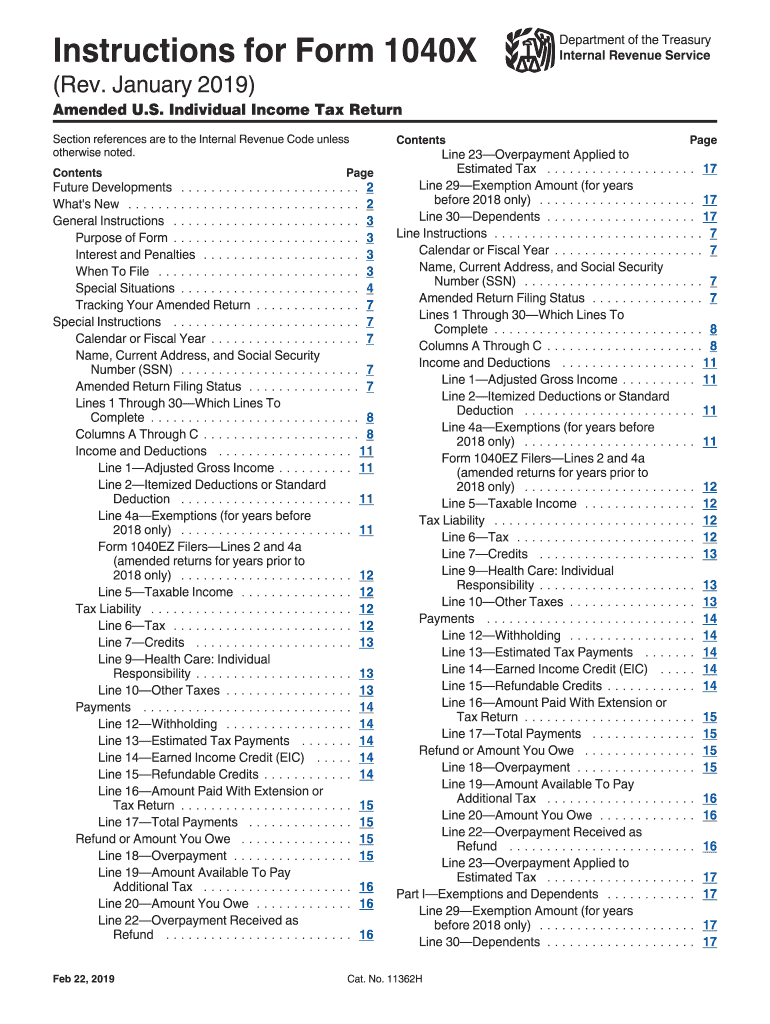

Definition and Purpose of Form 1040X

Form 1040X, or the Amended U.S. Individual Income Tax Return, is used by taxpayers to amend their previously filed federal income tax returns. This form allows individuals to correct errors or make changes to their income, deductions, credits, and filing status. It is essential to submit this form if you discover that you did not report all your income, you need to claim a tax credit, or if there are any other amendments required to accurately reflect your financial situation.

- Overall Intent: The primary intention is to provide the IRS with corrected information, ensuring compliance with tax laws and accurate assessment of tax liabilities.

- Applicable Scenarios: Taxpayers may need to use Form 1040X for reasons such as receiving W-2 forms or 1099 forms after the initial filing, changes in dependent status, or rediscovering documentation that affects claimed deductions.

Steps to Complete the 1040X Instructions 2018

Completing Form 1040X requires a meticulous approach. Here are the steps to successfully fill out and file the form.

- Obtain the Correct Form: Download Form 1040X from the IRS website or use tax preparation software that includes the form.

- Fill Out Personal Information: Enter your name, address, and Social Security number. Ensure that these match the information on the original tax return.

- Determine Changes: Identify the exact changes needed in your tax return, including increased or decreased income and any changes to deductions or credits.

- Complete the Form:

- Use columns A, B, and C to indicate figures from your original return, the changes being made, and the corrected amounts.

- Specify your reasons for each change to clearly communicate with the IRS.

- Sign and Date: Ensure that you and your spouse (if applicable) sign and date the form.

Each section requires comprehensive review to ensure all amendments are accurate, preventing further complications or inquiries from the IRS.

Important Terms Related to 1040X Instructions 2018

Understanding the terminology associated with Form 1040X is crucial for successful completion and compliance. Here are some key terms:

- Filing Status: Pertains to the classification of taxpayers for tax calculation purposes, e.g., single, married filing jointly, head of household.

- Amendment: Refers to the alteration of a previously submitted document, in this case, the tax return.

- Tax Credits/Deductions: These are specific amounts that reduce taxable income or tax liability, such as credits for education expenses or deductions for mortgage interest.

- Corrected Return: The return reflecting the changes made to the original submission, filed through Form 1040X.

Being familiar with these terms enhances understanding of the instructions and process associated with utilizing Form 1040X effectively.

Filing Deadlines and Important Dates for 1040X

Awareness of filing deadlines is crucial when dealing with Form 1040X to avoid penalties and interest. Key dates include:

- Filing Deadline: Generally, Form 1040X must be filed within three years from the original return’s due date or within two years from the date you paid the tax, whichever is later.

- Extension Periods: If an extension was obtained for the original return, the timeframe to amend may differ based on that extension.

Taxpayers must keep accurate records and remember these deadlines to ensure compliance and avoid unnecessary complications.

Who Typically Uses 1040X Instructions 2018?

Form 1040X is utilized by a variety of taxpayers, each with differing circumstances. These may include:

- Individuals Who Made Errors: Taxpayers who discover mistakes in income reporting or deductions after filing their original tax return.

- Those Claiming New Credits: Individuals who realize they qualify for credits or tax breaks that were not claimed initially, such as education credits.

- Changed Life Circumstances: Taxpayers who experience significant life events (divorce, death of a spouse, or changes in dependents) that may alter their tax strategy.

Understanding the diverse scenarios where Form 1040X is applicable helps taxpayers identify whether they need to make amendments and to follow the correct procedures.