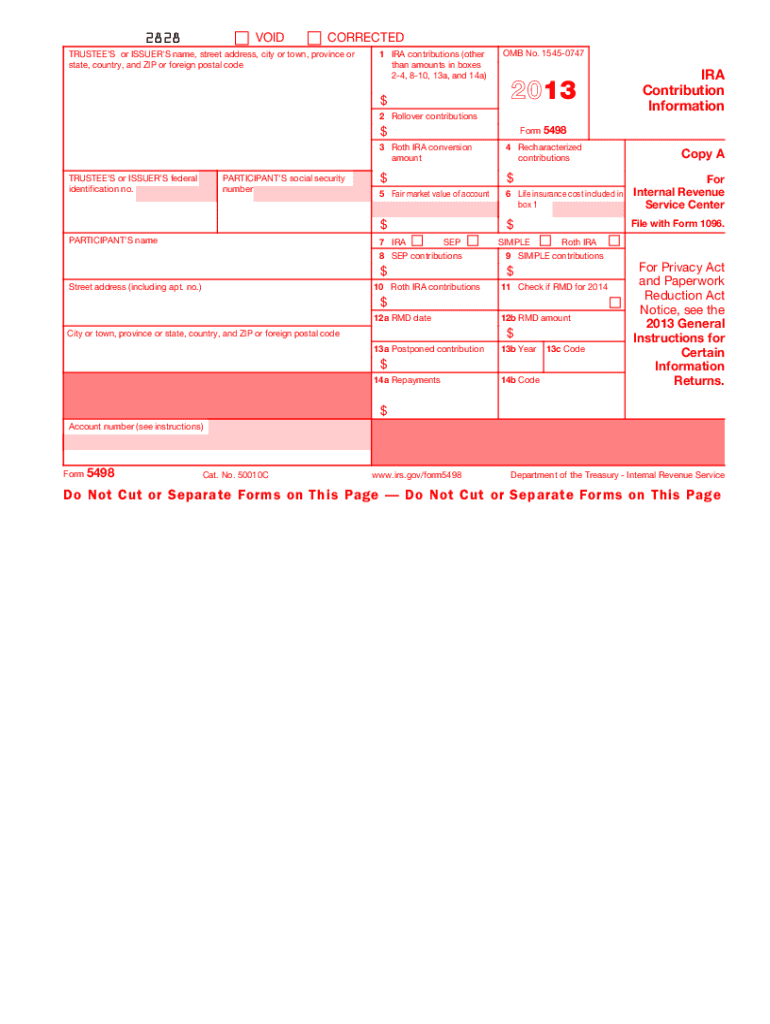

Definition and Purpose of Form 5498

Form 5498 is a tax document utilized to report various transactions related to individual retirement arrangements (IRAs) to the Internal Revenue Service (IRS). Primarily, this form captures contributions made to IRAs, including traditional, Roth, Simplified Employee Pension (SEP), and Savings Incentive Match Plan for Employees (SIMPLE) IRAs. It is essential for providing crucial information about retirement accounts to both the IRS and taxpayers.

The form includes details such as:

- The type of IRA: Traditional, Roth, SEP, or SIMPLE.

- The amount contributed during the tax year.

- The fair market value of the account at year-end.

- Whether any required minimum distributions (RMDs) were initiated or are pending.

Understanding Form 5498 is vital for tax reporting and ensuring compliance with IRS regulations regarding retirement savings.

How to Use Form 5498

The usage of Form 5498 primarily falls under the responsibility of the financial institution that manages the IRA. Here’s how the form is typically used:

-

Issuance: Financial institutions must provide Form 5498 to both the IRS and the account holder by May 31 of the following year. For instance, for contributions made in 2013, this form must be submitted by May 31, 2014.

-

Data Recording: Whenever contributions are made, institutions record them accurately on the form. They also ensure that they report the fair market value of the account and any RMDs, if applicable.

-

Review: Individuals should review Form 5498 for accuracy. This ensures that all contributions reported match their records, whether to confirm tax deductions or to assess retirement planning.

By understanding the function and requirements of Form 5498, individuals can better manage their retirement accounts and tax obligations.

Steps to Complete Form 5498

Completing Form 5498 is relatively straightforward but requires careful attention to detail. The following steps outline the process:

-

Gather Required Information: Collect details about all IRA contributions, including amounts and types of contributions made throughout the year.

-

Identify the Account Type: Determine the types of IRAs involved—traditional, Roth, SEP, or SIMPLE—as this will affect how contributions are reported.

-

Report Contributions: For each type of IRA, fill in the total contributions made during the year in the designated fields on the form. This includes rollover contributions, if applicable.

-

State the Fair Market Value: Report the fair market value of the accounts as of December 31, ensuring accuracy to avoid penalties.

-

Review and Submit: Check the completed form for errors. Once satisfied, send it electronically or via mail to the IRS and a copy to the account holder.

Following these steps ensures compliance with IRS requirements and allows for accurate tracking of IRA contributions.

Important Filing Deadlines

Filing deadlines for Form 5498 are critical for compliance and record-keeping. Here are the essential dates:

-

Contribution Deadline: Contributions for the previous year can be made until the tax filing deadline (generally April 15) of the following year. Any contributions made after this date must be reported in the next tax year.

-

Form Submission: Financial institutions must send Form 5498 to the IRS by May 31 of the year following the reporting year. For contributions made in 2013, this means a May 31, 2014 deadline.

-

Correction Period: If errors are found after submission, corrections must be made expeditively to avoid accounting issues or penalties.

Being aware of these deadlines helps ensure that both institutions and taxpayers meet their obligations promptly and avoid unnecessary penalties.

Key Elements of Form 5498

Understanding the key elements of Form 5498 can help users appreciate its significance in retirement account management. Key elements include:

-

Contributions: Details of all contributions made during the year, indicating if they are for a specific tax year or rollover contributions.

-

Fair Market Value (FMV): Reporting the account's FMV on the last day of the tax year helps gauge the account's growth and informs future decisions.

-

Required Minimum Distributions (RMDs): Information regarding RMDs is critical for individuals over age seventy-two, ensuring they comply with IRS withdrawal requirements.

-

Account Type: Clear indication of the type of IRA being reported ensures that the right rules apply when it comes to taxation or penalties.

These elements form the backbone of retirement reporting and reinforcement of taxpayer responsibility in managing their IRA accounts.

Who Typically Uses Form 5498

Form 5498 is used by a variety of parties involved in retirement planning. The main users include:

-

Financial Institutions: Banks, investment firms, and other institutions that manage IRAs are responsible for filing Form 5498 on behalf of account holders.

-

Individual Account Holders: Taxpayers who contribute to IRAs receive Form 5498 to use for their tax records and planning purposes.

-

Tax Professionals: Accountants and tax preparers rely on Form 5498 to assist clients in tax preparation, ensuring they take appropriate deductions related to retirement contributions.

Understanding who uses Form 5498 clarifies its role in the overall framework of retirement savings and tax compliance.