Definition & Meaning of the 1040X Fax 1992 Form

The 1040X is an IRS form used primarily by individuals to amend their tax returns. This form allows taxpayers to correct errors on previously filed forms, making necessary adjustments for income, deductions, or credits that changed after the original submission. The 1992 version of the 1040X specifically relates to those amendments submitted during that tax year. Understanding the function of the 1040X is critical for ensuring that taxpayers accurately report their financial information and comply with tax laws.

Purpose of the 1040X Form

- Correcting Errors: The primary purpose of the 1040X is to rectify mistakes made on a previously submitted tax return, including income miscalculations, overlooked deductions, or misreported credits.

- Changing Filing Status: Taxpayers may use this form to change their filing status, such as switching from single to married filing jointly.

- Claiming Refunds: If an amendment results in overpayment, the taxpayer can pursue a refund through the 1040X.

Understanding the definition and purpose of the 1040X is essential for taxpayers who may need to correct their tax filings.

How to Use the 1040X Fax 1992 Form

Using the 1040X form to file an amendment requires careful attention to detail. Taxpayers need to ensure they accurately complete each section of the form and provide necessary explanation for the changes made.

Steps to Utilize the 1040X Form

- Obtain the Form: The 1040X can be downloaded from the IRS website or requested directly from a tax professional.

- Complete the Form: Fill out the sections indicating the original amounts and the new amounts, clearly stating the specific changes.

- Provide Explanations: Use the space provided to explain why the amendment is necessary, including any calculations that justify the revised figures.

Filing the Form

- The completed 1040X must be submitted via mail to the IRS, accompanied by any required supporting documentation that substantiates the changes being reported.

Utilizing the 1040X correctly is crucial for ensuring proper adjustments and any potential refunds.

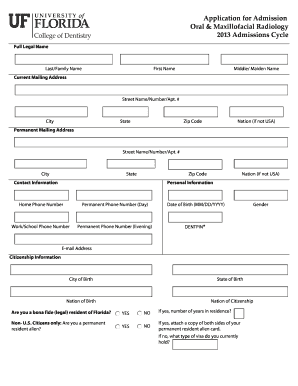

Steps to Complete the 1040X Fax 1992 Form

Completing the 1040X requires several steps to ensure accuracy and compliance with IRS regulations. Each part of the form must be carefully scrutinized to reflect true financial information.

Detailed Completion Process

- Part I: Provide basic information such as name, Social Security number, and the original tax year being amended.

- Part II: Report the original figures from the tax return filed as well as the corrected figures.

- Example: If a taxpayer originally reported $50,000 in income and later determined it was actually $55,000, both figures should be clearly indicated on the form.

- Part III: Provide a clear explanation for each change, referencing tax laws or IRS guidelines if applicable.

Important Considerations

- Only one tax year can be amended per 1040X, requiring separate forms for different years.

- Ensure to sign and date the form before submission to validate the amendment.

Following a structured process aids in reducing the chances of making errors that could lead to further complications with the IRS.

Filing Deadlines / Important Dates

Filing deadlines play a significant role in the utilization of the 1040X form. Taxpayers need to be aware of key dates to ensure amendments are submitted timely.

Key Deadlines

- Three-Year Rule: Taxpayers have three years from the original filing deadline, including extensions, to submit their 1040X for any given tax year.

- Refund Claims: If an amendment results in a refund, the claim must be filed within this three-year period to be eligible for recovery.

- Avoiding Penalties: Timely filing can help taxpayers avoid additional penalties associated with unpaid taxes resulting from errors.

Understanding these deadlines is vital for taxpayers to ensure they maintain compliance with IRS regulations while maximizing potential refunds.

Who Typically Uses the 1040X Fax 1992 Form

Various groups of taxpayers may find the 1040X form applicable depending on their financial circumstances and the nature of their tax filings.

Typical Users Include

- Individual Tax Filers: Those who discover mistakes or omissions after filing their returns in order to amend discrepancies.

- Self-Employed Individuals: Entrepreneurs who may need to adjust their income figures or deductions once all financial data is compiled.

- Students and Dependents: Young adults who may need to amend their returns upon realizing education credits or experiences that were not initially filed.

Tax Professionals

- Tax preparers often utilize the 1040X to amend client returns, ensuring accurate compliance for clients who experience changes in financial circumstances.

Understanding who uses the 1040X helps cater to the diverse needs of taxpayers seeking to amend their tax situations effectively.