Definition & Meaning

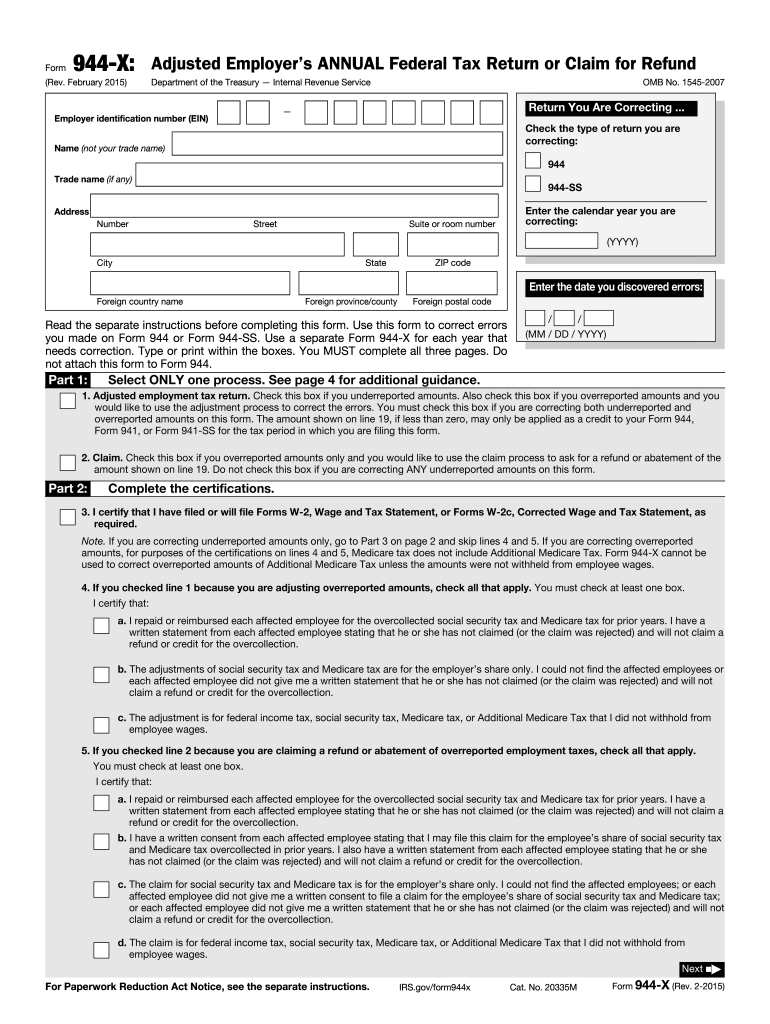

Form 944-X is an essential document used to correct errors on the Employer's Annual Federal Tax Return or Claim for Refund for 2015. It specifically addresses inaccuracies in the originally reported amounts of employee wages and taxes, such as Social Security and Medicare. This form provides a mechanism for employers to adjust discrepancies, ensuring compliance with IRS requirements. By using this form, employers can rectify either underreported or overreported tax figures, ultimately facilitating proper tax reconciliation and refund claims if applicable.

How to Use Form 944-X for 2015

Employers primarily use Form 944-X to amend their Form 944 submissions, which report annual federal tax liabilities. To utilize Form 944-X correctly, it's vital to:

- Identify the errors or discrepancies in the originally filed Form 944.

- Gather all the necessary documents that can help substantiate the corrections made.

- Complete the necessary sections on Form 944-X, detailing the nature of each correction.

- Certify any related reimbursements made to employees, which confirms that any overcollection of taxes has been addressed appropriately.

It's crucial that employers follow these steps meticulously to avoid further errors and ensure timely processing by the IRS.

Steps to Complete Form 944-X for 2015

Filing Form 944-X involves several steps:

-

Obtain and Read the Instructions: Before beginning, download Form 944-X for 2015 and carefully review the corresponding IRS instructions.

-

Review Original Form 944 Submission: Examine your initial Form 944 to locate specific areas needing corrections.

-

Provide Corrected Figures: Clearly enter the accurate figures in the designated fields on Form 944-X, contrasting them with the originally reported numbers.

-

Explain Corrections: Thoroughly complete the explanation section by detailing each correction, the reasons behind them, and how errors were identified.

-

Sign and Date the Form: Ensure that the form is signed by an authorized individual to affirm the accuracy of the corrections.

-

Submit to the IRS: Mail the completed Form 944-X to the IRS address specified for your geographic region or tax type.

-

Record Keeping: Keep copies of both the original Form 944 and the corrected Form 944-X, along with any supporting documentation, for at least four years.

Employers are encouraged to take careful note of these steps to facilitate a smooth amendment process.

Who Typically Uses Form 944-X for 2015

The primary users of Form 944-X are employers who submitted Form 944 and later discovered errors in their tax reporting for the year 2015. These may include small business owners, particularly those with simplified reporting requirements, as Form 944 condenses payroll tax reporting annually rather than quarterly. Businesses discovering inaccuracies after filing must utilize Form 944-X to amend their records and maintain accurate tax compliance.

IRS Guidelines

The IRS provides explicit guidelines for using Form 944-X, which include detailed instructions for completing each section of the form. These guidelines emphasize the importance of accuracy, the need for thorough documentation, and the requirement for employers to certify any employee refunds. Employers must ensure that they adhere to current IRS practices and procedures for correcting tax information to prevent potential penalties or delays in processing.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting Form 944-X, it must be filed as soon as errors are recognized. The statute of limitations generally allows for amendments to be filed within three years from the original tax filing date or two years from the date the tax was paid, whichever is later. It is crucial to address discrepancies promptly to ensure compliance and protect against interest or penalties.

Required Documents

Employers need several supporting documents when filing Form 944-X, including:

- A copy of the originally submitted Form 944 for 2015.

- Documentation verifying wages paid during the correction period, such as payroll records.

- Proof of taxes paid or adjustments reimbursed to employees.

- Any additional forms or schedules related to the changes being made.

These documents support the validity of the corrections and facilitate the review process by the IRS.

Examples of Using Form 944-X for 2015

Consider an employer who initially underreported Social Security taxes due to a payroll system error. After discovering the mistake, the employer must:

- Fill out Form 944-X to adjust the reported Social Security taxes.

- Provide evidence of the underreporting and proof of the corrected amounts.

- Ensure that employees affected by the error receive any due reimbursements if there was an overcollection.

This example underscores the practical application of Form 944-X and highlights the corrective actions necessary when discrepancies are identified.

Penalties for Non-Compliance

Failure to correct errors using Form 944-X can lead to penalties, including:

- Fines for inaccurate reporting or late payments.

- Accrued interest on unpaid tax amounts.

- Potential audits or further scrutiny by the IRS for unresolved discrepancies.

Employers should prioritize timely and accurate corrections to avoid these consequences and maintain the integrity of their tax records.