Definition and Scope of Form 706

Form 706, formally known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is essential for reporting the estate taxes due for a decedent. It applies to individuals who have died after December 31, 2019, and whose estate surpasses the filing threshold. The form facilitates tax calculation on the fair market value of the estate's assets, including real estate, stocks, bonds, and other properties. The instructions for Form 706 provide comprehensive guidance on completing each section accurately, ensuring all relevant assets and deductions are reported.

How to Use the Instructions for Form 706

Using the instructions for Form 706 involves understanding the documentation and steps necessary to file the return accurately. The guide aids executors in determining the gross estate, calculating deductions, and addressing any applicable credits. Executors should carefully follow the steps outlined to ensure compliance with IRS requirements. The instructions also include detailed explanations of terms and concepts, such as the portability of the deceased spousal unused exclusion and how to handle unique assets like collectibles.

Steps to Complete Form 706

- Determine the Gross Estate Value: Calculate the total fair market value of all assets owned by the decedent at the time of death.

- Identify Deductions and Credits: Consider deductions for debts, funeral expenses, charitable contributions, and marital transfers. Apply available credits to reduce the estate tax liability.

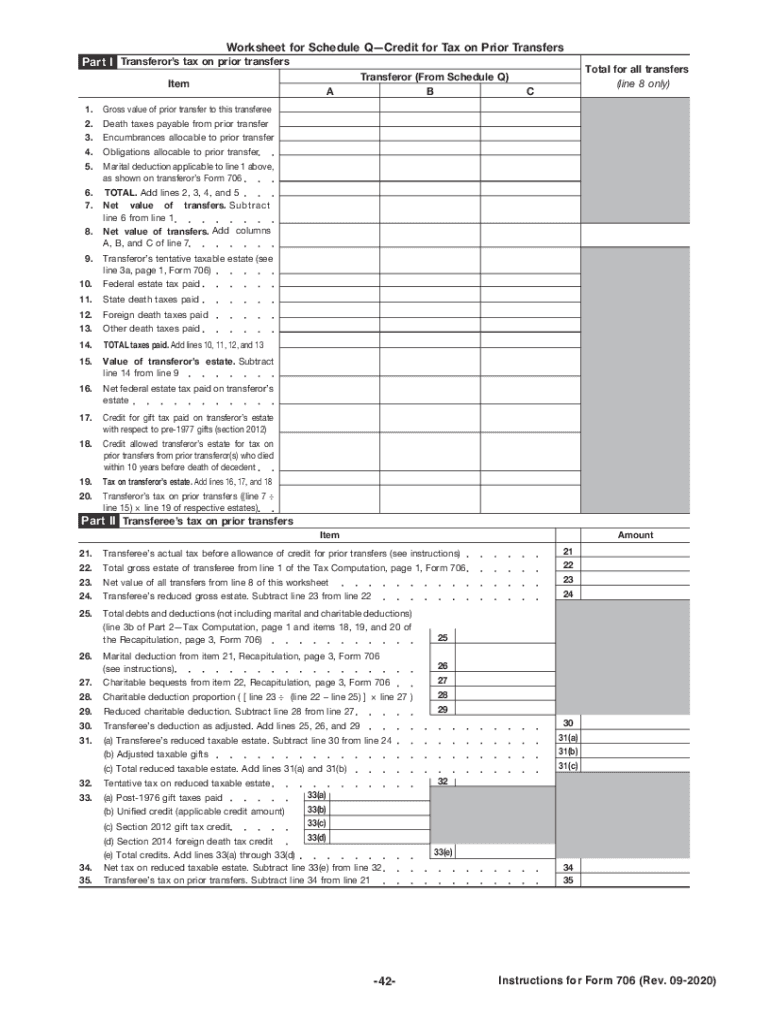

- Complete the Appropriate Schedules: Each type of asset, such as real estate or stocks, should be reported on its respective schedule.

- Calculate Estate Tax: Use the unified credit and other applicable credits to determine the estate tax owed.

- File the Form: Submit Form 706 to the IRS by the deadline, which is generally nine months after the decedent's death, unless an extension has been granted.

Key Elements of the Instructions

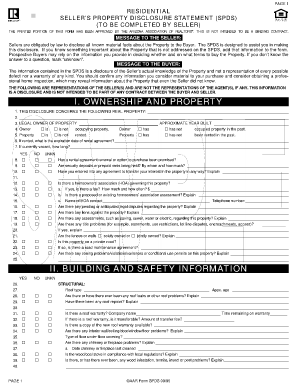

- Gross Estate Calculation: Instructions on assessing the fair market value of assets.

- Deductions and Credits: Guidance on subtracting allowable expenses and applying tax credits.

- Specific Schedules: Directions for completing each asset category's schedule.

- Portability Election: Information on transferring unused exclusion to the surviving spouse.

IRS Guidelines and Filing Requirements

The IRS provides specific guidelines in the instructions that detail filing requirements for Form 706. Executors must adhere to these to ensure the form is properly filled out and submitted timely. The guidelines cover everything from valuation techniques to documentation requirements and the process for electing portability.

Important Terms and Concepts

- Portability: Allows the transfer of the deceased spousal unused exclusion (DSUE) to the surviving spouse.

- Generation-Skipping Transfer Tax: Applies to transfers made to beneficiaries who are two or more generations below the decedent.

- Unified Credit: A tax credit that offsets the estate tax liability, linked to the estate tax exemption amount.

Filing Deadlines and Important Dates

The form must be filed within nine months of the decedent's death, with a possibility to request a six-month extension. Timely filing is crucial to avoid penalties and interest.

Required Documents for Submission

- Valuation Reports: Appraisals for real estate and other significant assets.

- Official Records: Copies of wills, trusts, and beneficiary designations.

- Evidence of Debt: Documentation for outstanding debts and liabilities.

- Proof of Payment: Receipts for paid expenses eligible for deduction.

Penalties for Non-Compliance

Failure to file Form 706 on time or accurately can result in penalties. These include monetary fines, interest on the unpaid tax, and potential legal consequences for misreported or undisclosed assets. Executors are advised to meticulously follow the instructions to avoid these penalties.

These sections provide comprehensive coverage of Form 706's instructions and ensure executors and tax professionals can accurately and efficiently manage estate tax returns following a decedent's passing.