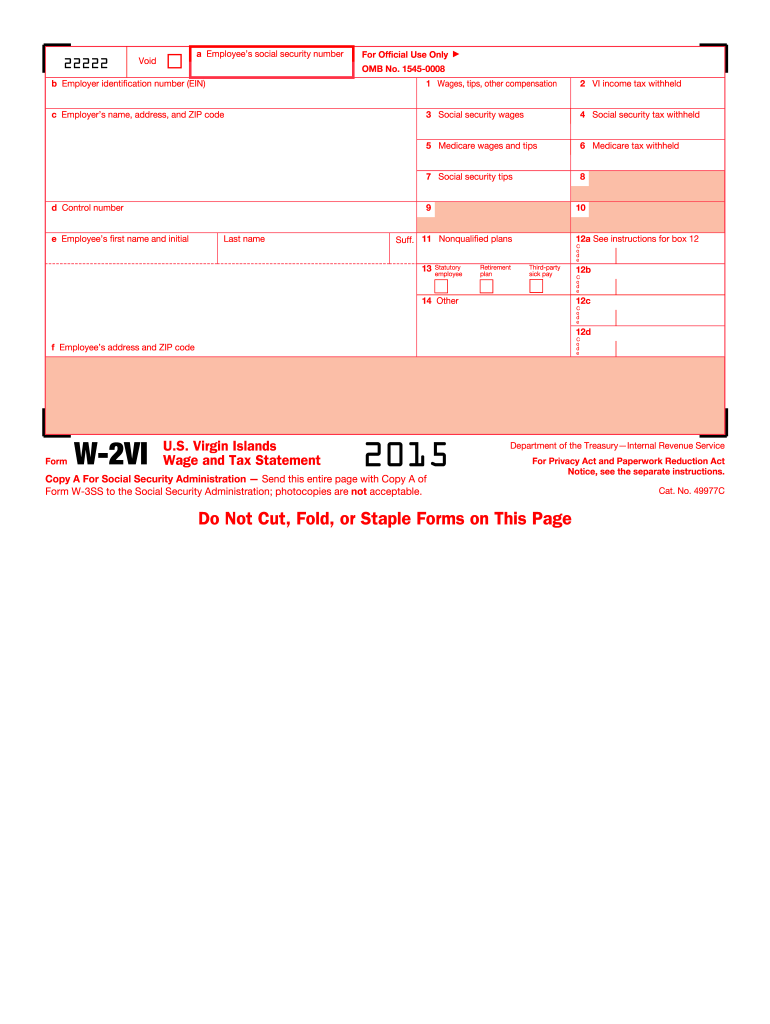

Overview of the W-2VI 2015 Form

The W-2VI 2015 form, or Wage and Tax Statement for employees working in the U.S. Virgin Islands, is an essential document for reporting wages paid and taxes withheld. This form is specifically tailored for employers and employees in the Virgin Islands, ensuring compliance with local tax regulations. It captures critical information such as total wages, Social Security earnings, and income tax withheld, which are pivotal for accurate tax filing.

Purpose and Significance of the W-2VI 2015 Form

The primary function of the W-2VI 2015 form is to provide a summary of an employee's earnings and tax withholdings. Employees use this form to fill out their federal tax returns accurately. For employers, it serves as an official record of employment-related income and federal taxes paid on behalf of their employees.

- It plays a critical role in ensuring compliance with the Internal Revenue Service (IRS) guidelines.

- Accurate reporting using this form can prevent potential tax issues or penalties.

Obtaining the W-2VI 2015 Form

Employers need to ensure they have access to the correct version of the W-2VI 2015 form.

Sources for Acquiring the Form

- IRS Website: Employers can download a copy directly from the IRS website, ensuring they get the most recent updates.

- Tax Software: Many tax preparation software solutions, like TurboTax and QuickBooks, include the W-2VI 2015 form within their systems, streamlining the preparation process.

- Local Tax Professionals: Employing the services of tax professionals can also be beneficial to ensure compliance with local tax laws and secure access to appropriate forms.

Completing the W-2VI 2015 Form

Filling out the W-2VI form requires accurate financial information and adherence to federal guidelines.

Step-by-Step Instructions for Completion

- Employee Identification: Fill in employee information, including the name, address, and Social Security number.

- Wage Information: Report total wages, tips, and other compensation in the appropriate boxes.

- Withheld Taxes: Indicate federal income tax withheld, Social Security wages, and Medicare wages.

- Employer Information: Complete employer details, including the employer's name, address, and Employer Identification Number (EIN).

- Each section of the form is critical for providing accurate information needed for tax calculations.

- Errors in this section can lead to audits or penalties, underscoring the importance of meticulous completion.

Usage of the W-2VI 2015 Form

The W-2VI 2015 form is primarily used by U.S. Virgin Islands employers and their employees.

Typical Users and Contexts for Usage

- Private Sector Employers: Companies operating within the U.S. Virgin Islands that have employed staff must use this form for tax reporting.

- Public Sector Employees: Government agencies in the Virgin Islands are also required to issue W-2VI forms to their employees.

- Tax Professionals: Accountants and tax preparers help in preparing and submitting W-2VI disclosures on behalf of businesses and individuals.

Important Regulations and Compliance Issues

Being informed about the legal uses and penalties related to the W-2VI 2015 form is essential for both employers and employees.

Compliance Considerations

- Improper filing of the W-2VI can result in fines or penalties for employers, emphasizing the need for accuracy.

- Employers must ensure forms are distributed to employees by January 31 of the year following the tax year reported.

- Companies that fail to file the form correctly may face audits from the IRS, necessitating careful documentation and record-keeping.

Potential Penalties

- Failure to file the W-2VI on time may result in monetary penalties, which can escalate based on the duration of the delay.

- Providing incorrect information can complicate tax filings for employees and lead to misreporting of earnings.

Conclusions on the W-2VI 2015 Form Usage Scenarios

In various situations, the W-2VI 2015 form operates as a crucial element of tax reporting.

Examples of Common Scenarios

- Seasonal Employment: Temporary employees in tourism-related jobs receive W-2VI forms to report their short-term earnings.

- Long-term Positions: Permanent employees must receive W-2VI forms annually for continuous employment, helping them maintain compliance with tax expectations.

- Multiple Employers: Employees with more than one job during the year must receive a W-2VI from each employer, which they will aggregate for their tax returns.

Understanding the various nuances of the W-2VI 2015 form helps ensure compliance and facilitates accurate accounting for employees in the U.S. Virgin Islands.