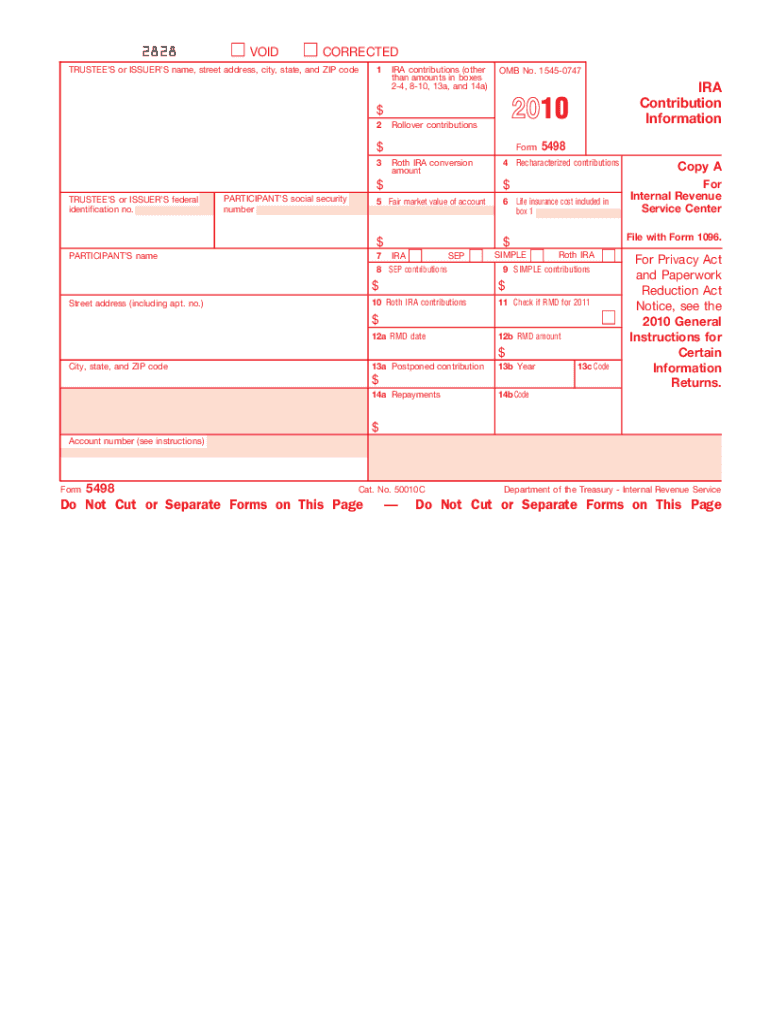

Definition & Meaning of the 2 Form

The 2 form is an IRS document used to report contributions made to individual retirement arrangements (IRAs), including traditional IRAs, Roth IRAs, and simplified employee pension (SEP) IRAs. This form is essential for both contributors and custodians, as it provides the IRS with vital information regarding IRA contributions and the fair market value of these accounts as of December thirty-first of the tax year.

Form 5498 facilitates the tracking of contributions, including rollover contributions and conversions from traditional IRAs to Roth IRAs. Accurate reporting through this form ensures that taxpayers adhere to contribution limits and allows the IRS to monitor compliance with retirement savings regulations. It is important to note that the 2 form is not filed by individual taxpayers; rather, it is prepared and submitted by the financial institution that manages the IRA.

How to Use the 2 Form

The 2 form must be used by financial institutions to report various types of information regarding IRA accounts. The primary users of this form include financial institutions, custodians, and trustees that manage IRA accounts. Here is how to effectively use the form:

-

Reporting Contributions: Financial institutions must report the total contributions made by the account holder for the year. This includes regular contributions, rollover contributions, and conversions.

-

Recording Required Minimum Distributions (RMDs): The 2 form also indicates whether the account holder is subject to RMDs and helps document the amounts withdrawn to meet these requirements.

-

Filing with the IRS: Financial institutions must submit the completed form to the IRS by May thirty-first of the following year. The institution must also provide a copy to the account holder by the same date.

In summary, the primary purpose of the 2 form is to ensure the proper reporting of IRA contributions and compliance with IRS regulations related to retirement accounts.

