-

Timeliness: K-1s must be distributed to shareholders by the due date of the S corporation's tax return. Typically, this is March 15, given that most S corporations follow a calendar year-end.

-

Accuracy: It is imperative that the information recorded on the K-1 must match the figures reported on the Form 1120S. Any discrepancies can lead to audits or additional tax assessments.

-

Compliance with Reporting Requirements: Shareholders are required to report the information from the K-1 on their personal income tax returns, using the data for accurate tax liability determination.

-

Use of Software: Businesses may benefit from using tax software that supports the 1120S Schedule K-1 to streamline the preparation process, ensuring that entries are current and conform to IRS regulations.

Understanding and following these IRS guidelines will help mitigate issues related to audits or incorrect tax filings and simplify the filing process for all parties involved.

State-Specific Rules for the 2S Schedule K-1

While the 1120S Schedule K-1 is a federal form, states may have their own requirements regarding the taxation of pass-through entities. Key considerations include:

-

State Income Taxation: Some states impose entity-level taxes on S corporations, requiring additional compliance beyond federal regulations. These taxes can vary significantly from state to state.

-

State K-1 Variations: A few states may require additional or modified forms that report similar information. For instance, California has its own K-1 form (1065) with different reporting requirements.

-

Reciprocal States: Shareholders residing in states different from where the corporation is based may encounter different tax obligations. States like New York require non-residents to file state tax returns, thus needing their K-1 to complete the process.

-

Local Regulations and Tax Incentives: It is essential to research if local jurisdictions offer tax incentives or specific compliance mandates that may impact the reporting of income from an S corporation.

Consulting with a tax professional who understands both federal and state regulations can help shareholders navigate these complexities effectively.