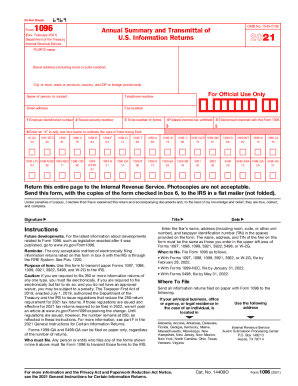

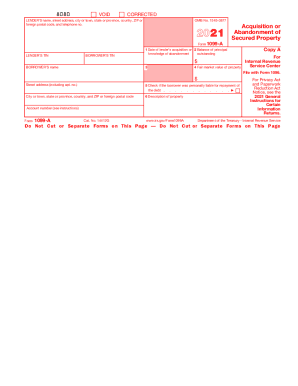

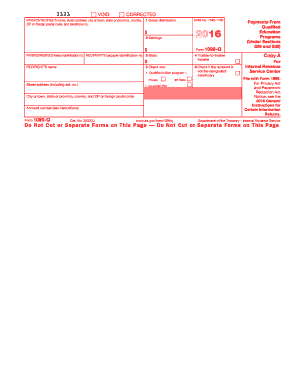

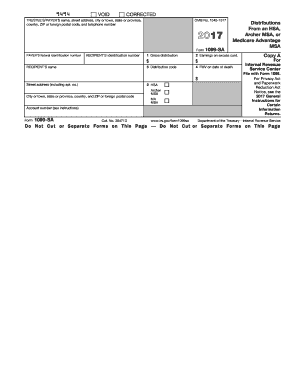

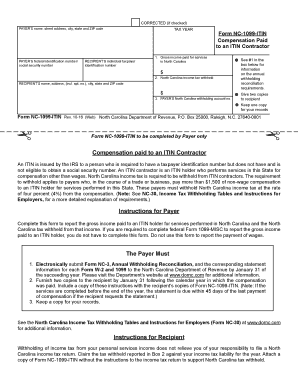

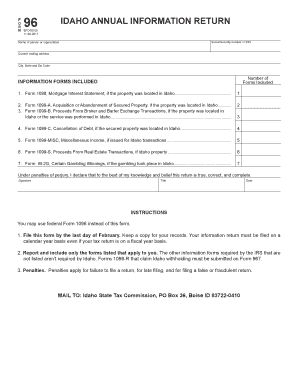

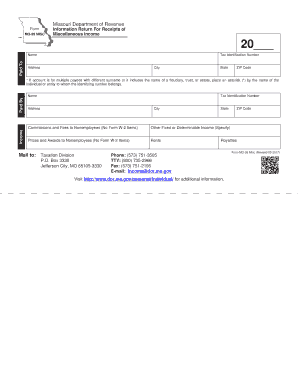

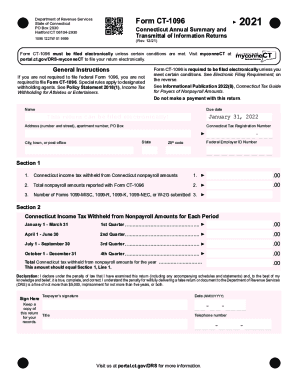

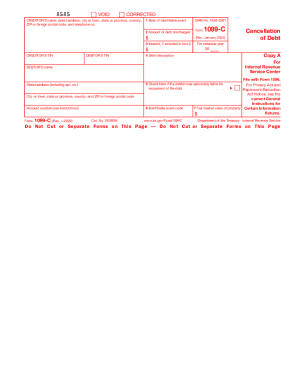

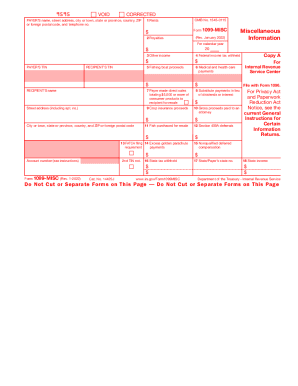

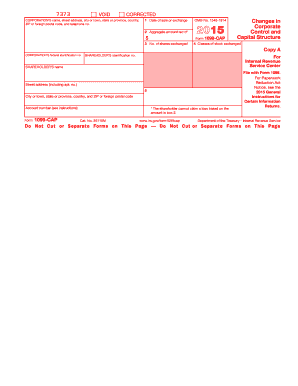

Streamline order forms management process and browse 1099 and 1096 Order Forms online collection. Find case-specific templates, adjust them, and safely send them with other team members.

Document management consumes to half of your office hours. With DocHub, it is simple to reclaim your time and effort and boost your team's productivity. Access 1099 and 1096 Order Forms online library and investigate all templates relevant to your everyday workflows.

The best way to use 1099 and 1096 Order Forms:

Speed up your everyday document management with the 1099 and 1096 Order Forms. Get your free DocHub profile right now to explore all forms.