Definition & Meaning of Schedule B (Form 1)

The Schedule B (Form 1) is an essential tax form used in the United States for reporting interest and dividend income. Specifically, individuals and entities use this form to detail their taxable interest and dividends received during the tax year. Accurate completion of Schedule B is crucial, as it guides on the tax implications of these income types. The information reported directly feeds into the taxpayer’s main tax return (Form 1040) and facilitates the IRS's assessment of potential tax liabilities.

Key Components

- Interest Income: List all taxable interest earned from bank accounts, bonds, loans, or other sources.

- Dividend Income: Report dividends received from stocks or mutual funds, categorized as qualified or ordinary dividends.

- Foreign Accounts: Schedule B requires disclosure of foreign bank accounts and trusts, subject to other IRS regulations.

Understanding these elements is the first step toward accurate tax reporting.

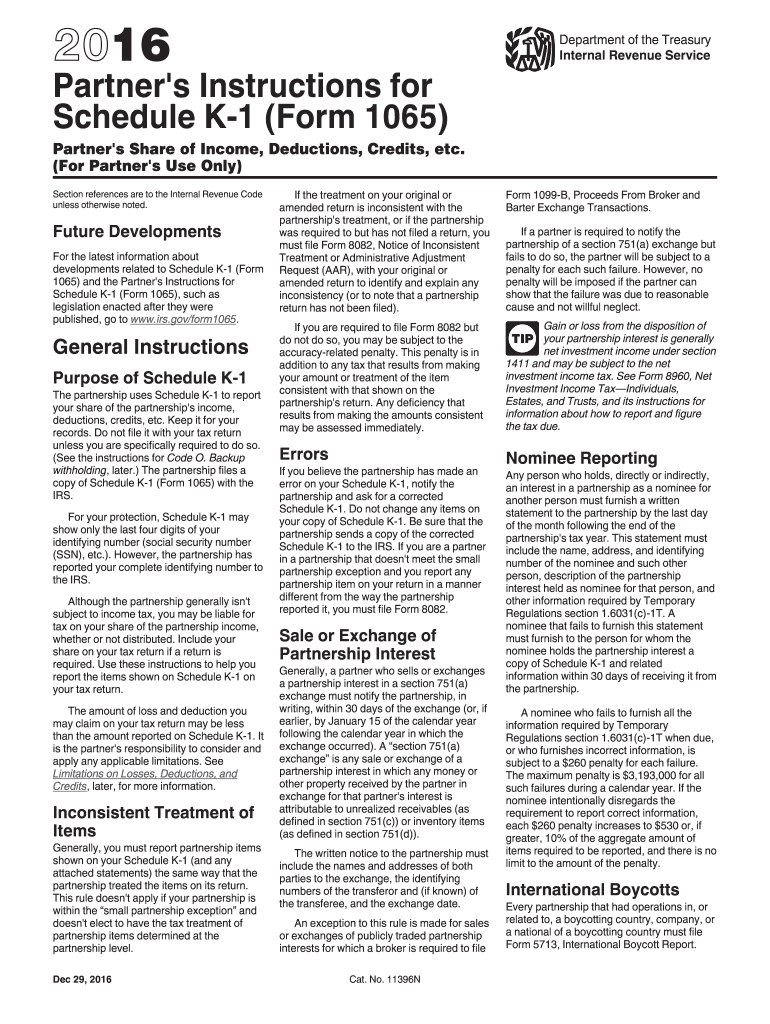

Steps to Complete Schedule B (Form 1)

Completing Schedule B requires attention to detail and systematic steps to ensure compliance with IRS regulations. Below are the structured steps needed to fill out the form correctly.

- Gather Financial Documents: Collect all 1099 forms, bank statements, and any other documentation showing interest or dividend income.

- Enter Interest Income: On Part I, report all taxable interest. You may need to sum up the interest from various sources to input a total.

- List Dividend Income: In Part II, detail dividend income as received. If there are qualified dividends, be sure to mark them accordingly.

- Foreign Accounts Disclosure: If applicable, respond to question 7 regarding foreign accounts. This is critical for compliance with IRS regulations on international financial reporting.

- Review and Submit: Once completed, cross-check your entries for accuracy. Submit the Schedule B along with your Form 1040 by the due date.

Following these steps carefully will help ensure that the form is correctly filled and submitted.

Important Terms Related to Schedule B (Form 1)

Familiarizing yourself with key terminologies associated with Schedule B can significantly enhance your understanding of the requirements and responsibilities involved in tax reporting.

- Taxable Interest: Any interest income subject to taxation, including interest from savings accounts or bonds.

- Qualified Dividends: Dividends that meet specific criteria to be taxed at a lower capital gains tax rate rather than the ordinary income rate.

- FBAR (Foreign Bank Account Report): A form required for U.S. citizens or residents with foreign bank accounts exceeding certain thresholds.

- 1099-INT: A form provided by banks and financial institutions to report interest income.

These terms play a vital role in filling out Schedule B accurately and understanding the broader tax implications.

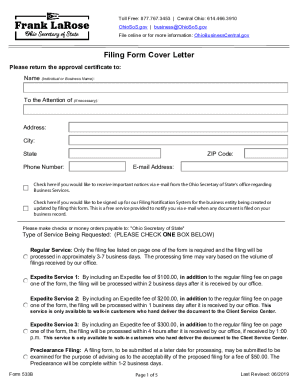

Filing Deadlines / Important Dates for Schedule B

Being aware of filing deadlines for Schedule B is critical to avoid penalties and ensure compliance with IRS requirements.

- Tax Year End: The tax year for most individuals ends on December 31.

- Filing Deadline: Schedule B must generally be submitted with your annual tax return, typically due on April 15 of the following year.

- Extensions: If you need additional time, you can file for an extension, moving the deadline to October 15, but this does not extend the time to pay any tax owed.

Staying informed about these dates will help in planning your filing strategy.

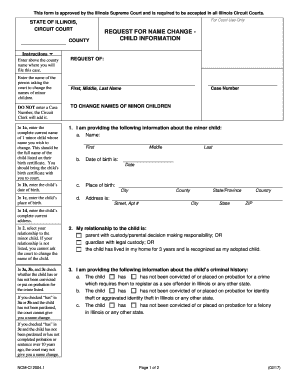

Who Typically Uses Schedule B (Form 1)

Schedule B is predominantly used by individuals, but it also applies to various entities that earn interest or dividend income. Here is a detailed look at who may need to complete this form.

- Individuals: Most taxpayers who earn interest or dividends are required to file Schedule B to report their income accurately.

- Small Business Owners: People operating sole proprietorships that earn interest on business accounts must also report on this form.

- Investors: Individuals with investment portfolios generating dividends should utilize Schedule B for compliance.

- Trusts and Estates: These entities may also be necessary to report income from interest and dividends received.

Understanding the diverse user base of Schedule B clarifies the form's importance in tax compliance.

IRS Guidelines for Schedule B (Form 1)

The IRS provides a comprehensive set of guidelines to ensure taxpayers report interest and dividend income accurately. Familiarity with these guidelines is necessary for successful completion of the form.

- Accuracy in Reporting: Ensure all income is reported as per the 1099 forms received, and follow IRS guidelines for calculating totals.

- Compliance with FATCA: For taxpayers with foreign financial interests, adherence to the Foreign Account Tax Compliance Act (FATCA) is crucial.

- Maintaining Records: Keep all supporting documentation and records for at least three years after filing in case of an audit.

Adhering to these guidelines protects taxpayers from potential issues with the IRS and ensures that all income is properly reported.