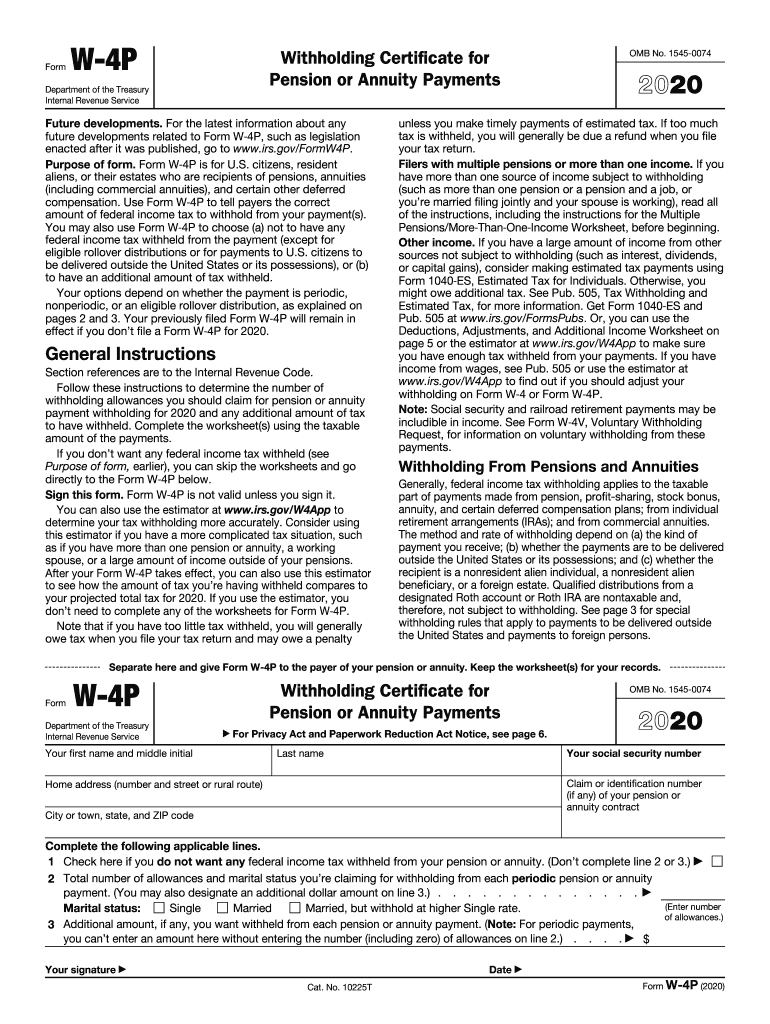

Definition and Purpose of Form W-4P

Form W-4P, the Withholding Certificate for Pension or Annuity Payments, is utilized by U.S. citizens and resident aliens to specify the amount of federal income tax to be withheld from their pension or annuity payments. By completing this form, recipients can ensure accurate withholding that reflects their personal tax circumstances, helping them avoid large tax bills or refunds come tax time. The form allows for flexibility in withholdings and addresses various payment types, making it a critical tool for financial planning in retirement.

Key Features of Form W-4P

- Customizable Withholding: Recipients can choose the exact amount to be withheld based on their tax situation.

- Versatile Use: Applicable to various types of payments, including pensions and annuities.

- Worksheet Inclusion: Offers worksheets to assist in calculating allowances and withholdings based on individual circumstances.

Steps to Complete Form W-4P

Filling out Form W-4P involves several calculated steps to ensure accuracy:

- Personal Information: Start by providing your name, Social Security Number, and filing status.

- Adjust Withholdings: Use the worksheets to determine your total tax withholdings based on other income sources, deductions, and credits.

- Multiple Income Scenarios: If you have other income or expect it, adjust your withholdings accordingly to avoid underpayment or overpayment.

- Sign and Date: Complete the form by signing and dating it, certifying the accuracy of the information provided.

Tips for Accurate Completion

- Review Past Tax Returns: Use previous returns to inform your withholding decisions.

