Definition and Meaning of Tax Credit Verification

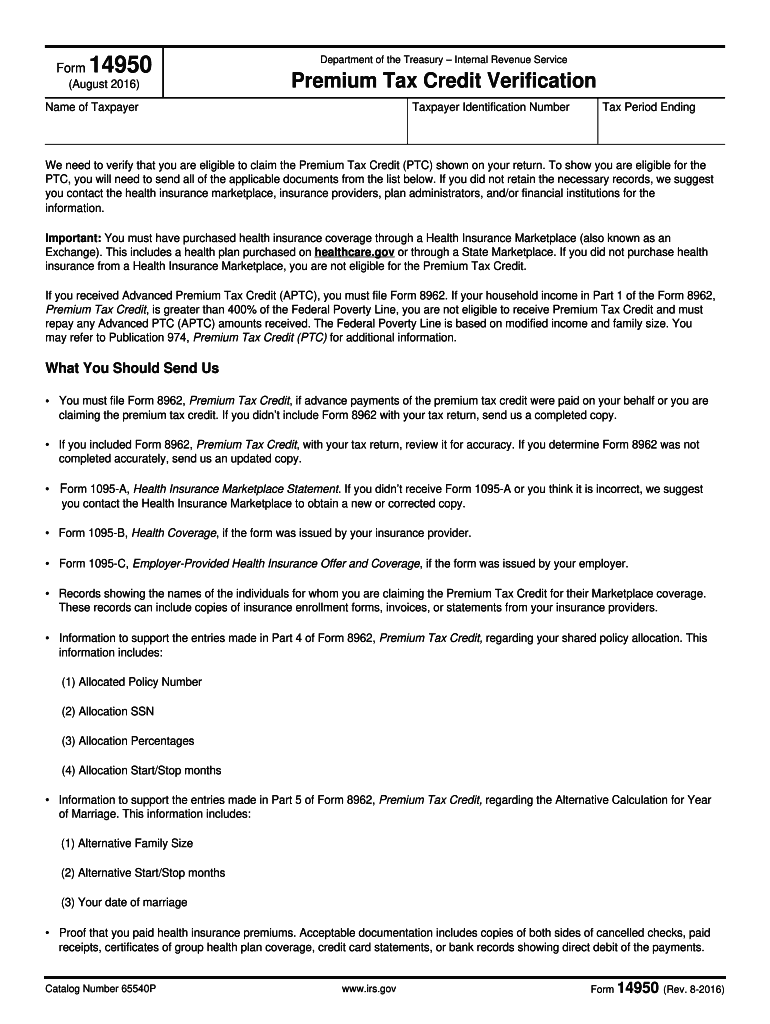

Tax credit verification is a process utilized by taxpayers to confirm their eligibility for a specific tax credit, particularly those related to healthcare and income. This verification typically involves the completion of Form 14950, which is a form designed by the Internal Revenue Service (IRS) to facilitate the required documentation necessary for claims made on tax returns. The primary purpose of this form is to validate the income levels and health insurance purchases that determine eligibility for certain credits, including the Premium Tax Credit (PTC). These credits are pivotal for individuals who have secured health insurance from the Health Insurance Marketplace, as they can substantially reduce out-of-pocket expenses related to healthcare coverage.

Understanding tax credit verification is essential, as it not only impacts tax obligations but also affects access to quality healthcare and financial relief for qualifying individuals. An accurate verification can streamline the tax filing process, providing clarity and minimizing the risk of audits or disputes with the IRS.

Steps to Complete the Tax Credit Verification

Completing the tax credit verification involves a systematic approach to ensure all necessary information is accurately reported and submitted. The steps can be outlined as follows:

-

Gather Required Documents:

- Tax documents such as Form 1040, which shows total income.

- Health insurance documentation, including Form 1095-A, which provides information about premiums and the coverage period.

- Other supporting materials to validate claims, such as income statements or pay stubs.

-

Fill Out Form 14950:

- Provide personal identification information, including your name, address, and Social Security number.

- Report income levels and select the appropriate tax year for verification.

- Indicate the type of tax credit you are applying for, detailing coverage through the Health Insurance Marketplace.

-

Review for Accuracy:

- Double-check all entries to confirm they are correct and complete.

- Ensure that any required fields are filled in, as incomplete forms can lead to delays or denials.

-

Submit the Verification:

- File the form via the chosen method (online, by mail, or in-person) based on IRS guidelines.

