Definition & Meaning

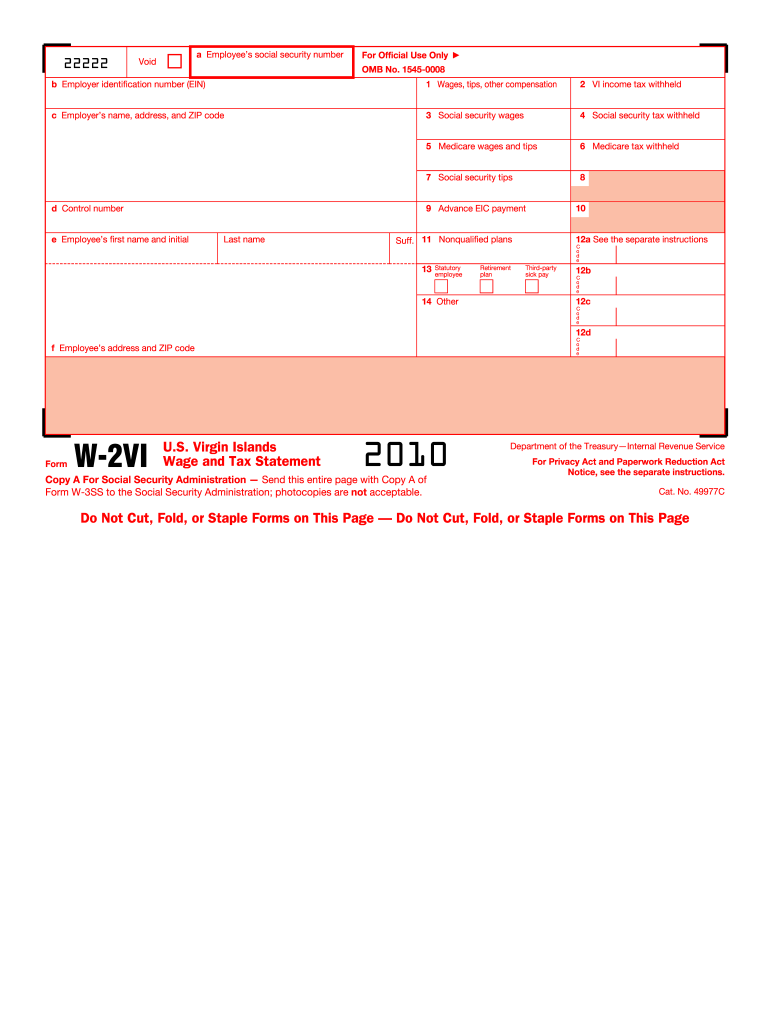

The 2010 W-2 template form serves as a critical document used by employers in the United States to report an employee’s annual wages and the amount of taxes withheld from them. Officially known as the Wage and Tax Statement, the W-2 form is a crucial component of tax reporting and administration. Employees rely on this form to file their federal and state income tax returns.

Each W-2 form contains detailed information, such as the employer's identification and contact details, the employee's Social Security number, and all pertinent income details. This form ensures that the Internal Revenue Service (IRS) receives consistent data about each taxpayer, thus maintaining the integrity of the tax system.

Key Elements of the 2010 W-2 Template Form

A comprehensive understanding of the key elements within the 2010 W-2 template form is essential for accurate completion. Some of the primary components include:

- Employee and Employer Information: The form requires distinct identification details, including the employer’s EIN and the employee’s Social Security number and contact details.

- Wages and Tax Withholdings: Boxes are dedicated to reporting total wages, tips, and other compensation, alongside taxes withheld for federal, state, and local jurisdictions.

- Special Codes and Boxes: Additional boxes on the form may denote specific financial transactions that need special handling, such as deferred compensation or designated Roth contributions.

Gathering all relevant financial data and understanding where it fits on the form streamlines the filing process and reduces the chances of errors or omissions.

Steps to Complete the 2010 W-2 Template Form

Completing the 2010 W-2 template form involves several structured steps to ensure accuracy:

- Collect Employee Data: Start by collecting accurate information about both the employee and employer.

- Verify Wage Information: Calculate the total wages, tips, post-tax contributions, and other compensations.

- Calculate Tax Withholdings: Update the form with federal, state, and local tax withholdings based on payroll records.

- Fill Out the Form: Input the collected data into the appropriate sections on the W-2 form.

- Review and Validate Entries: Double-check all details for accuracy to prevent discrepancies when filed with the IRS.

- Distribute Copies: Issue Quick W-2 copies to employees, and ensure copies are filed with government entities as required.

Crafting a detailed step-by-step guide enhances the clarity and efficiency of completing the W-2 form.

Required Documents

When preparing to complete the 2010 W-2 form, having the correct documents on hand is essential:

- Payroll Records: Detailed records showing earnings and tax withholdings.

- Personal Identification Information: Social Security numbers and contact information for accurate reporting.

- Employer's Identification: The employer's federal employer identification number (EIN) and contact details.

Being well-prepared with these documents ensures a more seamless and accurate completion process.

Legal Use of the 2010 W-2 Template Form

Understanding the legal implications of W-2 filing is pivotal. Employers are legally obligated to provide a W-2 form to any employee who receives a salary, wages, or other types of remuneration. The W-2 form fulfills tax liability requirements, acting as a formal statement of income and taxes for both employees and the IRS.

Failure to issue or accurately report W-2 forms can lead to significant penalties. Hence, ensuring strict adherence to legal requirements protects both employers and employees from legal complications.

Filing Deadlines / Important Dates

Timeliness is important when dealing with W-2 forms. Employers must provide completed W-2 forms to employees by January 31st of the following year. Moreover, they must file these forms with the Social Security Administration (SSA) by the same deadline.

Late submissions can lead to penalties. Therefore, maintaining awareness of these important dates is crucial for compliance and avoiding fines.

Penalties for Non-Compliance

Non-compliance with W-2 form submissions can result in penalties. Based on the nature and duration of the delay, fines can apply ranging from tens to thousands of dollars per form. Common reasons for fines include late submissions, incorrect information, and failure to submit.

Understanding these penalties motivates timely and accurate W-2 form submissions. Ensuring compliance safeguards the employer from potential legal and financial repercussions.

IRS Guidelines

The IRS provides clear guidelines on filing the W-2 form. Understanding these guidelines not only ensures compliance but also aids in preventing common filing mistakes. According to the IRS, accurate reporting of earnings and withholdings is necessary, and any corrections should be promptly communicated through a W-2c form.

These guidelines are an indispensable resource, helping both employers and employees navigate the complexities of tax documentation effectively.

Form Submission Methods (Online / Mail / In-Person)

The submission of the 2010 W-2 form can be accomplished through various methods:

- Online: Electronic filing through the SSA's Business Services Online (BSO) platform is available.

- Mail: You can opt for traditional postal submission, sending physical copies to the appropriate SSA office.

- In-Person: Some tax professionals offer direct drop-off services for greater control over the submission process.

Each submission method has its benefits and drawbacks. Online submission is generally the most efficient, while mailing and in-person drop-offs offer more direct oversight.