Definition and Purpose of the Online 1040X Form 2011

The online 1040X form serves as the Amended U.S. Individual Income Tax Return. It allows taxpayers to correct errors or make changes to their previously filed tax returns for the year 2011. Common reasons for using this form include reporting additional income, claiming new deductions, or correcting filing status errors. It is crucial for individuals who need to amend their tax returns to ensure compliance with IRS regulations and avoid penalties.

Key Functions of the Online 1040X Form 2011

- Correct Mistakes: If you discover that you made an error on your original Form 1040, using the 1040X allows you to rectify that mistake.

- Claim Additional Deductions or Credits: This form is useful for taxpayers who initially overlooked eligible deductions or credits that could lower their tax liability.

- Change Filing Status: Taxpayers may want to change their filing status due to life events such as marriage or divorce. The 1040X accommodates these changes.

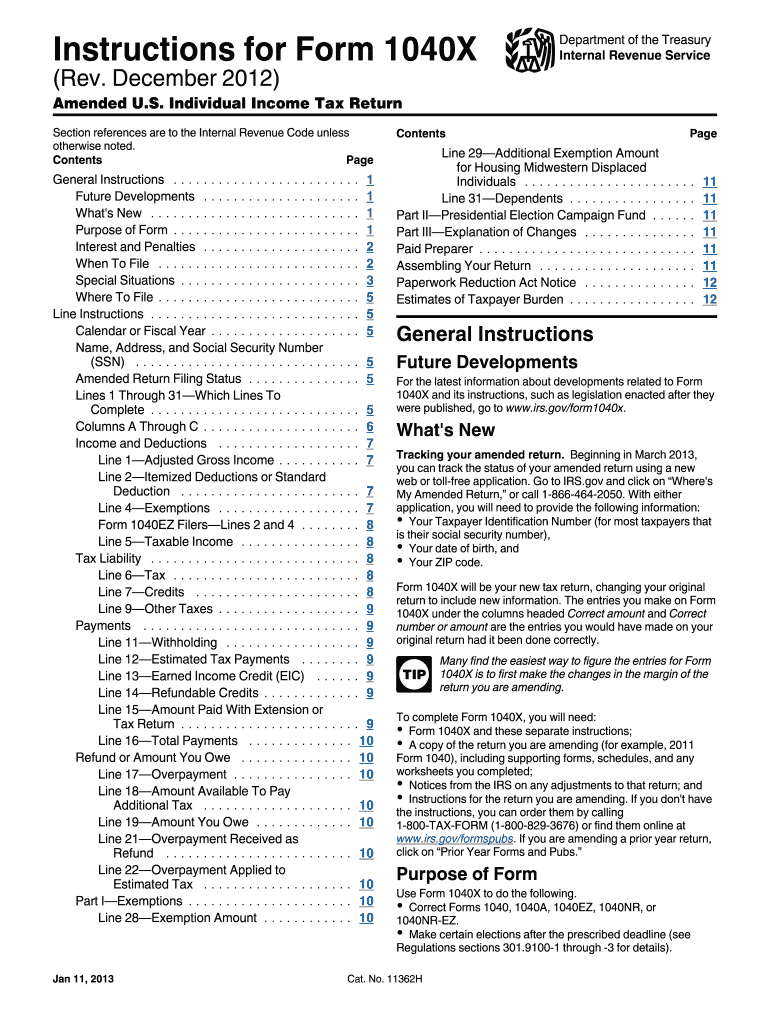

Steps to Complete the Online 1040X Form 2011

Completing the online 1040X form is a systematic process that requires careful attention to detail. Here is a structured approach to guide you through the completion of the form:

-

Gather Required Documents:

- Original tax return for 2011.

- W-2 forms, 1099s, and any additional income statements.

- Documentation for new deductions or credits you plan to claim.

-

Access the Form:

- Visit the IRS website or an authorized platform to obtain the online 1040X form.

-

Fill in Personal Information:

- Input your name, address, and Social Security number as they appeared on your original return.

-

Explain Changes Made:

- Use Part III to clearly explain why you are amending your return. Be concise but thorough.

-

Complete Sections for Changes:

- Fill out the necessary sections that reflect the changes to your income, deductions, or credits.

-

Review and Submit:

- Ensure all entries are accurate. Review your changes thoroughly before submitting through your chosen method—either electronically or via mail.

Important Terms Related to the Online 1040X Form 2011

Understanding the terminology associated with the online 1040X form is vital for effective completion and filing. Here are key terms relevant to this process:

- Adjusted Gross Income (AGI): The total income that is subject to tax after adjustments are made. It’s a critical figure appearing on both the original and amended return.

- Tax Liability: The total amount of tax you are responsible for paying, which can change based on adjustments entered in the 1040X.

- Filing Status: Determines the rate at which your income is taxed and eligibility for certain credits and deductions.

- Schedule A/C: These are forms that may need to be attached if you are claiming itemized deductions or credits that require additional information.

IRS Guidelines for Filing the Online 1040X Form 2011

The IRS provides specific guidelines for filing the online 1040X form, which ensures compliance and accuracy in the amendment process. Some essential points to keep in mind include:

- Filing Deadline: The 1040X must be filed within three years from the original return's due date, or within two years of paying any tax owed.

- Signature Requirements: You must sign and date the form. If filing jointly, both spouses need to sign.

- Attachments: Attach any relevant forms/schedules that are being affected by your amendment.

Who Typically Uses the Online 1040X Form 2011

Various taxpayers may find themselves needing to use the online 1040X form. Examples include:

- Individuals with Errors: Anyone who realizes they made an error on their tax return, such as misreported income or incorrect deductions.

- Taxpayers Claiming New Credits: Persons who are eligible for tax credits that they did not claim earlier, such as education credits.

- Life Changes: Taxpayers who experience life changes that affect their filing status, like marriage or divorce, often require this form for proper tax filing.

Filing Deadlines and Important Dates for the Online 1040X Form 2011

Timeliness is crucial when amending a tax return. Here are the relevant deadlines and important dates associated with the 1040X form:

- Deadline for 2011 Refund Claims: Typically, you must file your 1040X by April 15, 2015, to claim any refunds related to the 2011 tax year.

- Balance Due Changes: If changes result in tax owed, it’s essential to file as soon as possible to avoid accruing additional penalties and interest.

- Submission Timeline: The IRS generally processes 1040X forms within eight to twelve weeks, so plan accordingly if expecting a refund or needing to pay additional tax.

Required Documents for Completing the Online 1040X Form 2011

To ensure a smooth amendment process, certain documents are required. These include:

- Original Tax Return: The initial Form 1040 or 1040-EZ submitted for the 2011 tax year.

- Supporting Documents: Any W-2 forms, 1099s, and receipts for additional deductions being claimed on the amended return.

- New Schedules if Applicable: If changes impact deductions or credits, include the necessary schedules (e.g., Schedule A for itemized deductions).

Digital vs. Paper Version of the Online 1040X Form 2011

The 1040X form can be completed either online or on paper. Weighing the advantages of each method is important for taxpayer preferences:

-

Digital Submission:

- Faster Processing: Online submissions are typically processed faster by the IRS.

- Immediate Confirmation: Electronic submission provides immediate feedback on submission status.

-

Paper Submission:

- Manual Review: Some taxpayers prefer completing forms manually to ensure accuracy.

- Mailing Considerations: Be mindful of postal service times and ensure you send the form to the correct IRS address.

Adhering to the specified processes and guidelines for the online 1040X form ensures your amendments are correctly filed and processed efficiently.