How to Obtain the 2 Form

The 2 form is not typically available as a public document, as it is issued by custodians or trustees of IRAs. To obtain a copy of this form, follow these steps:

-

Contact Your IRA Custodian or Trustee: If you are an IRA owner, reach out to the financial institution managing your IRA. They are responsible for preparing and distributing the form to you.

-

Visit the IRS Website: While you cannot download the completed form directly, you can find guidelines and instructions relevant to Form 5498 on the IRS website. This can assist custodians in understanding their obligations.

-

Check Your Mail: If you are the account holder, the financial institution will send you a copy of the 2 form in the mail once it is filed with the IRS. This is typically done by May thirty-first of each year following the tax year in which contributions were made.

Understanding that custodians of IRAs are responsible for the completion and dissemination of Form 5498 is essential for ensuring compliance with IRS requirements.

Key Elements of the 2 Form

The 2 form consists of several critical sections that provide detailed information about the account holder's IRA. Key elements of the form include:

-

Participant Information: This section includes the name, address, and taxpayer identification number (TIN) of the individual who owns the IRA.

-

Account Type: The form specifies the type of IRA, whether it be a traditional IRA, Roth IRA, or another retirement account type.

-

Contribution Information: Financial institutions report the total contributions made to the IRA for the tax year. This includes regular contributions, rollover contributions, and any conversions that occurred during that year.

-

Fair Market Value: There is also a section where the fair market value of the IRA account must be reported as of December thirty-first of the relevant tax year.

-

Required Minimum Distribution (RMD): The form provides information regarding the RMD status, which is particularly important for account holders over seventy-and-a-half years of age.

Understanding these key elements can aid both custodians and IRA participants in ensuring the accurate reporting of information required by the IRS.

Important Terms Related to the 2 Form

Familiarity with specific terminology can enhance comprehension of the 2 form. Important terms include:

-

Contributions: This term refers to the money deposited into the IRA by the account holder. This includes both regular contributions and rollover contributions.

-

Rollover: A rollover occurs when funds from one retirement plan, such as a qualified plan, are transferred to another retirement plan, including IRAs.

-

Fair Market Value (FMV): This is the price that the assets in the IRA would sell for on the open market. FMV is reported on the 2 form to provide an accurate valuation of the account at the end of the tax year.

-

Required Minimum Distribution (RMD): This term refers to the minimum amount that must be withdrawn from retirement accounts once the account holder reaches a certain age, specifically seventy-and-a-half.

-

IRA (Individual Retirement Account): A tax-advantaged account that helps individuals save for retirement. There are various types of IRAs including traditional, Roth, and SEP IRAs.

Understanding these terms is crucial for individuals navigating their retirement savings options and ensuring compliance with IRS requirements.

Penalties for Non-Compliance

Failure to comply with the requirements set forth by the IRS when it comes to the 2 form can result in various penalties. Key considerations concerning non-compliance include:

-

Failure to File: If an IRA custodian does not file a 2 form by the deadline, the IRS may impose penalties. These typically start at $50 per form, per failure, and can increase based on how late the form is submitted.

-

Inaccurate Reporting: Submitting a form with incorrect information can also lead to penalties. This includes failing to report contributions accurately or providing the wrong fair market value.

-

Account Holder Repercussions: If an account holder does not receive their copy of Form 5498, they may find themselves under reporting their IRA contributions during tax preparation, which may lead to further complications with their taxes.

Adhering to the IRS guidelines for filing the 2 form and ensuring accuracy in its information helps avoid potential penalties and legal ramifications.

Examples of Using the 2 Form

The 2 form is utilized in a variety of scenarios relating to IRA accounts. Here are examples to illustrate its usage:

-

Annual Reporting by Custodians: A bank that manages IRAs must complete and submit Form 5498 for each account. For instance, if a client contributes five thousand dollars to their traditional IRA during the tax year, the bank will report this on their customer's 5498 form.

-

Tracking Rollover Contributions: If an individual rolls over funds from a 401(k) plan into a Roth IRA, the financial institution must report this rollover on the 2 form. This provides a clear indication to the IRS that the transfer of funds was executed properly and adheres to legal guidelines.

-

Calculating Fair Market Value: At the end of the year, if the investments within the IRA appreciate significantly, the financial institution must report the new fair market value on the form. This information is crucial for tax calculations and compliance.

These examples reflect how the 2 form serves an integral role in maintaining transparency and reporting accuracy in retirement savings.