Definition and Meaning

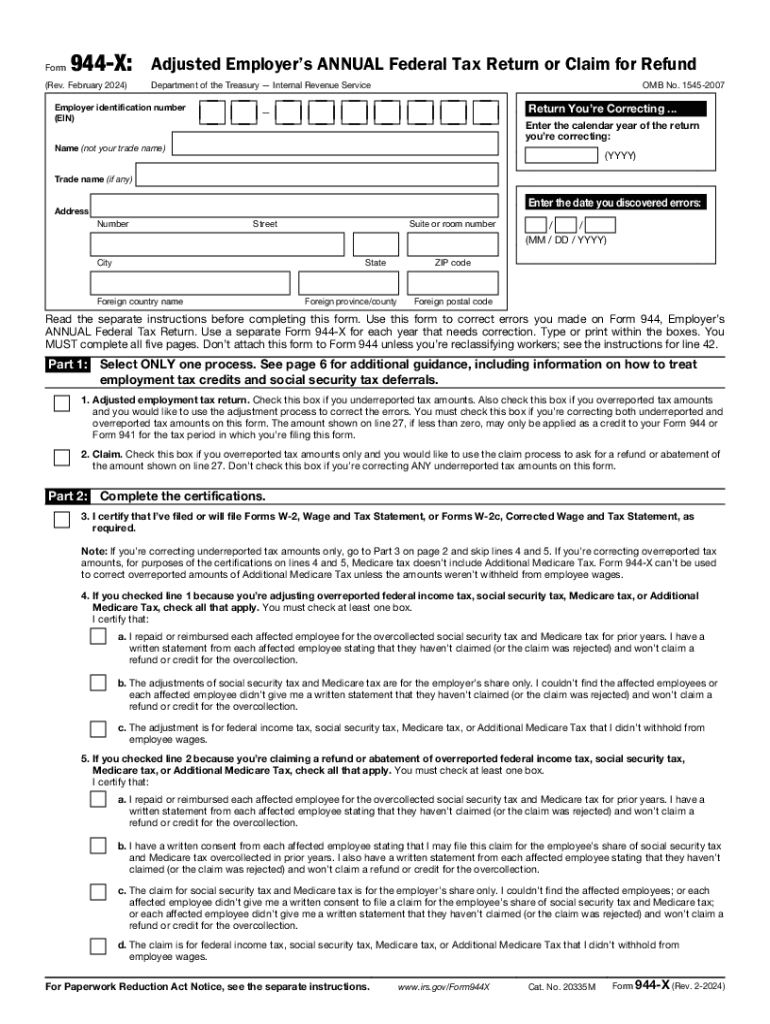

Form 944-X, also known as the Adjusted Employer's Annual Federal Tax Return or Claim for Refund, is a document designed to correct errors made on Form 944. Employers use this form to make adjustments to federal tax liabilities reported in a previous calendar year. It caters to scenarios where employment taxes were misreported due to underpayments or overpayments.

Common Adjustments Made on Form 944-X

- Social Security and Medicare Taxes: Corrections often occur in taxes related to Social Security and Medicare contributions incorrectly calculated or withheld from employee wages.

- Federal Income Taxes: Adjustments might include discrepancies in the amount of federal income taxes withheld.

- Sickness and Accident Pay: Employers sometimes need to amend reported wages connected to sickness or accident pay.

Broad Legal Context

The purpose of the form is to rectify federal tax reporting errors. Consequently, it's crucial to maintain accurate corporate financial records to reduce liability issues. Additionally, understanding compliance with the Internal Revenue Service (IRS) regulations contributes to adhering to tax laws, minimizing the penalty risks.

Steps to Complete Form 944-X

Completing Form 944-X requires precision and attention to detail. Follow these steps to ensure accuracy:

- Gather Necessary Documents: Collect all relevant payroll records, previous tax filings, and supporting documents necessary for the correction.

- Determine the Correction Type: Identify whether the adjustment pertains to an overreported or underreported tax situation.

- Complete the Form: Fill out each section of the form, focusing on Part 1 to Part 5, paying attention to detailed instructions.

- Calculate Adjustments: Ensure all tax calculations are precise. Utilize Available Worksheets to aid in this process if needed.

- Finalize the Form: Verify all sections for accuracy, and review for completeness before submission.

Amendments and Signature

- Amendment Justification: Provide a comprehensive explanation of the amendments, including exact figures and specifics behind the discrepancy.

- Signature Certification: The form requires an authorized signature from the employer, confirming the accuracy and truthfulness of the amendment.

Who Typically Uses Form 944-X

This form is pertinent for small employers who initially opted for annual tax filing instead of quarterly reports via Form 941. These employers generally handle a limited payroll operation and need to adjust reported data over a full fiscal year.

Business Entity Types

- Small Corporations: Often prefer simplified annual filings as conducive to streamlined accounting.

- Limited Liability Companies (LLCs): Possibly use Form 944-X to reconcile annual employment tax obligations.

- Family-Owned Enterprises: May rely on this form for corrections and refunds aligned with their annual reporting cycle.

IRS Guidelines

Operating within IRS guidelines is critical for the correct use of Form 944-X. The IRS mandates detailed record-keeping and encourages the accurate and timely filing of amended tax returns.

Mandatory Compliance Steps

- Record Accuracy: Maintain precise payroll records supporting all reported figures and corrections.

- Timely Filing: Submit Form 944-X within the specified deadline for the correction period.

- Supporting Documentation: Attach all necessary statements and explanations to validate adjustments.

Filing Deadlines and Important Dates

Proper adherence to deadlines ensures compliance with IRS regulations and mitigates potential penalties.

Key Submission Dates

- Original Filing Requirement: Form 944 originally requires submission January 31 following the tax year.

- Amendment Timeframe Limitations: Certain corrections must be submitted within a defined period after the discovery of the error. Generally, this period may extend up to three years from the original filing date.

Penalties for Non-Compliance

Failing to adhere to requirements could manifest in penalties or interests imposed by the IRS. These include late filing fees and possible scrutiny from audits if amended returns deviate from typical standards.

Avoidance of Penalties

- Timely Corrections: Promptly address discrepancies to avoid accumulating interest.

- Thorough Record Management: Ensure all supporting documentation is comprehensive and verifies amendments.

- Professional Consultation: Consider engaging a tax professional or lawyer to oversee high-stakes corrections.

Digital vs. Paper Version

Form 944-X is available both digitally and on paper, with each having unique advantages.

Advantages of Digital Forms

- Convenience: Fill and submit forms electronically for immediate IRS receipt.

- Error Reduction: Automated calculations limit potential for mistakes.

- Verification: Digital submissions receive electronic confirmation of receipt.

Benefits of Paper-Based Filing

- Tangible Records: Hard copy submissions provide physical documentation for personal records.

- No Internet Dependence: Ideal for areas with unreliable technology infrastructure.

Software Compatibility

While specific IRS platforms support digital submissions, many third-party applications facilitate preparation.

Common Applications

- TurboTax and QuickBooks: These platforms aid employers in calculating and filing tax forms, integrating previous records to streamline corrections and remove manual administrative loads.

- DocHub: In line with the solutions for filling and signing documents, this is an ideal tool for completing digital forms securely and efficiently.

By understanding these facets of the Form 944-X, employers can ensure compliance, strategize effective corrections, and avoid the negative repercussions of incorrect federal tax returns.