Definition & Meaning

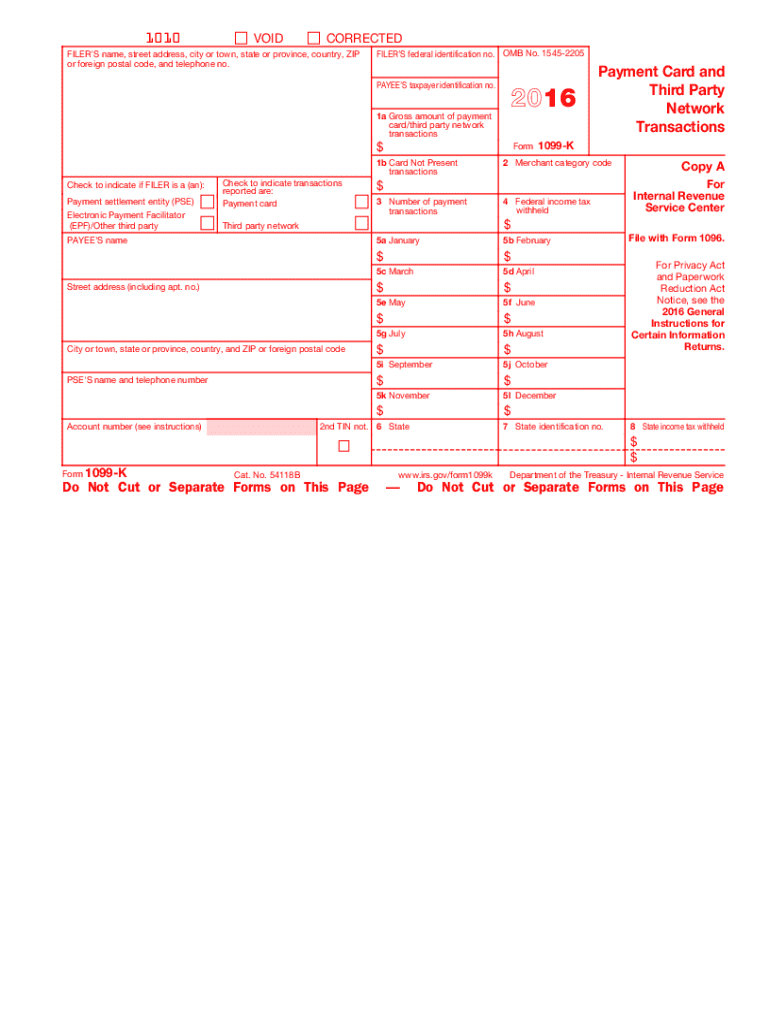

The Form 1099-K is primarily used to report payment card and third-party network transactions to the IRS. It ensures that all income, particularly revenue from credit card transactions and online platforms, is accurately declared. The form is vital in preventing tax evasion by capturing transactions that might otherwise go unreported. As the economy grows increasingly digital, the significance of this form has escalated, reflecting its role in maintaining fiscal transparency.

How to Use the Form 1099-K

When using Form 1099-K, individuals and businesses must carefully review the information reported. The form includes amounts received via payment card transactions and third-party network transactions exceeding a certain threshold. Recipients should cross-reference the figures reported with their own records to ensure consistency. Accurate figures on the form help maintain compliance with IRS guidelines and prevent potential discrepancies that could lead to audits.

Steps to Complete the Form 1099-K

-

Gather Payment Information: Collect detailed information about all payment card and third-party network transactions throughout the year.

-

Verify Details: Ensure the payer’s and recipient’s information is accurate, including names, addresses, and Taxpayer Identification Numbers (TINs).

-

Fill in Transaction Amounts: Accurately list the total dollar amount of transactions that meet the reporting threshold on the form.

-

Review for Accuracy: Check all entered details for accuracy to avoid potential IRS inquiries or issues with recipients.

-

Submission: Submit the form to the IRS by the specified deadline and provide copies to the transaction recipients.

Who Typically Uses Form 1099-K

The form is commonly used by businesses engaged in e-commerce or those accepting credit card payments. This includes online retailers, freelancers offering services via platforms like PayPal, and other independent contractors. Additionally, marketplaces and third-party payment processors are significant users, as they are generally the entities responsible for issuing Form 1099-K to sellers and service providers.

IRS Guidelines

IRS guidelines for Form 1099-K specify that payment settlement entities must issue the form if the transaction total exceeds $20,000 and involves more than 200 transactions. This threshold was set to reduce administrative burdens, ensuring only significant incomes are flagged. However, ongoing discussions hint at a future reduction in the threshold to capture a broader range of transactions.

Filing Deadlines and Important Dates

Form 1099-K should be filed with the IRS by the end of February if submitting on paper, or March 31 if filing electronically. Copies must be provided to recipients by January 31. It's crucial to adhere to these deadlines to avoid penalties. Late submissions can lead to fines, which increase based on how overdue the forms are.

Penalties for Non-Compliance

Failure to file Form 1099-K accurately and on time can result in penalties ranging from $50 to $530 per form, depending on how late the forms are filed. Intentional disregard for filing can lead to even more significant fines. Moreover, discrepancies between forms submitted to the IRS and copies provided to individuals or businesses can attract additional scrutiny.

Required Documents

To complete Form 1099-K, gather documentation detailing all credit card transactions and third-party network payments. This includes monthly statements, invoices, and any digital records from payment processors. Keeping organized records aids in ensuring accuracy and compliance, making the annual tax filing process smoother.