Definition and Purpose of Form 944-X for 2013

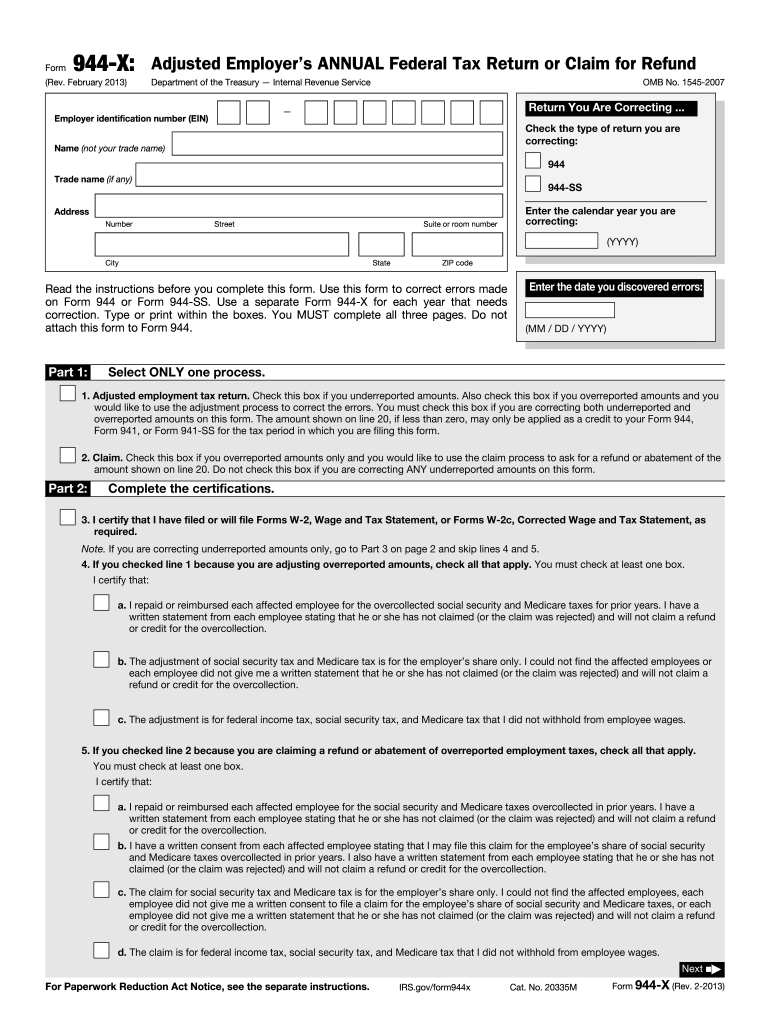

Form 944-X is used to correct any errors identified in the Employer's Annual Federal Tax Return, Form 944, for the tax year 2013. Employers typically use this form to adjust any underreported or overreported employment taxes. By submitting Form 944-X, companies can amend details such as social security, Medicare, and withheld federal income taxes. It's essential for keeping records accurate and compliant with IRS regulations.

How to Use Form 944-X for 2013

Employers should use Form 944-X to correct previously filed Form 944 errors. The first step is identifying the specific errors in the original filing. Then, employers must provide correct data, including payments made to employees, adjustments for sick pay, and any other factors affecting tax calculations. Form 944-X must be completed thoroughly, ensuring the IRS can process these corrections effectively.

Steps to Complete Form 944-X for 2013

- Review Original Form 944: Compare the original submission to your records for discrepancies.

- Identify Errors: Clearly outline each error to be corrected in the appropriate sections of Form 944-X.

- Separate Corrections by Column: Use the columns designated for "previously reported" and "correct information."

- Provide Explanations: Each adjustment requires a written explanation to describe the nature and reason for the correction.

- Complete Certification: The employer must certify the form, confirming accuracy and truthfulness.

- Maintenance of Records: Keep copies of all correspondence and documents for your records.

Important Terms Related to Form 944-X for 2013

- Tax Liability: The total amount owed to the IRS, based on corrected employment taxes.

- Adjustments: Refers to changes in reported taxes due to errors in the initial filing.

- Underreported/Overreported Taxes: Instances where initial taxes were either less than or more than the correct amount.

- FICA: Federal Insurance Contributions Act taxes that fund Social Security and Medicare.

Key Elements of Form 944-X for 2013

Key elements include the employee information, adjustments for benefits like sick pay, prior period adjustments, and detailed explanations for each change made. The form also requires a breakdown of the corrected tax amounts and a certification section for finalizing the correction.

Filing Deadlines and Important Dates

Form 944-X should be filed as soon as errors are identified. There are no specific annual deadlines, but promptly addressing errors helps avoid late fees and penalties. Corrections should be submitted within the statute of limitations, typically within three years from the original filing date or two years from the date of payment, whichever is later.

Form Submission Methods for Form 944-X

Form 944-X can be submitted via mail or electronically. It’s essential to verify which method is required for your context. Secure mailing options or approved IRS software services should be used for electronic submissions, ensuring data safety.

IRS Guidelines for Form 944-X for 2013

The IRS stipulates that forms must be completed accurately with all pertinent information. They provide a comprehensive guide for completing Form 944-X, which is crucial for ensuring compliance. Following these guidelines helps avoid rejection or penalties due to errors.

Penalties for Non-Compliance with Form 944-X for 2013

Non-compliance or failure to correct errors timely can result in significant penalties and interest charges by the IRS. Furthermore, incomplete corrections or repeated errors might lead to audits. Therefore, carefully reviewing and submitting Form 944-X is vital to maintaining compliance and avoiding financial repercussions.