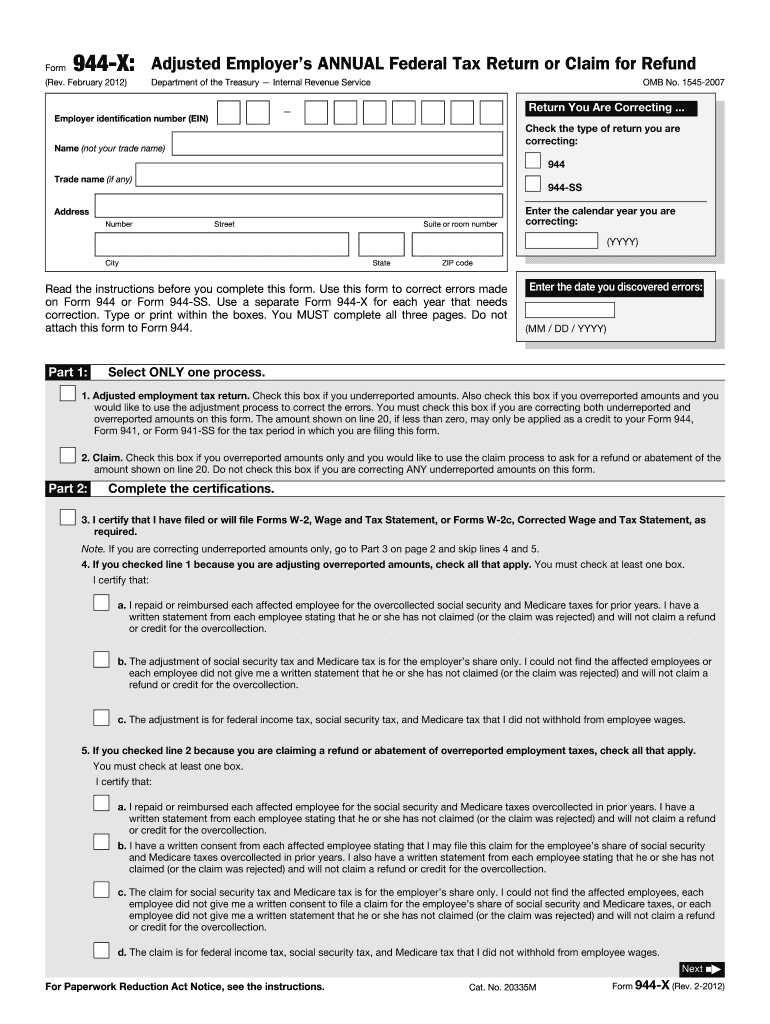

Definition and Purpose of Form 944-X for 2012

Form 944-X is used by employers to correct inaccuracies on Form 944, the annual Federal Tax Return, or to claim a refund concerning employment taxes for the year 2012. This form allows employers to amend reported amounts on their original tax filings, addressing both underreported and overreported figures. Understanding the purpose of Form 944-X is crucial, as it directly affects how business owners handle their tax obligations, ensuring compliance with federal requirements. It is vital for accurately maintaining employment tax records and addressing discrepancies in a timely manner.

How to Use Form 944-X for 2012

To use Form 944-X effectively, employers must identify the specific errors from their initial Form 944 submission. This involves a careful comparison of the information provided in the original filing against actual records and calculations. The form includes sections for various types of corrections, such as employee wages, tax withholdings, and social security amounts. It is important to follow the designated instructions for each section, ensuring that the corrections are accurately and thoroughly documented. This process helps maintain transparent and correct records for both the employer and the IRS.

Steps to Complete Form 944-X for 2012

-

Gather Necessary Documents: Before starting, collect all relevant employment records, original Form 944, and any previous correspondence with the IRS regarding the tax return.

-

Identify Corrections: Review prior filings and determine any discrepancies in reported amounts. Ensure that these corrections align with actual payment records and documentation.

-

Fill Out Necessary Sections: Enter corrected figures in the appropriate sections of Form 944-X. Provide explanations and calculations in the "Explanation of Corrections" part for each adjustment made.

-

Sign and Date the Form: The business owner or an authorized representative must sign Form 944-X. Include the date of signing to validate the amendments.

-

Submit the Form: Depending on the IRS instructions, submit the form either electronically, by mail, or in person, ensuring compliance with submission guidelines.

IRS Guidelines for Using Form 944-X

The IRS provides specific guidelines for using Form 944-X, which include detailed instructions for completing each section of the form. Employers must adhere to these guidelines to ensure that the corrections are processed accurately. Moreover, it is essential for users to stay informed about any updates to IRS policies or changes in the filing procedures that can impact the correction process. Compliance with IRS guidelines not only facilitates smooth processing but also helps in avoiding penalties or further inquiries.

Filing Deadlines and Important Dates for Form 944-X

Employers seeking to amend their Form 944 must be aware of the specific deadlines associated with the 944-X filing. Generally, corrections should be submitted within three years from the date of filing the original Form 944 or within two years from the date the tax was paid, whichever is later. Keeping track of deadlines is integral to ensuring timely corrections and avoiding penalties. It is advisable to consult the IRS updates or a tax professional to verify deadlines each tax season.

Required Documents for Filing Form 944-X

To accurately complete and file Form 944-X, employers must compile an assortment of documents:

- Original Form 944: This serves as the reference point for identifying discrepancies.

- Payroll Records: Includes employee wage summaries and tax withholding documents.

- Tax Payment Receipts: Proof of tax payments made to validate claims and corrections.

- Previous IRS Correspondence: If corrections were discussed with the IRS, these records help in clarifying the context.

Having a complete set of accurate documents ensures that employers can substantiate the corrections made on Form 944-X and respond effectively to any inquiries from the IRS.

Penalties for Non-Compliance with Form 944-X

Failure to comply with IRS guidelines and deadlines for filing Form 944-X can lead to significant penalties. These may include fines for late submissions or inaccurate reporting, which can add undue financial burdens on businesses. To mitigate risks, employers are encouraged to review and double-check all entries on Form 944-X before submission. Additionally, seeking the advice of a tax professional when discrepancies or uncertainties arise can prevent costly mistakes and ensure adherence to federal tax regulations.

Software Compatibility for Filing Form 944-X

Employers can take advantage of modern tax software platforms like TurboTax or QuickBooks for completing Form 944-X. These platforms often incorporate IRS guidelines, offering step-by-step guidance and error-checking features that enhance the accuracy of the filing process. Utilizing compatible software can streamline the correction of employment tax discrepancies, especially for businesses that are accustomed to electronic record-keeping and submissions. It is important to ensure that the software version used is up-to-date with the latest IRS requirements to prevent submission errors.

Who Typically Uses Form 944-X for 2012

Form 944-X is primarily utilized by small businesses and employers who originally filed Form 944 for their annual tax returns in 2012. Typically, these entities are those whose total employment tax liability is $1,000 or less annually. Understanding the user base is crucial, as it emphasizes the need for a thorough and precise approach to filing corrections. By focusing on the specifics relevant to their business scale and operations, employers can efficiently address any past errors in their tax documentation.