- Keep copies of all submitted documents for your records.

-

Track the Application Status:

- After submission, monitor any communications from the IRS regarding approval or additional documentation requests.

Following these steps ensures compliance with IRS requirements and substantiates claims for available tax credits.

Key Elements of Tax Credit Verification

Several critical elements determine the effectiveness and efficiency of tax credit verification. These components include:

-

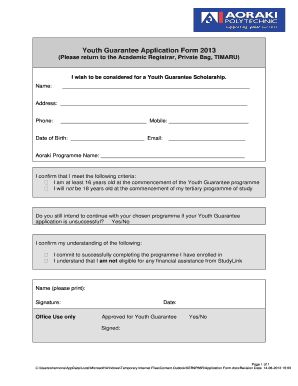

Eligibility Criteria:

- Understanding who qualifies for specific tax credits and the parameters that define such eligibility is essential. Factors like household income, family size, and health insurance status play significant roles.

-

Required Documentation:

- It's vital to know which forms are needed to support tax credit verification. Standard requirements often include Form 14950 for tax credit claims and Form 1095-A for proof of health insurance coverage.

-

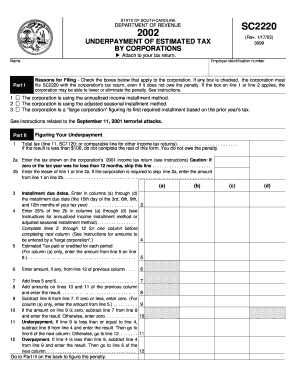

Filing Methods:

- Taxpayers can submit their tax credit verification through various channels, such as online platforms provided by the IRS, by mailing the forms, or directly at designated IRS offices.

-

Compliance Requirements:

- Adherence to the IRS guidelines is crucial to avoid penalties. Familiarize yourself with the consequences of non-compliance, which could lead to fines or other legal actions.

-

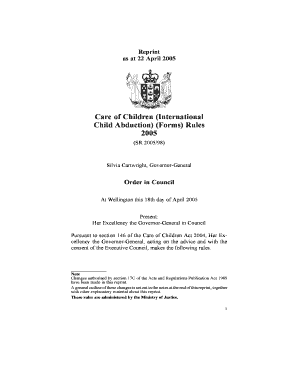

Legal Framework:

- The verification process must comply with federal laws that govern tax credits. These regulations help in determining the validity and legality of claims filed.

Understanding these key elements helps ensure taxpayers approach tax credit verification with the necessary foresight and preparedness.

Important Terms Related to Tax Credit Verification

Familiarity with specific terminology is crucial for navigating the tax credit verification process effectively. Some key terms include:

-

Premium Tax Credit (PTC):

- A subsidy available to individuals who purchase health insurance through the Marketplace, reducing the overall cost of premiums based on income and household size.

-

Form 14950:

- The official form used to verify tax credits when claiming eligibility for different forms of tax relief, particularly relating to health coverage.

-

Form 1095-A:

- A crucial document that health insurance providers send to individuals, detailing the amount of premium paid and indicating the coverage months for reference during tax filing.

-

Health Insurance Marketplace:

- A marketplace established by the Affordable Care Act where individuals can purchase health insurance and apply for applicable tax credits based on their financial status.

Understanding these terms equips taxpayers with the knowledge needed to engage with the tax credit verification process confidently.

IRS Guidelines for Tax Credit Verification

Navigating IRS guidelines is fundamental for a successful tax credit verification. Key guidelines include:

-

Eligibility Determination:

- The IRS provides definitions of income thresholds based on Federal Poverty Guidelines, which determine if a taxpayer qualifies for the Premium Tax Credit.

-

Mandatory Forms and Supporting Documents:

- IRS guidelines specify which forms must be submitted alongside the tax return to claim tax credits, such as Form 14950 and Form 1095-A. Accuracy in completing these documents is critical.

-

Deadline Compliance:

- Adhering to filing deadlines ensures that taxpayers do not miss out on eligibility. The IRS outlines specific dates by which tax credit verification must be submitted each year.

-

Audit Protocols:

- The IRS has established processes for auditing claims related to tax credit verification. Being informed about what triggers audits can help taxpayers prepare better and maintain accurate records.

These considerations, rooted in IRS instructions, facilitate a smoother verification process, minimizing risks of denial or audit complications.