Definition & Meaning

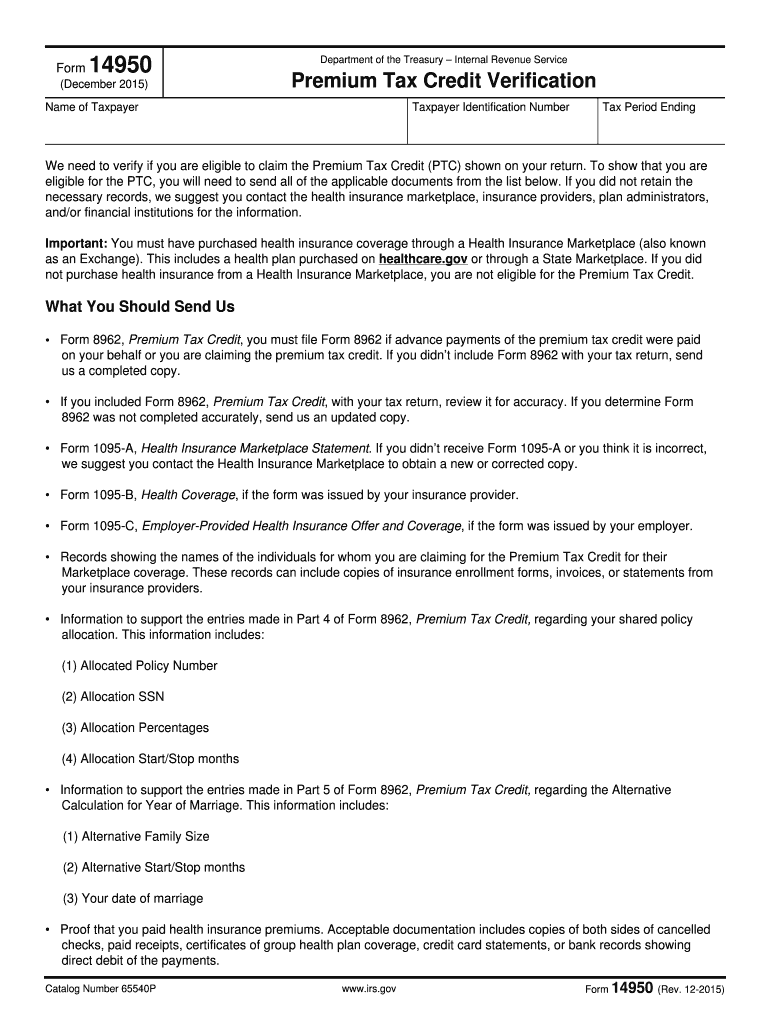

Form 14950, issued by the Department of the Treasury's Internal Revenue Service (IRS), serves as a verification instrument for taxpayers. It is primarily used to confirm eligibility for the Premium Tax Credit (PTC), which assists in subsidizing health insurance premiums for individuals and families who obtain coverage through the Health Insurance Marketplace. In essence, this form acts as part of the documentation process that ensures taxpayers meet specific criteria to qualify for these tax credits.

Steps to Complete the Form 14950

Completing Form 14950 requires attention to detail to ensure all necessary information is accurately reported. Here is a step-by-step guide:

-

Gather Required Documentation: Before you begin, collect all pertinent documents such as Form 8962, Form 1095-A, and proof of health insurance premium payments. These are essential to verifying your eligibility for the PTC.

-

Review the Instructions: Carefully read through the provided instructions on Form 14950 to understand what information is required in each section.

-

Fill Out Personal Information: Input your personal details, including your full name, social security number, and address. Ensure this information matches what is on your other tax-related documents.

-

Report Health Coverage Details: Provide comprehensive data about your health insurance plan as prompted by the form. This includes dates of coverage and premium amounts paid.

-

Verification of Marketplace Coverage: Confirm that your health plan was obtained through the Health Insurance Marketplace, as eligibility for the PTC is contingent upon this factor.

-

Double-Check Entries: Before submission, verify that all details are correct and no information is missing.

Required Documents

Successful completion of Form 14950 necessitates providing evidence that supports your eligibility for the PTC. Key documents include:

- Form 8962: This form is essential for reconciling the PTC with your health insurance premium tax return.

- Form 1095-A: Issued by the Marketplace, it outlines the details of your health coverage.

- Proof of Premium Payments: Gather receipts or statements that validate the amounts paid towards your health insurance.

Important Terms Related to Form 14950

Familiarity with the terminology associated with Form 14950 is crucial to accurately completing the form:

- Premium Tax Credit (PTC): A tax credit offering financial assistance for health insurance premiums based on income and family size.

- Health Insurance Marketplace: A service that helps individuals shop for and enroll in affordable health insurance.

- Form 8962: The IRS form used to reconcile the advance payments of the PTC.

- Form 1095-A: Provides information necessary to fill out Form 8962, detailing plan premiums, coverage dates, and advance payments.

IRS Guidelines

The IRS provides specific guidelines for Form 14950 to ensure proper completion and submission. These include strict requirements for maintaining accuracy in all reported details, ensuring the alignment of information across all related forms, and adhering to federal deadlines and procedures to avoid penalties or delays in processing.

How to Obtain the Form 14950

Form 14950 can be acquired through several convenient methods:

- Direct Download: Access the form via the IRS website, where it is available as a free downloadable PDF.

- Postal Request: Contact the IRS to receive a physical copy through mail.

- Tax Software: Certain tax preparation software may offer access to Form 14950, streamlining the process of documenting and submitting tax information.

Penalties for Non-Compliance

Failure to accurately submit Form 14950, or to provide adequate documentation supporting PTC eligibility, may incur penalties. These can include the requirement to repay part or all of the PTC that was received, plus potential interest. Ensuring full compliance by adhering to guidelines and deadlines helps mitigate these risks.

Digital vs. Paper Version

Taxpayers have the option to complete Form 14950 either digitally or on paper. The digital version offers ease of use, particularly with online tax software that guides users through the process. Alternatively, the paper version may be preferable for those who feel more comfortable with traditional methods or lack reliable internet access. Both formats require the same meticulous attention to detail to ensure compliance.