Definition & Meaning

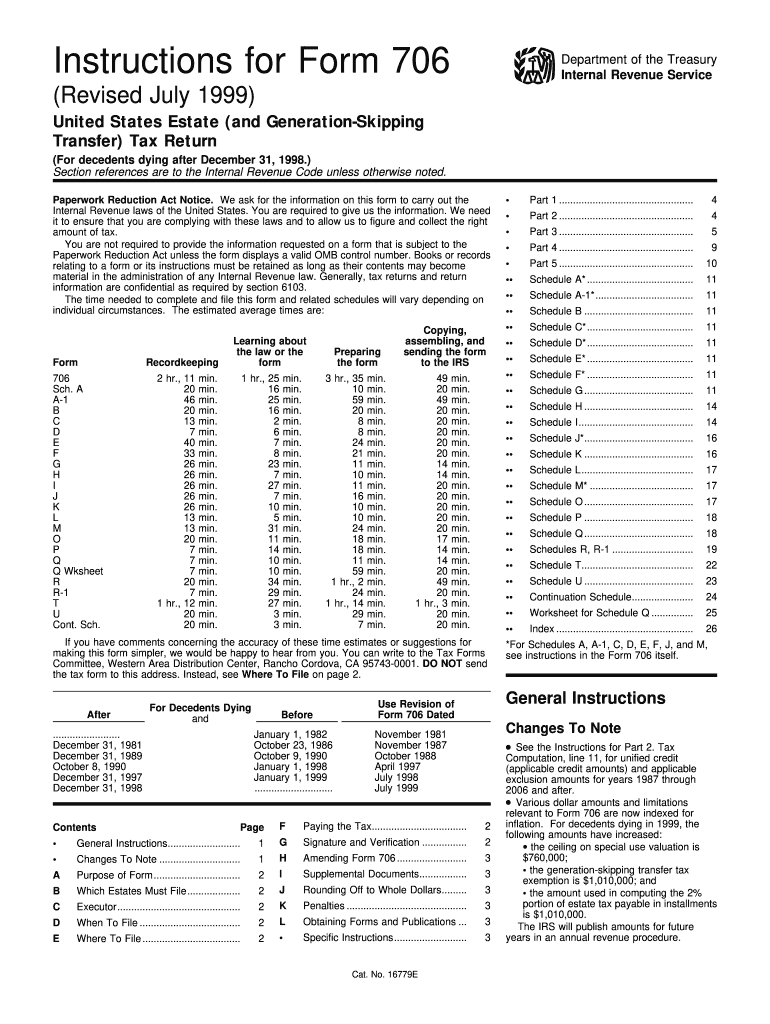

The 1999 Form 706, known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is an essential document used for reporting and calculating estate and generation-skipping transfer taxes for individuals who died after December 31, 1998. The primary purpose of this form is to assess the taxable estate of the decedent and the taxes due on any transfers that skip a generation. Such transfers often include direct gifts or inheritances made to grandchildren.

This form is integral in ensuring that the Internal Revenue Service (IRS) receives accurate information about the decedent’s gross estate. This includes the total value of assets, accounting for any deductions applicable to the estate. The form serves as a legal document to verify compliance with U.S. tax laws regarding estate transfers.

How to Obtain the 1999 706 Form

Obtaining the 1999 Form 706 is an essential initial step for executors or authorized personnel handling the estate of a decedent. The IRS provides this specific form, which can be downloaded directly from their official website. Alternatively, individuals may request a physical copy through the IRS's mail service by calling their toll-free number.

- Online Download: Available in PDF format on the IRS website.

- Request by Mail: Contact the IRS directly to receive a mailed copy.

It's crucial to ensure that the correct version related to the specific year of death is used to avoid any filing discrepancies. Copies of the form can also be sought from legal advisors or tax professionals handling estate planning and administration matters.

Steps to Complete the 1999 706 Form

-

Gather Necessary Information: Collect all details related to the decedent's assets, including real estate, personal property, financial accounts, and any debts or liabilities.

-

Calculate Gross Estate: List and evaluate the full market value of all assets to compute the gross estate total.

-

Identify Deductions: Determine eligible deductions, such as marital and charitable deductions, debts, and administrative expenses.

-

Determine Taxable Estate: Subtract allowable deductions from the gross estate to identify the taxable amount.

-

Calculate Estate Tax: Using the taxable estate amount, calculate the estate tax due following the IRS provided tax tables.

-

Attach Required Schedules: Ensure all required schedules are completed correctly, detailing assets and deductions.

-

Review and Sign: After verifying all entries and calculations, the executor must sign the form.

-

Submit the Form: File the completed form with the IRS along with any required payment.

Key Elements of the 1999 706 Form

Several critical elements define the structure and content of the 1999 Form 706, making it essential for ensuring accurate tax reporting:

- Schedules: Multiple schedules detailing assets like real estate, stocks, bonds, and insurance.

- Deductions: Sections for marital, charitable, and administrative deductions.

- Executor Certification: The executor's declaration confirming the accuracy of the information.

- Tax Computation: Detailed tax calculation protocols reflective of IRS estate tax tables.

- Filing Instructions: A step-by-step guide included for completing and submitting the form.

Completing this form requires accuracy in recording all estates, liabilities, and deductions to ensure the correct tax amounts are calculated and filed.

Important Terms Related to the 1999 706 Form

Understanding the terms associated with this form is crucial for it to be completed accurately.

- Gross Estate: The total market value of the decedent's property before deductions.

- Taxable Estate: The remaining estate value subject to taxation after allowable deductions.

- Executor: The legal representative appointed to manage the estate.

- Generation-Skipping Transfer: Transfers that benefit individuals who are at least two generations younger than the donor.

- Marital Deduction: Tax deductions allowed for transfers to a surviving spouse.

These terms play a pivotal role in the interpretation and execution of the tax return filing.

Filing Deadlines / Important Dates

Adhering to deadlines is critical for avoiding penalties and ensuring compliance with IRS requirements.

- Initial Filing Deadline: Typically nine months after the decedent's death.

- Extension Option: Executors may request an extension if more time is needed, typically giving an additional six months.

- Payment Deadlines: Any taxes owed should be paid by the initial filing deadline to avoid interest and penalties.

Understanding these timelines ensures prompt submission and minimizes potential complications for the estate administrator.

Penalties for Non-Compliance

Failing to comply with IRS filing regulations for Form 706 can result in significant penalties:

- Late Filing Penalty: A penalty of 5% of the amount due for each month the form is late, up to 25%.

- Late Payment Penalty: An additional 0.5% of the tax owed per month.

- Interest Charges: Accrued on any unpaid tax from the time it was due until payment is made.

Ensuring accurate and timely filing is crucial to avoid these financial repercussions.

IRS Guidelines and Requirements

The IRS provides specific guidelines to make sure Form 706 is correctly filled out:

- Detailed Instructions: Available on the IRS website, outlining each section of the form.

- Compliance: Ensure compliance with federal tax laws as they pertain to estate taxes.

- Documentation: Required to support valuations and claimed deductions for assets.

- Audit Potential: IRS may audit the return, necessitating precise documentation and evidence.

Following IRS guidelines meticulously ensures orderly filing and reduces the risk of errors.