Definition and Purpose of the 2014 Form 1099-K

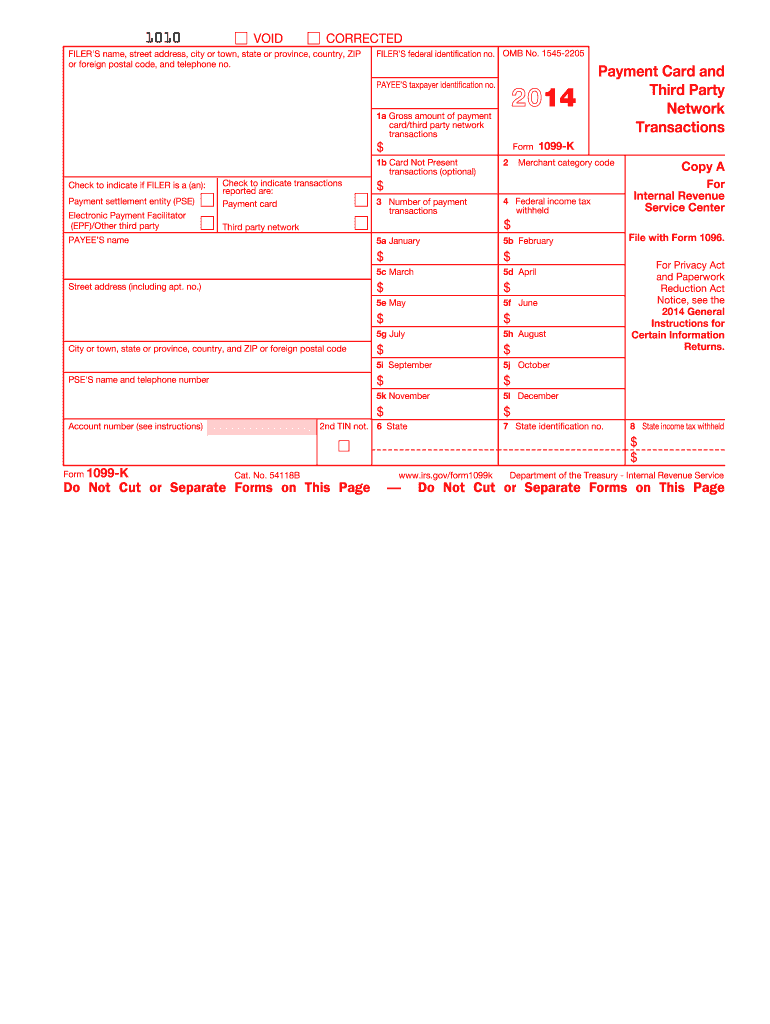

The 2014 Form 1099-K is a tax document used in the United States to report payments made via credit card transactions and third-party network transactions. It is a critical form for both the Internal Revenue Service (IRS) and taxpayers, because it ensures that all transactions are accurately reported for tax purposes. The form captures the gross amount of reportable transactions, which includes all payments processed by the payment settlement entity (PSE).

Key Elements Included in the Form

- Gross Amount of Payment Card Transactions: Total value of payments received through credit and debit card transactions.

- Third-Party Network Transactions: These are transactions made via platforms that process payments, such as PayPal and other payment apps.

- Taxpayer Identification Number (TIN): This is crucial for identifying the recipient of the payments.

- Merchant Category Code (MCC): This code classifies the type of business that is receiving the payments.

Understanding these elements is essential for ensuring that the form is completed correctly and that all IRS reporting requirements are met.

How to Use the 2014 Form 1099-K

Using the 2014 Form 1099-K involves several steps to ensure that all required information is collected and reported accurately.

Steps to Complete the Form

- Collect Required Information: Gather all transaction data from payment processors for the year 2014, including credit card transactions and third-party payments.

- Verify Taxpayer Identification: Double-check that the TIN and other identifying information are correct to avoid any issues with the IRS.

- Fill Out Relevant Sections: Populate the form with the gross payment amounts and any other pertinent details such as MCC.

- Submit to the IRS and Recipient: Once completed, distribute one copy of the form to the IRS and another to the payment recipient for their records.

Who Needs the 2014 Form 1099-K

The 2014 Form 1099-K is utilized mainly by businesses and individuals who process a substantial volume of payments through third-party networks or credit card transactions.

Who Typically Uses This Form

- Small Business Owners: Particularly those who accept credit card payments or use third-party processors.

- Self-Employed Individuals: Freelancers and independent contractors who receive payments via platforms like PayPal.

- E-commerce Platforms: Online retailers using third-party processors for transactions with customers.

Understanding who needs to file this form helps ensure compliance and avoid penalties.

Filing Deadlines and Important Dates

Compliance with deadlines is crucial for the 2014 Form 1099-K.

Important Filing Dates

- January 31, 2015: The date by which the form should have been sent to the recipient.

- February 28, 2015: Deadline for paper submissions to the IRS.

- March 31, 2015: Deadline for electronic submissions to the IRS.

Meeting these deadlines is critical to avoid late fees and ensure smooth processing by the IRS.

How to Obtain the 2014 Form 1099-K

There are several ways to obtain the 2014 Form 1099-K, depending on your preference for digital or paper formats.

Methods to Obtain the Form

- IRS Website: Download directly as a PDF from the IRS website for printing and manual entry.

- Tax Software: Utilize popular tax preparation software, which may provide access to the necessary forms.

- Financial Institutions: Often, banks and financial service providers can offer the form if they are the payment settlement entity involved in the transaction.

These sources can provide the form required for accurate reporting.

Understanding IRS Guidelines for the 1099-K

The IRS has specific guidelines for the use and completion of Form 1099-K to ensure accurate tax reporting.

Key IRS Guidelines to Note

- Accuracy of Information: Ensure all data on the form, such as gross transaction amounts and taxpayer identification, is accurate and current.

- Reporting Requirements: Understand the thresholds for reporting, especially focusing on the $20,000 and 200 transactions criteria for triggering the form.

- Corrections: Procedures are in place for correcting any mistakes on forms that have already been submitted.

Following these guidelines helps in avoiding fines or audits from the IRS.

Penalties for Non-Compliance with the 1099-K

Filing the Form 1099-K accurately and timely is critical to avoid penalties set by the IRS for non-compliance.

Understanding Potential Penalties

- Failure to File: Fines may be issued if the form is not filed by the specified deadlines.

- Incorrect Information Penalties: Providing inaccurate information can result in additional fines and the need for corrected returns.

- Intentional Disregard Penalty: In cases where there is intentional disregard in filing requirements, the penalties can become significantly higher.

Adhering to compliance standards is crucial for minimizing financial consequences.

Digital vs. Paper Version of the Form

The 2014 Form 1099-K can be filed both digitally or through traditional paper methods, each with its own set of advantages and considerations.

Comparing the Two Formats

- Digital Filing: Faster processing times, reduced risk of errors, and convenience of electronic submissions. Ideal for those comfortable with digital platforms and needing fast tracking.

- Paper Filing: Provides a traditional method that some individuals may prefer for its physical confirmation of submission. Necessary for those without reliable access to digital tools.

Choosing the appropriate filing method can impact both ease and processing speed of the form.