- Consider Life Changes: Adjust withholdings if you experience changes in income, family size, or filing status.

How to Obtain Form W-4P

Form W-4P can be accessed in several ways:

- Download from the IRS Website: The form is available for download as a PDF document on the IRS official site.

- Request from an Employer or Plan Administrator: Those receiving payments from employers or plan administrators can request the form directly from these agencies.

- Local IRS Office: Obtain physical copies at an IRS office location.

Digital vs. Paper Versions

- Digital Download: Provides convenience and ensures you have the most up-to-date version.

- Paper Copies: Useful for those who prefer hard copies or have limited internet access.

Who Typically Uses Form W-4P

Form W-4P is primarily utilized by individuals who receive regular pension or annuity payments. These include:

- Retirees: Individuals who have retired and receive pensions.

- Annuity Holders: Those with annuities that distribute periodic payments.

- Beneficiaries of Retirement Accounts: Individuals who inherit annuities or retirement accounts.

Considerations for Users

- Self-employed Retirees: May need to adjust withholdings if they still earn income.

- Multiple Annuity Recipients: Should coordinate with each payer to avoid under or over-withholding.

Important Terms Related to Form W-4P

Understanding specific terms related to Form W-4P can simplify the completion process:

- Allowances: These reduce the amount of income that is subject to withholding.

- Filing Status: Affects the withholding calculation and could be single, married, or head of household.

- Exemptions: Certain circumstances allow for exemptions, reducing taxable income related to pension or annuity payments.

Contextual Examples

- Single vs. Married Filing: Different withholding strategies may apply based on marital status.

- Tax Credit Eligibility: Understanding what credits you are eligible for can affect withholding amounts.

Legal Use of Form W-4P

Form W-4P must be accurately completed to comply with IRS regulations, ensuring lawful tax-exemptions and deductions. Compliance is key in maintaining legal standing and avoiding penalties associated with incorrect tax filings.

Compliance Best Practices

- Periodic Reviews: Regularly update withholdings to reflect any changes in income or tax law.

- Consulting Professionals: Engaging with tax advisors can ensure compliance and optimization of tax strategies.

Key Elements of Form W-4P

Each section of the form is crucial for ensuring proper tax withholding, and includes:

- Personal Details Section: Accurate identification including name and Social Security Number.

- Allowance Elections: Crucial for determining the amount exempt from withholding.

- Additional Withholding Requests: Option to request additional taxes be withheld, useful for those predicting higher annual tax liabilities.

Practical Scenarios

- Seasonal Income Workers: May adjust withholdings during high-income seasons to better match tax liabilities.

- Frequent Movers: Need to ensure address and residency status are up to date for accurate withholding.

IRS Guidelines for Form W-4P

The IRS provides guidelines to assist individuals in correctly filling out Form W-4P. These guidelines help ensure:

- Misalignment Correction: How to adjust if too little or too much is withheld.

- Exemption Criteria and Procedures: Understand the criteria for exemptions and how to apply them correctly.

Additional IRS Resources

- Publication 15-A (Employer's Tax Guide): Offers insight into withholding compliance.

- IRS Online Tools: Utilization of tax calculators to verify withholding amounts.

State-Specific Rules for Form W-4P

While Form W-4P is a federal tax form, some states have specific requirements that may affect withholding calculations. It's essential to recognize:

- State Tax Withholding Forms: Some states require their own version of withholding forms.

- State-specific Allowances and Exemptions: Variations in state tax codes can impact federal withholding decisions.

State-specific Examples

- California Residents: May have additional forms to consider due to unique state tax laws.

- Non-income Tax States: Residents should understand the implications on federal withholdings in the absence of state income tax.

By understanding the role, completion process, and compliance details of Form W-4P, individuals can effectively manage their tax obligations related to pension and annuity payments. This comprehensive guide has explored key aspects, practical examples, and scenarios to equip users with the knowledge needed to navigate their tax responsibilities efficiently.