Definition and Meaning of Form 1099-INT

Form 1099-INT (Rev. January 2022) is an IRS tax form used to report interest income earned by individuals, businesses, and other entities. The form serves as a way to inform the IRS about the amount of interest that has been paid to each recipient during the tax year. It is important for recipients because this income must be reported on their federal tax returns. The 1099-INT form is typically issued by banks, credit unions, and other financial institutions that pay interest on deposit accounts or other financial products, ensuring compliance with IRS regulations.

Key purposes of the Form 1099-INT include:

- Reporting Interest Payments: Institutions report interest payments made for the previous calendar year to individuals and entities.

- Tax Compliance: It ensures individuals accurately report interest income, helping to maintain transparency and tax compliance.

- Information Sharing: The form provides necessary information to both the taxpayer and the IRS, summarizing financial activities that could affect tax filings.

How to Use Form 1099-INT

Using Form 1099-INT requires understanding both the issuance process and how to incorporate the reported information into personal tax returns.

- Receiving the Form: Taxpayers typically receive Form 1099-INT by January 31 of the following year from the financial institution that paid the interest.

- Reviewing the Information: Upon receiving the form, it is crucial to review the reported interest amount for accuracy. Any discrepancies should be addressed with the issuer immediately.

- Incorporating into Tax Returns: The IRS mandates that interest reported on a 1099-INT must be included as income when filing taxes. Taxpayers indicate the interest income on their tax return via forms like the IRS Form 1040.

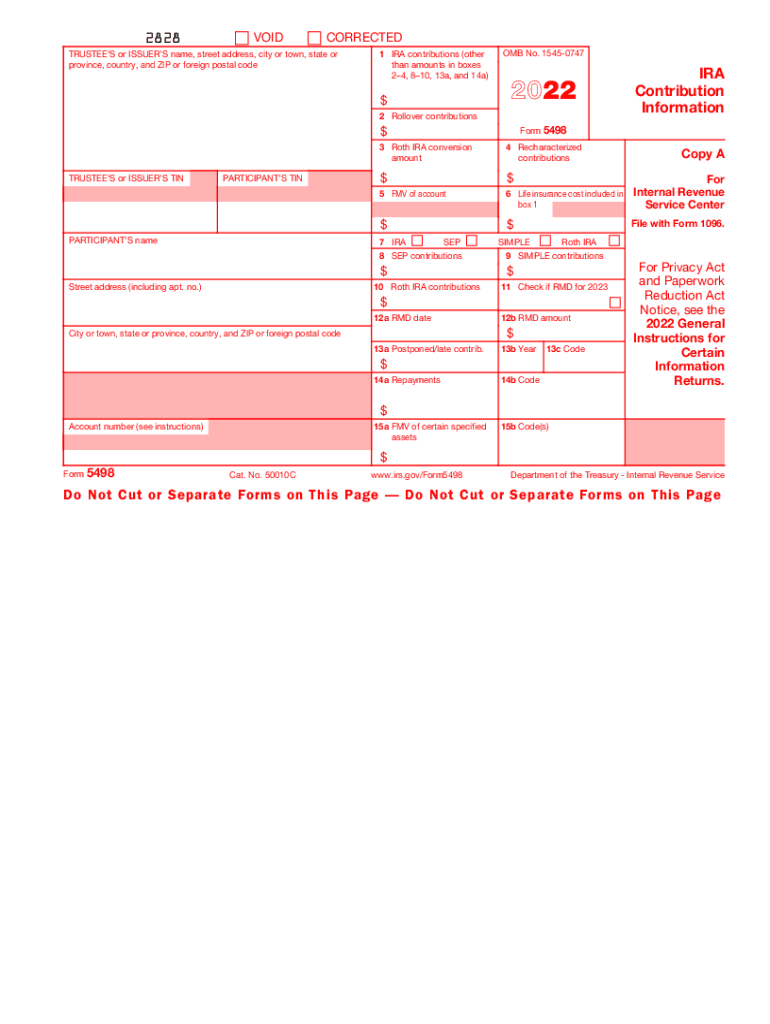

Important segments of the form contain various boxes, including:

- Box 1: Reports the total interest income paid.

- Box 2: Shows early withdrawal penalties, if applicable.

- Box 3: Lists interest on U.S. Savings Bonds and Treasury obligations.

Steps to Complete Form 1099-INT

Completing Form 1099-INT involves an organized process, ensuring all information is accurately reported.

-

Gather Required Information:

- Obtain the total interest paid to each recipient.

- Collect recipients’ Taxpayer Identification Numbers (TINs).

-

Fill Out the Form:

- Enter the payer's information (name, address, and TIN).

- Include each recipient's information in the designated fields.

- Report the total interest paid in the relevant box (typically Box 1).

-

Distribute Copies:

- Provide the recipient with Copy B (for their tax return).

- File Copy A with the IRS, adhering to submission deadlines.

-

Keep Records:

- Maintain copies for personal records and any potential audits or inquiries.

Filing Deadlines for Form 1099-INT

Adhering to deadlines is critical to avoid penalties and ensure compliance. The essential filing deadlines for Form 1099-INT include:

- Recipient Copies: Due by January 31 of the year following the tax year.

- IRS Submission: Copy A must be submitted to the IRS by February 28 if filing by paper, or by March 31 for electronic submissions.

Not adhering to these deadlines can result in penalties, which may vary depending on how late the filing is.

Who Typically Uses Form 1099-INT

Form 1099-INT is widely utilized across various demographics. Common users include:

- Individuals: Taxpayers who earn interest from savings accounts, bonds, or other financial accounts.

- Corporations: Businesses that pay interest on loans or investments.

- Financial Institutions: Banks and credit unions that pay interest to customers are responsible for issuing the form.

Understanding which entities utilize this form can help recipients recognize the importance of accurately reporting interest income on their tax returns.

Important Terms Related to Form 1099-INT

Familiarity with key terminology associated with Form 1099-INT is essential for correctly understanding and using the form.

- Interest Income: The total earnings accrued from financial products like savings accounts, bonds, etc.

- Payer: The entity responsible for issuing the 1099-INT and reporting interest payments to the IRS.

- Recipient: The individual or entity receiving the interest income, required to report it on their tax returns.

- Taxpayer Identification Number (TIN): A unique number assigned to individuals and businesses for tax purposes.

Understanding these terms ensures accurate use and compliance with tax reporting requirements.